1. On November 1, Chris Clark opens a new business and deposits $25,000 in a bank account in the name of NetSolutions. 2. On November 5, NetSolutions paid $20,000 for the purchase of land as a future building site. 3. On November 10, NetSolutions purchased supplies on

1. On November 1, Chris Clark opens a new business and deposits $25,000 in a bank account in the name of NetSolutions. 2. On November 5, NetSolutions paid $20,000 for the purchase of land as a future building site. 3. On November 10, NetSolutions purchased supplies on

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter3: The Double-entry Framework

Section: Chapter Questions

Problem 6SEB: TRANSACTION ANALYSIS George Atlas started a business on June 1,20--. Analyze the following...

Related questions

Question

100%

Please solve this question step by step and make it clear to understand. Please send clear picture. Thanks!

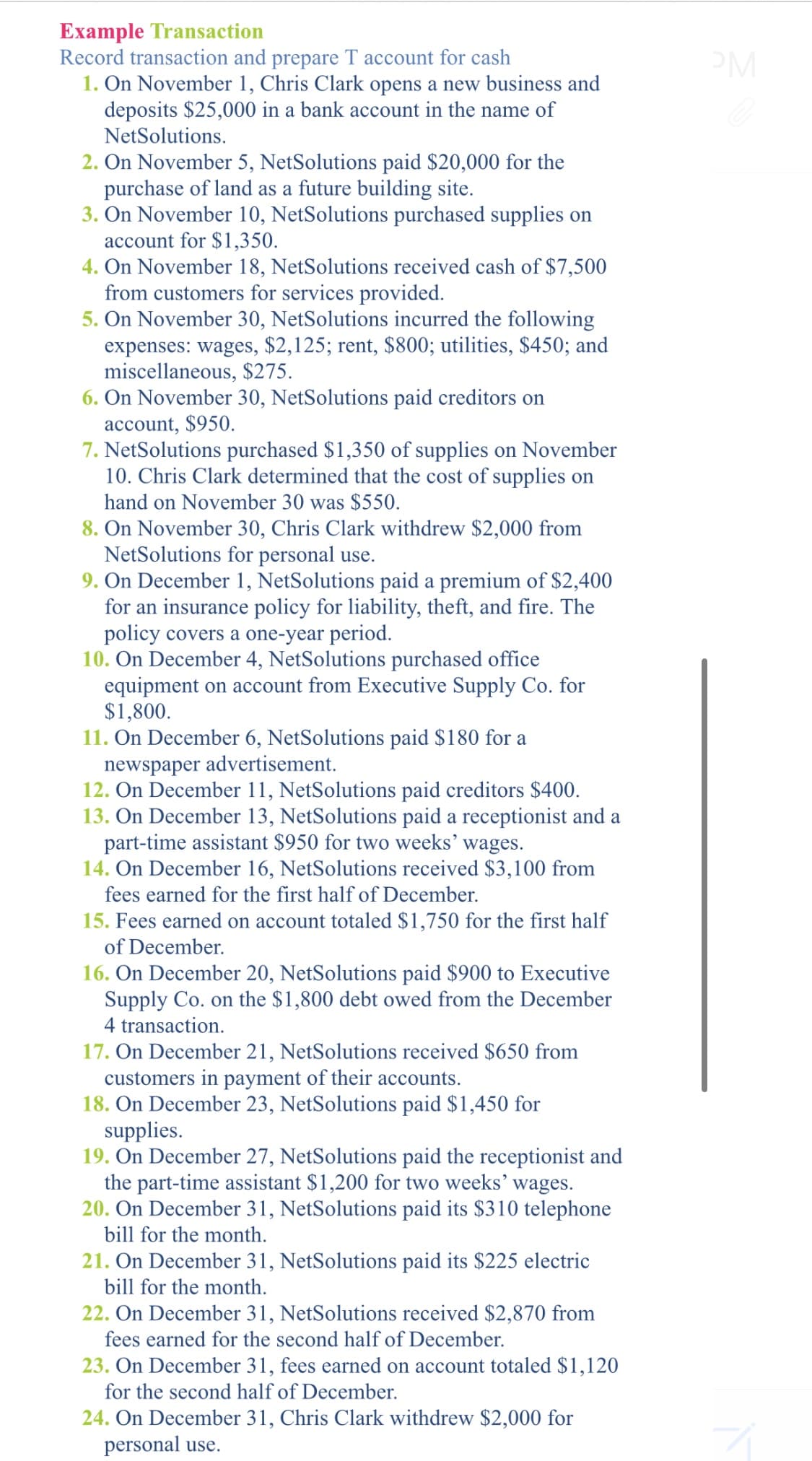

Transcribed Image Text:Example Transaction

Record transaction and prepare T account for cash

1. On November 1, Chris Clark opens a new business and

deposits $25,000 in a bank account in the name of

PM

NetSolutions.

2. On November 5, NetSolutions paid $20,000 for the

purchase of land as a future building site.

3. On November 10, NetSolutions purchased supplies on

account for $1,350.

4. On November 18, NetSolutions received cash of $7,500

from customers for services provided.

5. On November 30, NetSolutions incurred the following

expenses: wages, $2,125; rent, $800; utilities, $450; and

miscellaneous, $275.

6. On November 30, NetSolutions paid creditors on

account, $950.

7. NetSolutions purchased $1,350 of supplies on November

10. Chris Clark determined that the cost of supplies on

hand on November 30 was $550.

8. On November 30, Chris Clark withdrew $2,000 from

NetSolutions for personal use.

9. On December 1, NetSolutions paid a premium of $2,400

for an insurance policy for liability, theft, and fire. The

policy covers a one-year period.

10. On December 4, NetSolutions purchased office

equipment on account from Executive Supply Co. for

$1,800.

11. On December 6, NetSolutions paid $180 for a

newspaper advertisement.

12. On December 11, NetSolutions paid creditors $400.

13. On December 13, NetSolutions paid a receptionist and a

part-time assistant $950 for two weeks' wages.

14. On December 16, NetSolutions received $3,100 from

fees earned for the first half of December.

15. Fees earned on account totaled $1,750 for the first half

of December.

16. On December 20, NetSolutions paid $900 to Executive

Supply Co. on the $1,800 debt owed from the December

4 transaction.

17. On December 21, NetSolutions received $650 from

customers in payment of their accounts.

18. On December 23, NetSolutions paid $1,450 for

supplies.

19. On December 27, NetSolutions paid the receptionist and

the part-time assistant $1,200 for two weeks' wages.

20. On December 31, NetSolutions paid its $310 telephone

bill for the month.

21. On December 31, NetSolutions paid its $225 electric

bill for the month.

22. On December 31, NetSolutions received $2,870 from

fees earned for the second half of December.

23. On December 31, fees earned on account totaled $1,120

for the second half of December.

24. On December 31, Chris Clark withdrew $2,000 for

personal use.

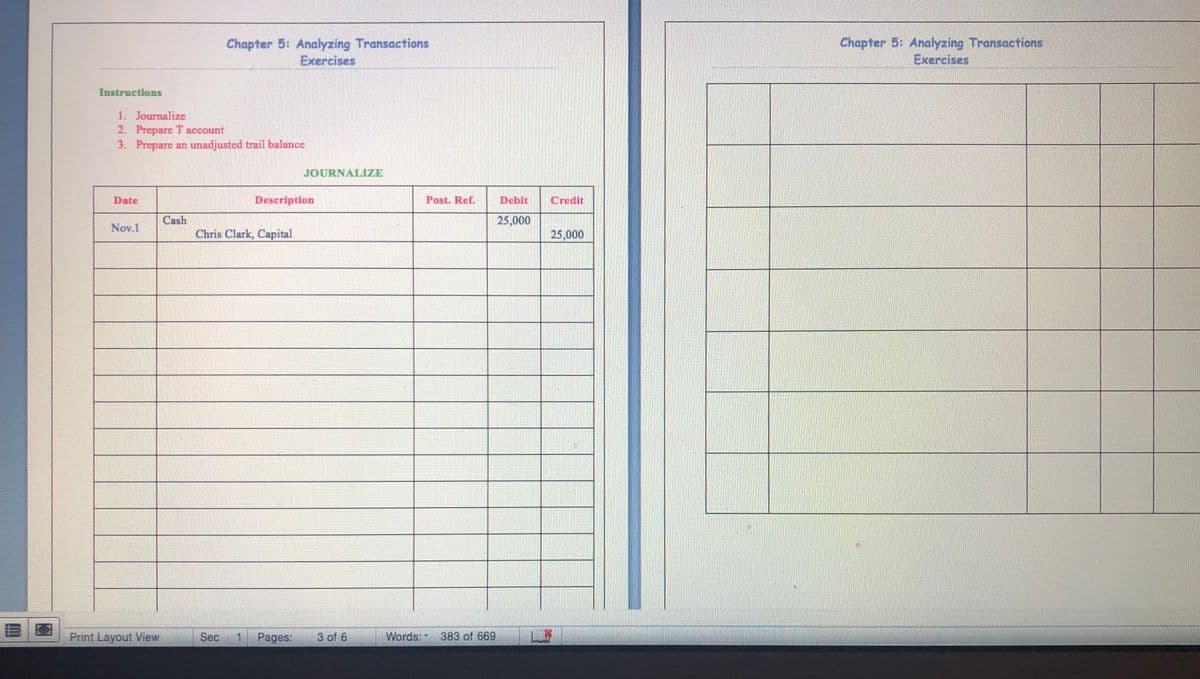

Transcribed Image Text:Chapter 5: Analyzing Transactions

Exercises

Chapter 5: Analyzing Transactions

Exercises

Instructions

1. Journalize

2. Prepare T account

3. Prepare an unadjusted trail balance

JOURNALIZE

Date

Description

Post. Ref.

Deblt

Credit

Cash

25,000

Nov.1

Chris Clark, Capital

25,000

Print Layout iew

Sec

1 Pages:

3 of 6

Words: 383 of 669

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub