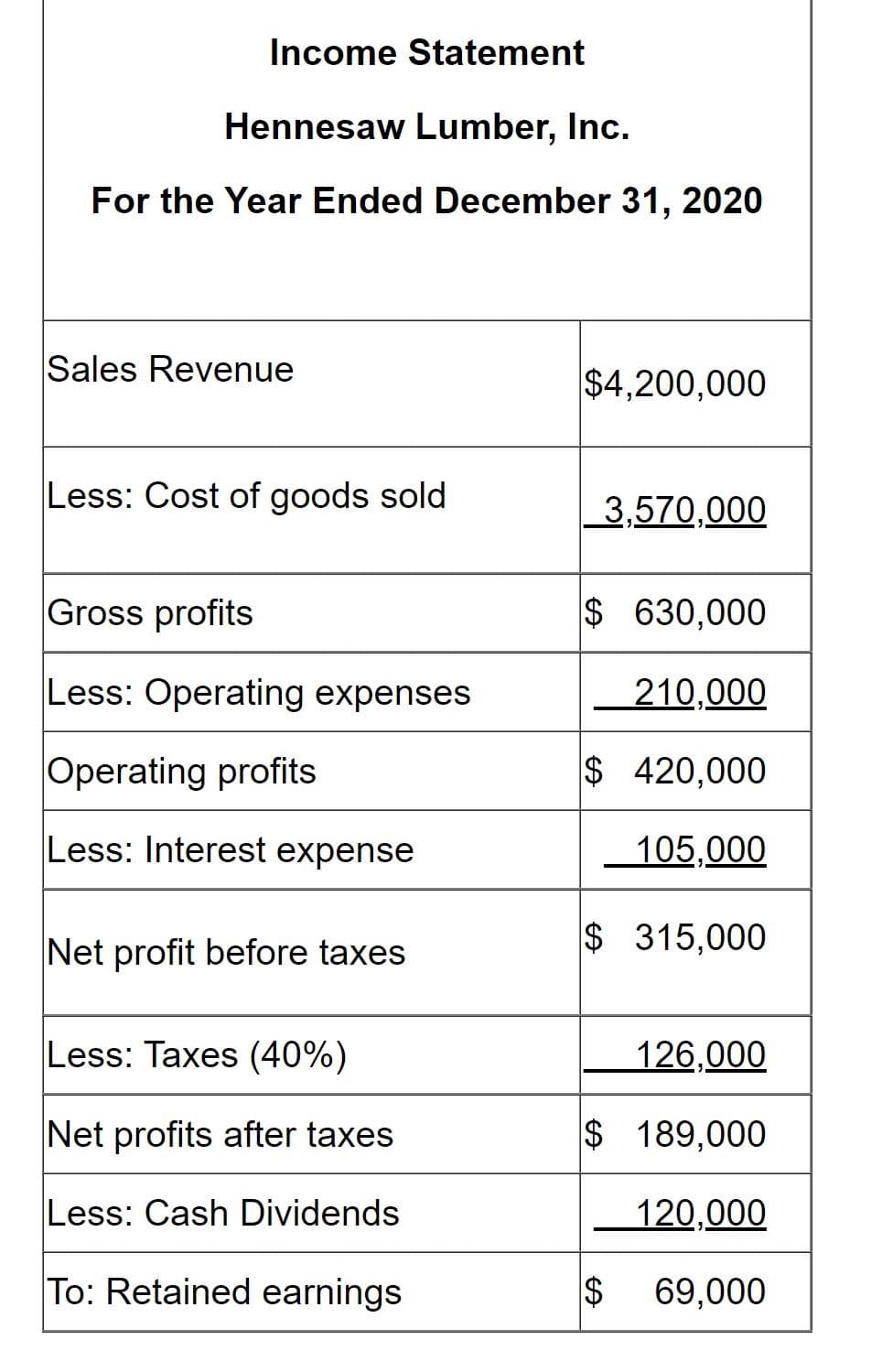

Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2021, for Hennesaw Lumber, Inc. Hennesaw Lumber, Inc. estimates that its sales in 2021 will be $4,500,000. Interest expense is to remain unchanged at $105,000 and the firm plans to pay cash dividends of $150,000 during 2021. Hennesaw Lumber, Inc.'s income statement for the year ended December 31, 2020 is shown below. The pro forma net profits after taxes for 2015 are _____

Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2021, for Hennesaw Lumber, Inc. Hennesaw Lumber, Inc. estimates that its sales in 2021 will be $4,500,000. Interest expense is to remain unchanged at $105,000 and the firm plans to pay cash dividends of $150,000 during 2021. Hennesaw Lumber, Inc.'s income statement for the year ended December 31, 2020 is shown below. The pro forma net profits after taxes for 2015 are _____

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1RE: Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of...

Related questions

Question

Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2021, for Hennesaw Lumber, Inc.

Hennesaw Lumber, Inc. estimates that its sales in 2021 will be $4,500,000. Interest expense is to remain unchanged at $105,000 and the firm plans to pay cash dividends of $150,000 during 2021. Hennesaw Lumber, Inc.'s income statement for the year ended December 31, 2020 is shown below. The pro forma net profits after taxes for 2015 are _____

Transcribed Image Text:Income Statement

Hennesaw Lumber, Inc.

For the Year Ended December 31, 2020

Sales Revenue

$4,200,000

Less: Cost of goods sold

3,570,000

Gross profits

$ 630,000

Less: Operating expenses

210,000

Operating profits

$ 420,000

Less: Interest expense

105,000

Net profit before taxes

$ 315,000

Less: Taxes (40%)

126,000

Net profits after taxes

$ 189,000

Less: Cash Dividends

120,000

To: Retained earnings

2$

69,000

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College