2. Assume the Chair Division purchases the 800 cushions needed from the Cushion Division at its current sales price. What is the total contribution margin for each division and the company? 3. Assume the Chair Division purchases the 800 cushions needed from the Cushion Division at its current variable cost. What is the total contribution margin for each division and the company? 5. Assume the Cushion Division has capacity of 1,600 cushions per quarter and can continue to supply its outside customers with 800 cushions per quarter and also supply the Chair Division with 800 cushions per quarter. What transfer price should Harris Company set? Explain your reasoning. Using the transfer price you determined, calculate the total contribution margin for the quarter.

2. Assume the Chair Division purchases the 800 cushions needed from the Cushion Division at its current sales price. What is the total contribution margin for each division and the company? 3. Assume the Chair Division purchases the 800 cushions needed from the Cushion Division at its current variable cost. What is the total contribution margin for each division and the company? 5. Assume the Cushion Division has capacity of 1,600 cushions per quarter and can continue to supply its outside customers with 800 cushions per quarter and also supply the Chair Division with 800 cushions per quarter. What transfer price should Harris Company set? Explain your reasoning. Using the transfer price you determined, calculate the total contribution margin for the quarter.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 30P

Related questions

Question

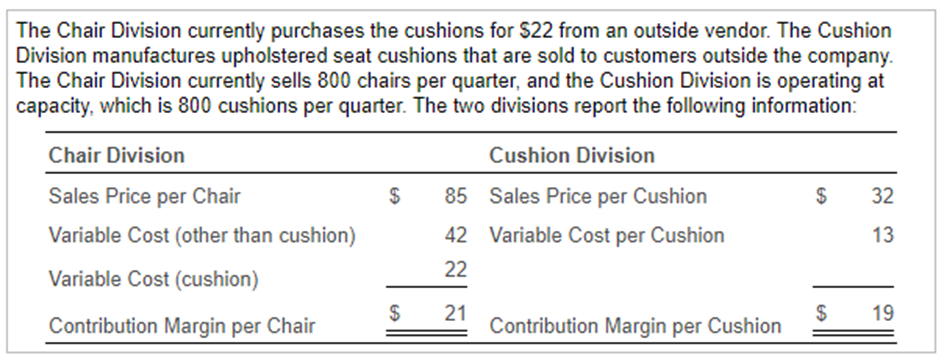

Transcribed Image Text:The Chair Division currently purchases the cushions for $22 from an outside vendor. The Cushion

Division manufactures upholstered seat cushions that are sold to customers outside the company.

The Chair Division currently sells 800 chairs per quarter, and the Cushion Division is operating at

capacity, which is 800 cushions per quarter. The two divisions report the following information:

Chair Division

Cushion Division

Sales Price per Chair

$

85 Sales Price per Cushion

32

Variable Cost (other than cushion)

42 Variable Cost per Cushion

13

22

Variable Cost (cushion)

$

21

Contribution Margin per Cushion

$

19

Contribution Margin per Chair

%24

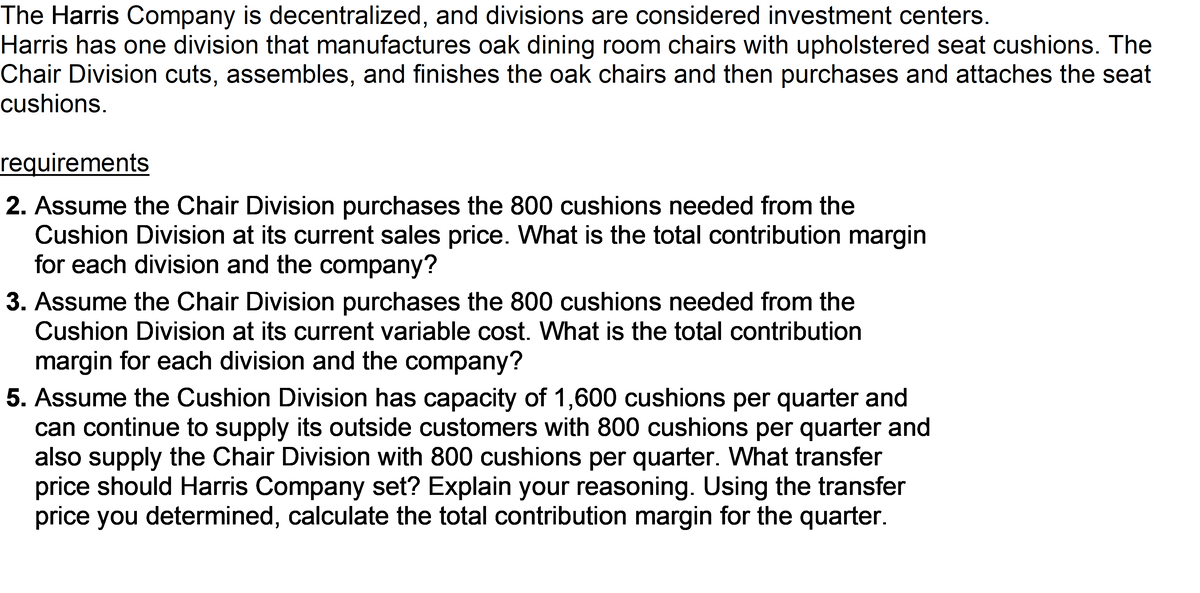

Transcribed Image Text:The Harris Company is decentralized, and divisions are considered investment centers.

Harris has one division that manufactures oak dining room chairs with upholstered seat cushions. The

Chair Division cuts, assembles, and finishes the oak chairs and then purchases and attaches the seat

cushions.

requirements

2. Assume the Chair Division purchases the 800 cushions needed from the

Cushion Division at its current sales price. What is the total contribution margin

for each division and the company?

3. Assume the Chair Division purchases the 800 cushions needed from the

Cushion Division at its current variable cost. What is the total contribution

margin for each division and the company?

5. Assume the Cushion Division has capacity of 1,600 cushions per quarter and

can continue to supply its outside customers with 800 cushions per quarter and

also supply the Chair Division with 800 cushions per quarter. What transfer

price should Harris Company set? Explain your reasoning. Using the transfer

price you determined, calculate the total contribution margin for the quarter.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning