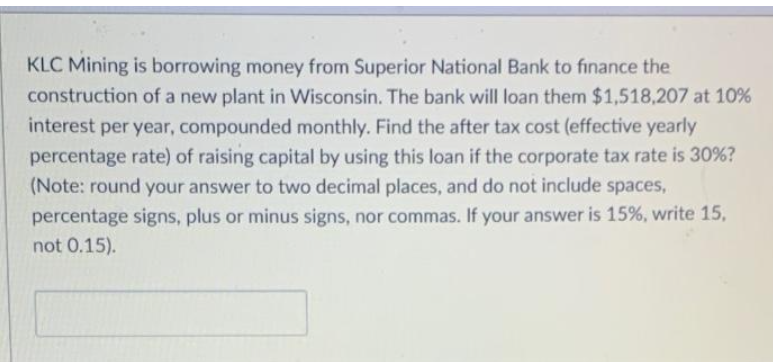

KLC Mining is borrowing money from Superior National Bank to finance the construction of a new plant in Wisconsin. The bank will loan them $1,518,207 at 10% interest per year, compounded monthly. Find the after tax cost (effective yearly percentage rate) of raising capital by using this loan if the corporate tax rate is 30%? (Note: round your answer to two decimal places, and do not include spaces, percentage signs, plus or minus signs, nor commas. If your answer is 15%, write 15, not 0.15).

KLC Mining is borrowing money from Superior National Bank to finance the construction of a new plant in Wisconsin. The bank will loan them $1,518,207 at 10% interest per year, compounded monthly. Find the after tax cost (effective yearly percentage rate) of raising capital by using this loan if the corporate tax rate is 30%? (Note: round your answer to two decimal places, and do not include spaces, percentage signs, plus or minus signs, nor commas. If your answer is 15%, write 15, not 0.15).

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 14P

Related questions

Question

Pls help with below homework.

Transcribed Image Text:KLC Mining is borrowing money from Superior National Bank to finance the

construction of a new plant in Wisconsin. The bank will loan them $1,518,207 at 10%

interest per year, compounded monthly. Find the after tax cost (effective yearly

percentage rate) of raising capital by using this loan if the corporate tax rate is 30%?

(Note: round your answer to two decimal places, and do not include spaces,

percentage signs, plus or minus signs, nor commas. If your answer is 15%, write 15,

not 0.15).

Expert Solution

Step 1

Effective annual interest rate(EAR) refers to the real rate of return that we earn on our savings or paid onto a loan when the effect of the compounding period is taken into consideration. The more the compounding periods, the more will be the effective interest rate, and the lower the number of the compounding periods, the lower will be the effective interest rate . When there is only one compounding period in a year, the effective annual interest rate will be equal to the stated nominal interest rate.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning