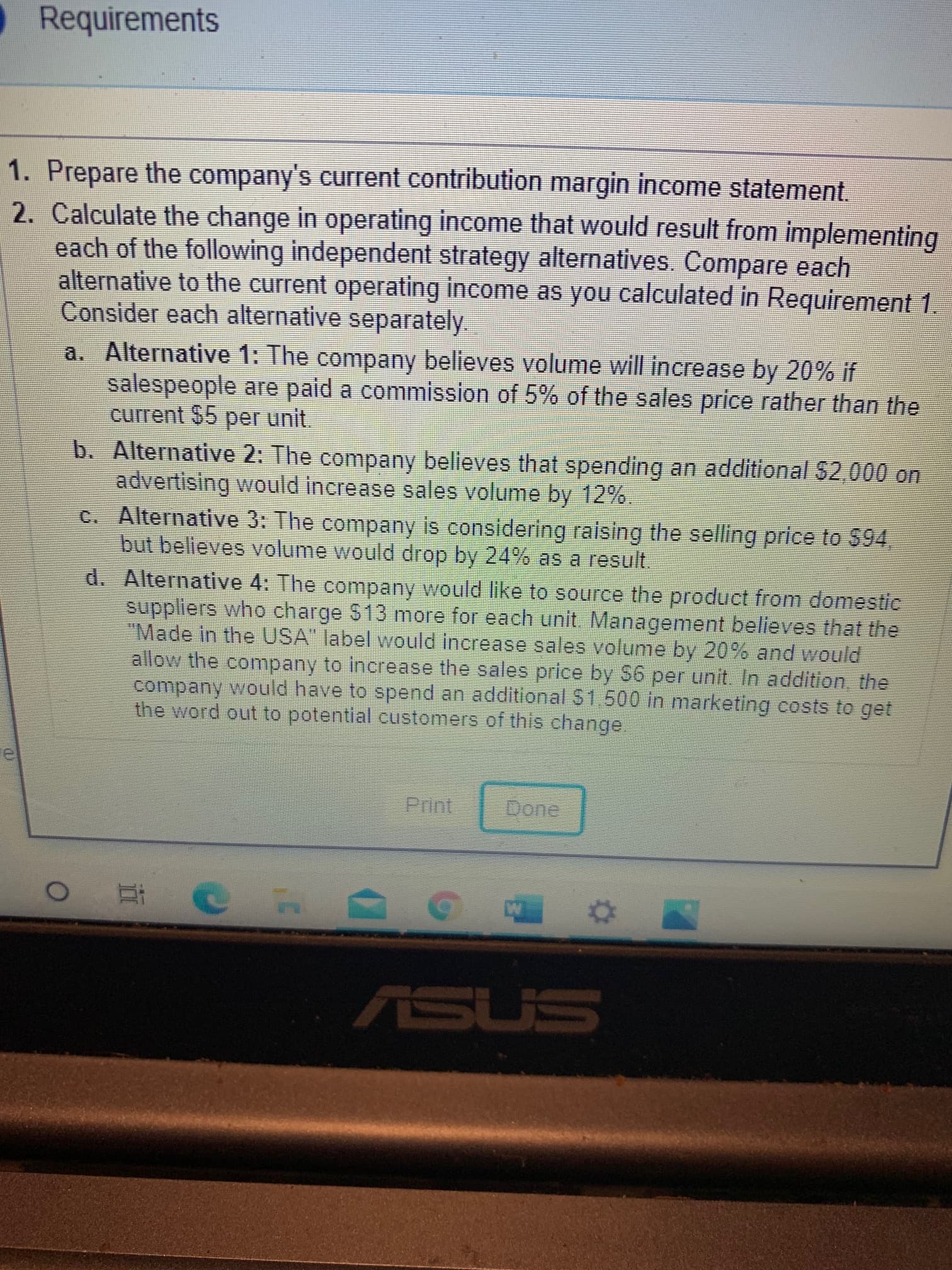

1. Prepare the company's current contribution margin income statement. 2. Calculate the change in operating income that would result from implementing each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated in Requirement 1. Consider each alternative separately. a. Alternative 1: The company believes volume will increase by 20% if salespeople are paid a commission of 5% of the sales price rather than the current $5 per unit. b. Alternative 2: The company believes that spending an additional $2,000 on advertising would increase sales volume by 12%. C. Alternative 3: The company is considering raising the selling price to $94 but believes volume would drop by 24% as a result. d. Alternative 4: The company would like to source the product from domestic suppliers who charge S13 more for each unit. Management believes that the "Made in the USA" label would increase sales volume by 20% and would allow the company to increase the sales price by $6 per unit. In addition, the company would have to spend an additional $1.500 in marketing costs to get the word out to potential customers of this change.

1. Prepare the company's current contribution margin income statement. 2. Calculate the change in operating income that would result from implementing each of the following independent strategy alternatives. Compare each alternative to the current operating income as you calculated in Requirement 1. Consider each alternative separately. a. Alternative 1: The company believes volume will increase by 20% if salespeople are paid a commission of 5% of the sales price rather than the current $5 per unit. b. Alternative 2: The company believes that spending an additional $2,000 on advertising would increase sales volume by 12%. C. Alternative 3: The company is considering raising the selling price to $94 but believes volume would drop by 24% as a result. d. Alternative 4: The company would like to source the product from domestic suppliers who charge S13 more for each unit. Management believes that the "Made in the USA" label would increase sales volume by 20% and would allow the company to increase the sales price by $6 per unit. In addition, the company would have to spend an additional $1.500 in marketing costs to get the word out to potential customers of this change.

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 20MC: A multi-step income statement ________. A. separates cost of goods sold from operating expenses B....

Related questions

Question

Valet Seating Company is currently selling 3,200 oversized bean bag chairs a month at a price of $74 per chair. The variable cost of each chair sold includes $35 to purchase the bean bag chairs from suppliers and a $5 sales commission. Fixed costs are $13,000 per month. The company is considering making several operational changes and wants to know how the change will impact its operating income.

Transcribed Image Text:1. Prepare the company's current contribution margin income statement.

2. Calculate the change in operating income that would result from implementing

each of the following independent strategy alternatives. Compare each

alternative to the current operating income as you calculated in Requirement 1.

Consider each alternative separately.

a. Alternative 1: The company believes volume will increase by 20% if

salespeople are paid a commission of 5% of the sales price rather than the

current $5 per unit.

b. Alternative 2: The company believes that spending an additional $2,000 on

advertising would increase sales volume by 12%.

C. Alternative 3: The company is considering raising the selling price to $94

but believes volume would drop by 24% as a result.

d. Alternative 4: The company would like to source the product from domestic

suppliers who charge S13 more for each unit. Management believes that the

"Made in the USA" label would increase sales volume by 20% and would

allow the company to increase the sales price by $6 per unit. In addition, the

company would have to spend an additional $1.500 in marketing costs to get

the word out to potential customers of this change.

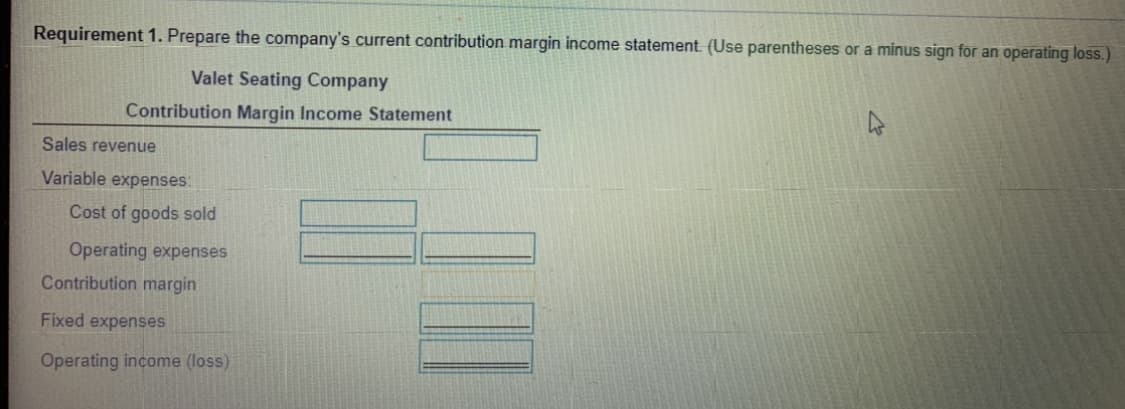

Transcribed Image Text:Requirement 1. Prepare the company's current contribution margin income statement. (Use parentheses or a minus sign for an operating loss.)

Valet Seating Company

Contribution Margin Income Statement

Sales revenue

Variable expenses:

Cost of goods sold

Operating expenses

Contribution margin

Fixed expenses

Operating income (loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College