1. Is the company's net income the amount stated by the owner? 2. Is the company a good investment? Why or why not?

1. Is the company's net income the amount stated by the owner? 2. Is the company a good investment? Why or why not?

Chapter2: Analysis Of Financial Statements

Section: Chapter Questions

Problem 15PROB

Related questions

Question

100%

- Is the company’s net income the amount stated by the owner?

- Is the company a good investment? Why or why not? Cite at least two reasons for your answer.

Transcribed Image Text:11:05

< Chapter 6 Multiple Step Income Stmt.do...

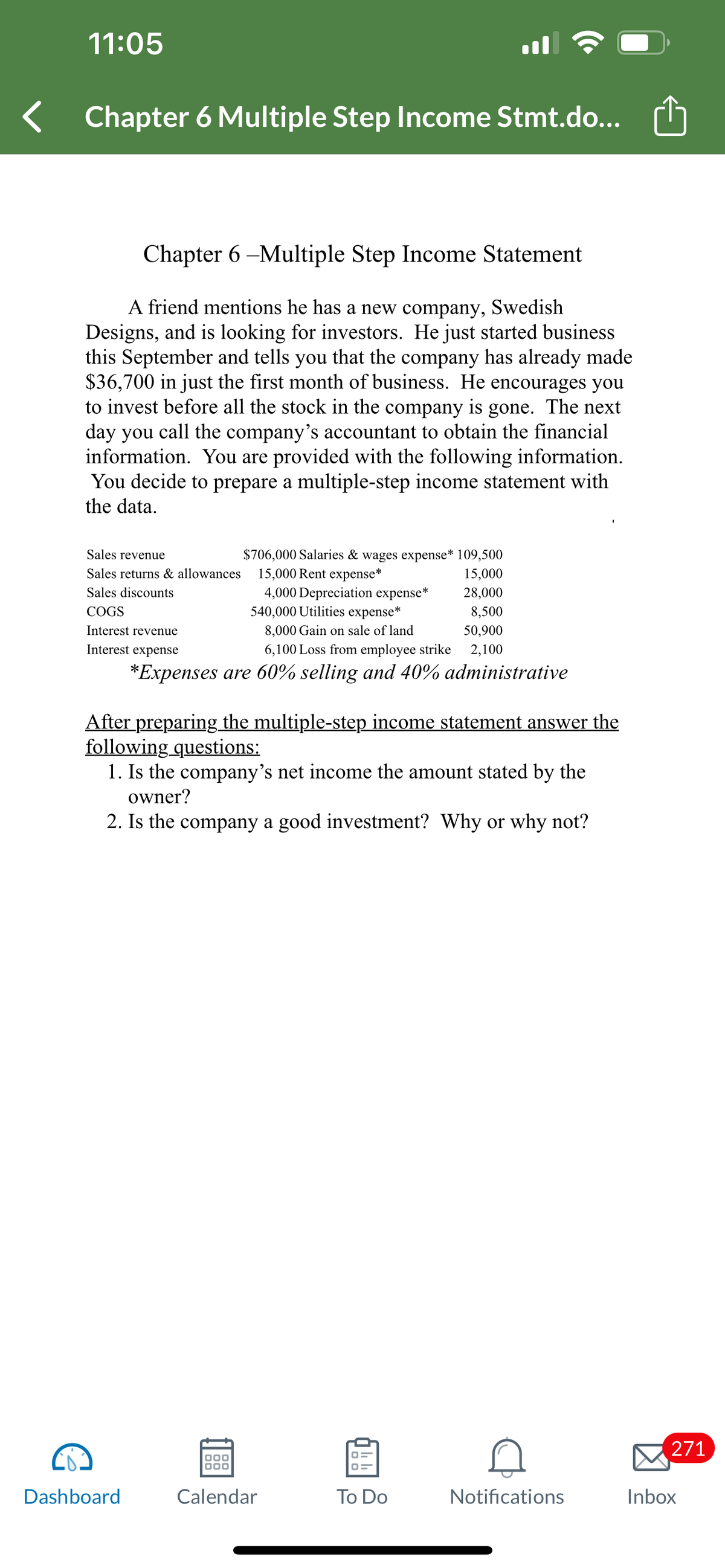

Chapter 6 -Multiple Step Income Statement

A friend mentions he has a new company, Swedish

Designs, and is looking for investors. He just started business

this September and tells you that the company has already made

$36,700 in just the first month of business. He encourages you

to invest before all the stock in the company is gone. The next

day you call the company's accountant to obtain the financial

information. You are provided with the following information.

You decide to prepare a multiple-step income statement with

the data.

Sales revenue

Sales returns & allowances

Sales discounts

COGS

Interest revenue

Interest expense

$706,000 Salaries & wages expense* 109,500

15,000

28,000

8,500

50,900

2,100

Dashboard

15,000 Rent expense*

4,000 Depreciation expense*

540,000 Utilities expense*

8,000 Gain on sale of land

6,100 Loss from employee strike

*Expenses are 60% selling and 40% administrative

After preparing the multiple-step income statement answer the

following questions:

1. Is the company's net income the amount stated by the

owner?

2. Is the company a good investment? Why or why not?

000

000

Calendar

To Do

Notifications

271

Inbox

Transcribed Image Text:11:05

Chapter 6 Multiple Step Income Stmt_s...

Sheet2 Sheet1

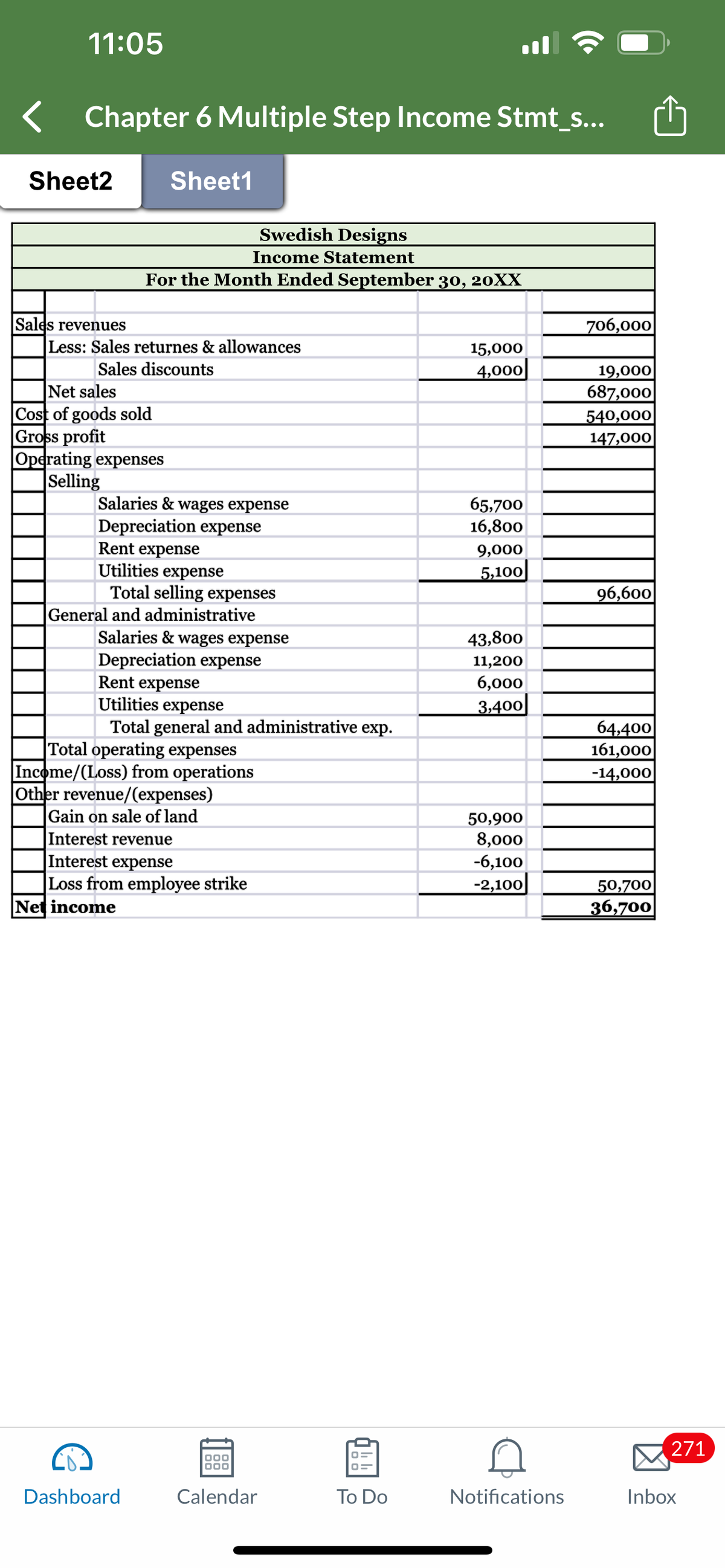

Sales revenues

Less: Sales returnes & allowances

Sales discounts

Swedish Designs

Income Statement

For the Month Ended September 30, 20XX

Net sales

Cost of goods sold

Gross profit

Operating expenses

Selling

Salaries & wages expense

Depreciation expense

Rent expense

Utilities expense

Total selling expenses

General and administrative

Salaries & wages expense

Depreciation expense

Rent expense

Utilities expense

Total general and administrative exp.

Total operating expenses

Income/(Loss) from operations

Other revenue/(expenses)

Gain on sale of land

Interest revenue

Interest expense

Loss from employee strike

Net income

Dashboard

000

000

Calendar

To Do

15,000

4,000

65,700

16,800

9,000

5,100

43,800

11,200

6,000

3,400

50,900

8,000

-6,100

-2,100

Notifications

706,000

19,000

687,000

540,000

147,000

96,600

64,400

161,000

-14,000

50,700

36,700

271

Inbox

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you