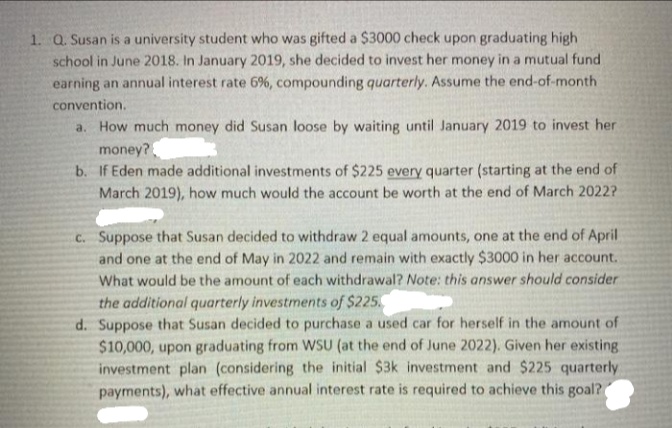

1. Q. Susan is a university student who was gifted a $3000 check upon graduating high school in June 2018. In January 2019, she decided to invest her money in a mutual fund earning an annual interest rate 6%, compounding quarterly. Assume the end-of-month convention. a. How much money did Susan loose by waiting until January 2019 to invest her money? b. If Eden made additional investments of $225 every quarter (starting at the end of March 2019), how much would the account be worth at the end of March 2022? C. Suppose that Susan decided to withdraw 2 equal amounts, one at the end of April and one at the end of May in 2022 and remain with exactly $3000 in her account. What would be the amount of each withdrawal? Note: this answer should consider the additional quarterly investments of $225.

1. Q. Susan is a university student who was gifted a $3000 check upon graduating high school in June 2018. In January 2019, she decided to invest her money in a mutual fund earning an annual interest rate 6%, compounding quarterly. Assume the end-of-month convention. a. How much money did Susan loose by waiting until January 2019 to invest her money? b. If Eden made additional investments of $225 every quarter (starting at the end of March 2019), how much would the account be worth at the end of March 2022? C. Suppose that Susan decided to withdraw 2 equal amounts, one at the end of April and one at the end of May in 2022 and remain with exactly $3000 in her account. What would be the amount of each withdrawal? Note: this answer should consider the additional quarterly investments of $225.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

ChapterM: Time Value Of Money Module

Section: Chapter Questions

Problem 11E

Related questions

Question

100%

Transcribed Image Text:1. Q. Susan is a university student who was gifted a $3000 check upon graduating high

school in June 2018. In January 2019, she decided to invest her money in a mutual fund

earning an annual interest rate 6%, compounding quarterly. Assume the end-of-month

convention.

a. How much money did Susan loose by waiting until January 2019 to invest her

money?

b. If Eden made additional investments of $225 every quarter (starting at the end of

March 2019), how much would the account be worth at the end of March 2022?

C. Suppose that Susan decided to withdraw 2 equal amounts, one at the end of April

and one at the end of May in 2022 and remain with exactly $3000 in her account.

What would be the amount of each withdrawal? Note: this answer should consider

the additional quarterly investments of $225.

d. Suppose that Susan decided to purchase a used car for herself in the amount of

$10,000, upon graduating from WSU (at the end of June 2022). Given her existing

investment plan (considering the initial $3k investment and $225 quarterly

payments), what effective annual interest rate is required to achieve this goal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning