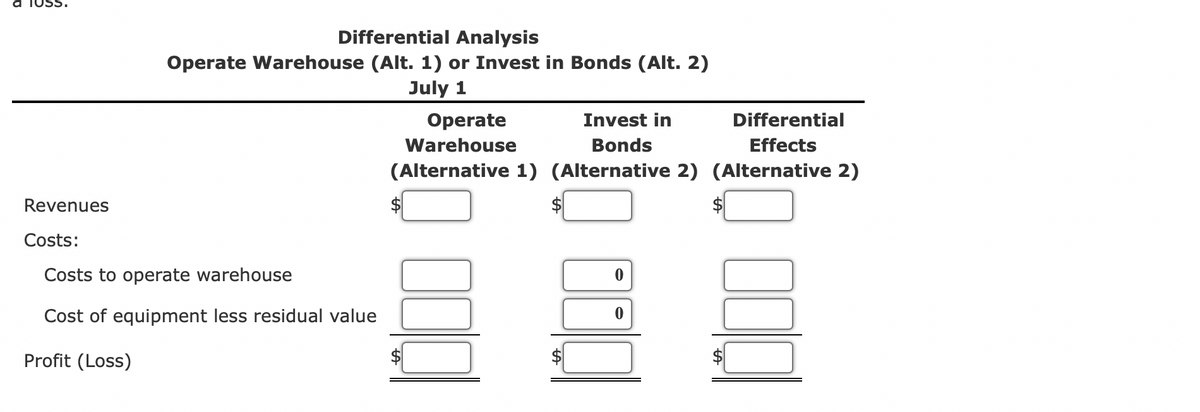

1. Prepare a differential analysis as of July 1 presenting the proposed operation of the warehouse for the 16 years (Alternative 1) as compared with investing in U.S. Treasury bonds (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss.

1. Prepare a differential analysis as of July 1 presenting the proposed operation of the warehouse for the 16 years (Alternative 1) as compared with investing in U.S. Treasury bonds (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate a loss.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 1PB

Related questions

Concept explainers

Question

Transcribed Image Text:Differential Analysis

Operate Warehouse (Alt. 1) or Invest in Bonds (Alt. 2)

July 1

Operate

Invest in

Differential

Warehouse

Bonds

Effects

(Alternative 1) (Alternative 2) (Alternative 2)

Revenues

Costs:

Costs to operate warehouse

Cost of equipment less residual value

Profit (Loss)

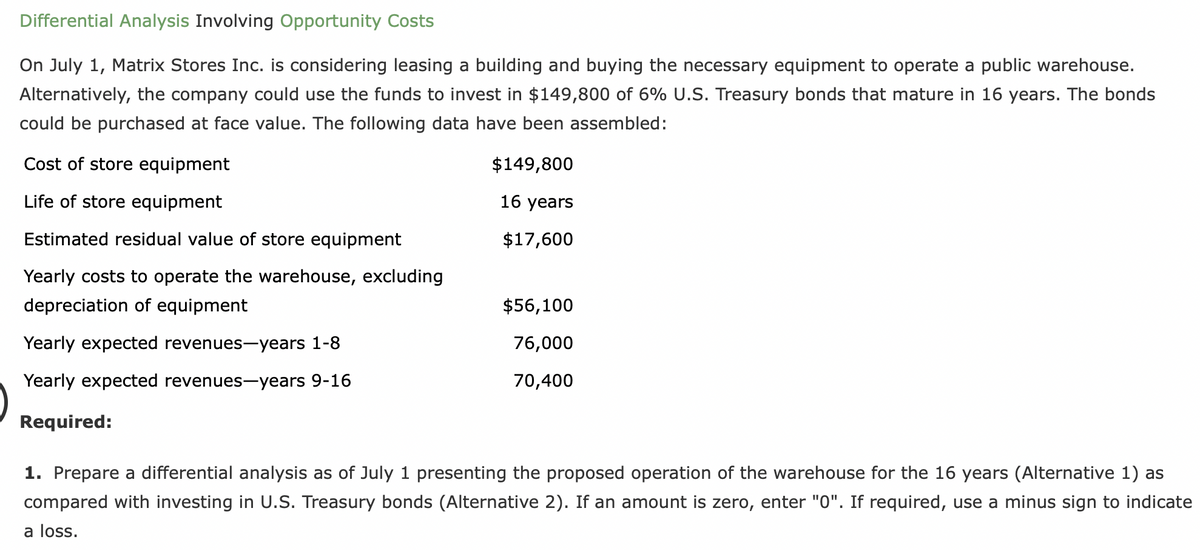

Transcribed Image Text:Differential Analysis Involving Opportunity Costs

On July 1, Matrix Stores Inc. is considering leasing a building and buying the necessary equipment to operate a public warehouse.

Alternatively, the company could use the funds to invest in $149,800 of 6% U.S. Treasury bonds that mature in 16 years. The bonds

could be purchased at face value. The following data have been assembled:

Cost of store equipment

$149,800

Life of store equipment

16 years

Estimated residual value of store equipment

$17,600

Yearly costs to operate the warehouse, excluding

depreciation of equipment

$56,100

Yearly expected revenues-years 1-8

76,000

Yearly expected revenues-years 9-16

70,400

Required:

1. Prepare a differential analysis as of July 1 presenting the proposed operation of the warehouse for the 16 years (Alternative 1) as

compared with investing in U.S. Treasury bonds (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to indicate

a loss.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning