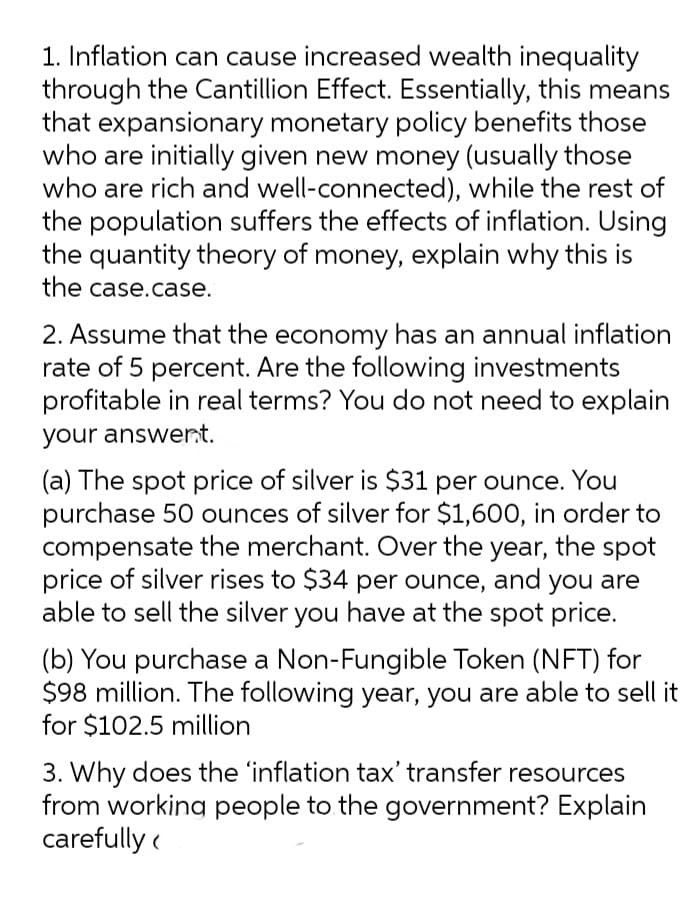

1. Inflation can cause increased wealth inequality through the Cantillion Effect. Essentially, this means that expansionary monetary policy benefits those who are initially given new money (usually those who are rich and well-connected), while the rest of the population suffers the effects of inflation. Using the quantity theory of money, explain why this is the case.case.

1. Inflation can cause increased wealth inequality through the Cantillion Effect. Essentially, this means that expansionary monetary policy benefits those who are initially given new money (usually those who are rich and well-connected), while the rest of the population suffers the effects of inflation. Using the quantity theory of money, explain why this is the case.case.

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter22: Money Growth And Inflation

Section: Chapter Questions

Problem 1PA

Related questions

Question

Transcribed Image Text:1. Inflation can cause increased wealth inequality

through the Cantillion Effect. Essentially, this means

that expansionary monetary policy benefits those

who are initially given new money (usually those

who are rich and well-connected), while the rest of

the population suffers the effects of inflation. Using

the quantity theory of money, explain why this is

the case.case.

2. Assume that the economy has an annual inflation

rate of 5 percent. Are the following investments

profitable in real terms? You do not need to explain

your answert.

(a) The spot price of silver is $31 per ounce. You

purchase 50 ounces of silver for $1,600, in order to

compensate the merchant. Over the year, the spot

price of silver rises to $34 per ounce, and you are

able to sell the silver you have at the spot price.

(b) You purchase a Non-Fungible Token (NFT) for

$98 million. The following year, you are able to sell it

for $102.5 million

3. Why does the 'inflation tax' transfer resources

from working people to the government? Explain

carefully (

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax