If a company will pay $100,000 for a truck that will increase deliveries to be made, giving an additional $15,000 in revenue each year for 10 years, should the company buy it? Interest rates are 5%. Show your math. B) Now revenue is estimated to be only $12,000 a year for 10 years. Same interest rate, should the truck be purchased? C) Explain where interest rates come from, using details.

6. A) If a company will pay $100,000 for a truck that will increase deliveries to be made, giving an additional $15,000 in revenue each year for 10 years, should the company buy it? Interest rates are 5%. Show your math.

B) Now revenue is estimated to be only $12,000 a year for 10 years. Same interest rate, should the truck be purchased?

C) Explain where interest rates come from, using details.

Consider the given information below to answer the questions:

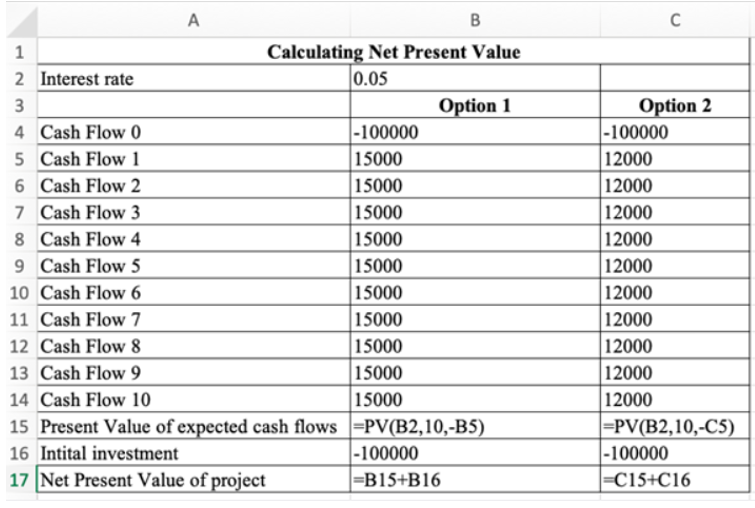

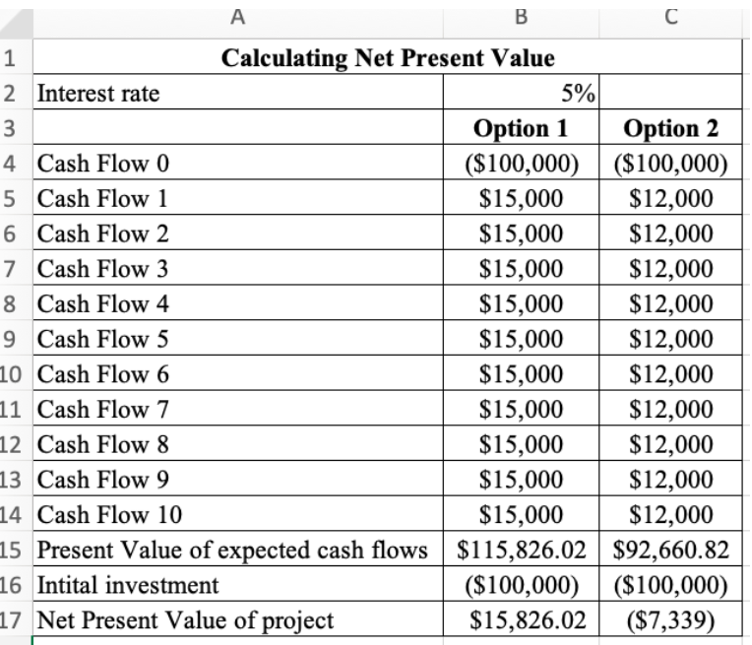

The companies make use of the net present value (NPV)method in order to determine whether to undertake an investment decision or not in the economy. This means that the company would value the project and the net present value of the returns will be calculated using the method of discounting. The discounting is the method of calculating the present value of the stream of future payments. It helps to identify the investment is really worth or not using the time value of money. In this case, the cash flows is equal at $15,000 from year 1 to year 10. The interest rate is given to be 5 percent. The NPV can be calculated using Excel as follows:

Using an excel spreadsheet in order to calculate the Net Present Value of the process is a method that can easily calculate the NPV of the project. The NPV of the projects will be as follows:

Step by step

Solved in 2 steps with 2 images