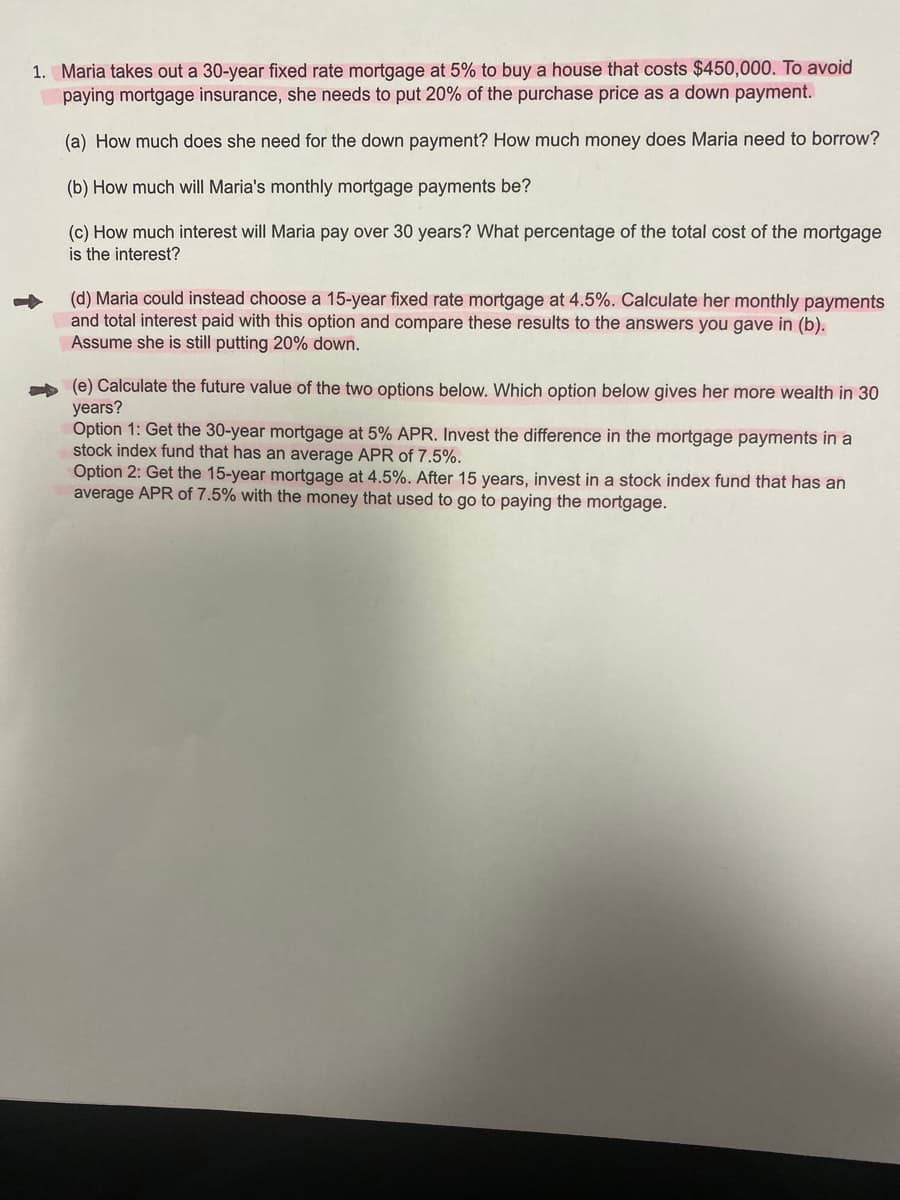

1. Maria takes out a 30-year fixed rate mortgage at 5% to buy a house that costs $450,000. To avoid paying mortgage insurance, she needs to put 20% of the purchase price as a down payment. (a) How much does she need for the down payment? How much money does Maria need to borrow? (b) How much will Maria's monthly mortgage payments be? (c) How much interest will Maria pay over 30 years? What percentage of the total cost of the mortgage is the interest? (d) Maria could instead choose a 15-year fixed rate mortgage at 4.5%. Calculate her monthly payments and total interest paid with this option and compare these results to the answers you gave in (b). Assume she is still putting 20% down. (e) Calculate the future value of the two options below. Which option below gives her more wealth in 30 years? Ontion 1. Got tbe 20v

1. Maria takes out a 30-year fixed rate mortgage at 5% to buy a house that costs $450,000. To avoid paying mortgage insurance, she needs to put 20% of the purchase price as a down payment. (a) How much does she need for the down payment? How much money does Maria need to borrow? (b) How much will Maria's monthly mortgage payments be? (c) How much interest will Maria pay over 30 years? What percentage of the total cost of the mortgage is the interest? (d) Maria could instead choose a 15-year fixed rate mortgage at 4.5%. Calculate her monthly payments and total interest paid with this option and compare these results to the answers you gave in (b). Assume she is still putting 20% down. (e) Calculate the future value of the two options below. Which option below gives her more wealth in 30 years? Ontion 1. Got tbe 20v

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 38P

Related questions

Question

I only need the highlighted portion of this question answered. a & b have already been completed.

Transcribed Image Text:1. Maria takes out a 30-year fixed rate mortgage at 5% to buy a house that costs $450,000. To avoid

paying mortgage insurance, she needs to put 20% of the purchase price as a down payment.

(a) How much does she need for the down payment? How much money does Maria need to borrow?

(b) How much will Maria's monthly mortgage payments be?

(c) How much interest will Maria pay over 30 years? What percentage of the total cost of the mortgage

is the interest?

(d) Maria could instead choose a 15-year fixed rate mortgage at 4.5%. Calculate her monthly payments

and total interest paid with this option and compare these results to the answers you gave in (b).

Assume she is still putting 20% down.

A (e) Calculate the future value of the two options below. Which option below gives her more wealth in 30

years?

Option 1: Get the 30-year mortgage at 5% APR. Invest the difference in the mortgage payments in a

stock index fund that has an average APR of 7.5%.

Option 2: Get the 15-year mortgage at 4.5%. After 15 years, invest in a stock index fund that has an

average APR of 7.5% with the money that used to go to paying the mortgage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning