Chapter31: Capital Markets

Section: Chapter Questions

Problem 2E

Related questions

Question

help pls

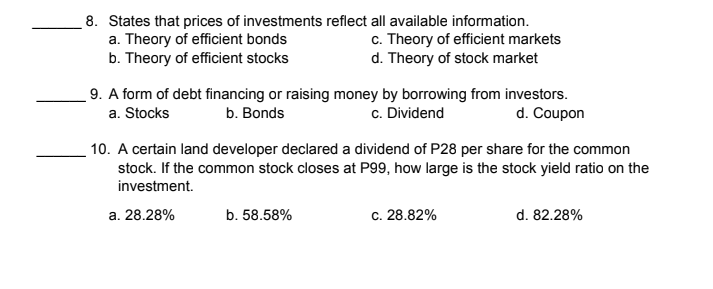

Transcribed Image Text:8. States that prices of investments reflect all available information.

a. Theory of efficient bonds

b. Theory of efficient stocks

c. Theory of efficient markets

d. Theory of stock market

9. A form of debt financing or raising money by borrowing from investors.

a. Stocks

b. Bonds

c. Dividend

d. Coupon

10. A certain land developer declared a dividend of P28 per share for the common

stock. If the common stock closes at P99, how large is the stock yield ratio on the

investment.

a. 28.28%

b. 58.58%

c. 28.82%

d. 82.28%

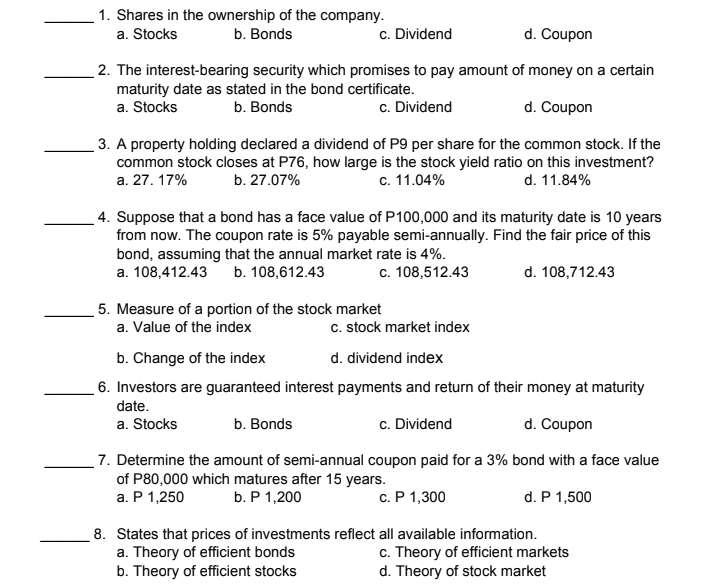

Transcribed Image Text:1. Shares in the ownership of the company.

a. Stocks

b. Bonds

c. Dividend

d. Coupon

2. The interest-bearing security which promises to pay amount of money on a certain

maturity date as stated in the bond certificate.

a. Stocks

b. Bonds

c. Dividend

d. Coupon

3. A property holding declared a dividend of P9 per share for the common stock. If the

common stock closes at P76, how large is the stock yield ratio on this investment?

a. 27. 17%

b. 27.07%

c. 11.04%

d. 11.84%

4. Suppose that a bond has a face value of P100,000 and its maturity date is 10 years

from now. The coupon rate is 5% payable semi-annually. Find the fair price of this

bond, assuming that the annual market rate is 4%.

a. 108,412.43

b. 108,612.43

c. 108,512.43

d. 108,712.43

5. Measure of a portion of the stock market

a. Value of the index

c. stock market index

d. dividend index

6. Investors are guaranteed interest payments and return of their money at maturity

b. Change of the index

date.

a. Stocks

b. Bonds

c. Dividend

d. Coupon

7. Determine the amount of semi-annual coupon paid for a 3% bond with a face value

of P80,000 which matures after 15 years.

а. Р 1,250

b. P 1,200

с. Р 1,300

d. P 1,500

8. States that prices of investments reflect all available information.

a. Theory of efficient bonds

b. Theory of efficient stocks

c. Theory of efficient markets

d. Theory of stock market

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax