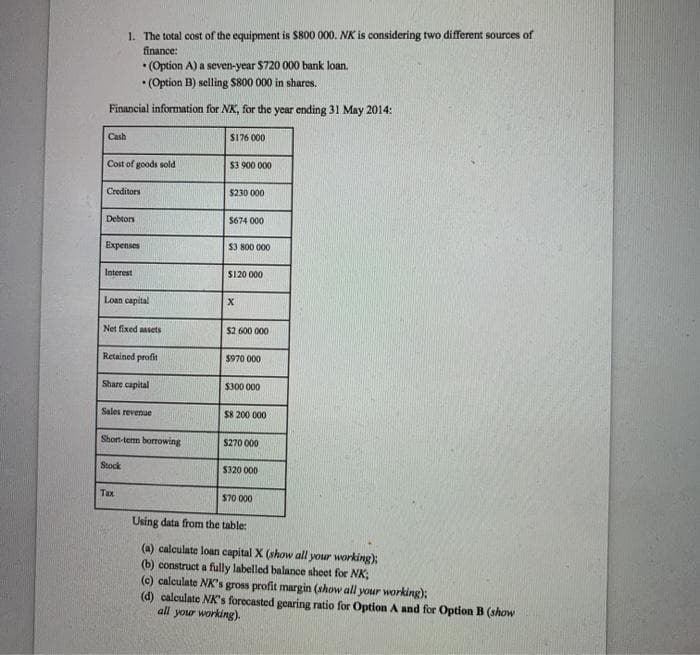

1. The total cost of the equipment is $800 000. K is considering two different sources of finance: • (Option A) a seven-year $720 000 bank loan. •(Option B) selling S800 000 in shares. Financial information for NK, for the year ending 31 May 2014: Cash S176 000 Cost of goods sold $3 900 000 Creditors $230 000 Debtors $674 000 Expenses $3 800 000 Interest $120 000 Loan capital Net fixed sets $2 600 000 Retained profit $970 000 Share capital $300 000 Sales revenue $8 200 000 Short-term borrowing $270 000 Stock $320 000 Tax $70 000 Using data from the table: (a) calculate loan capital X (show all your working); (b) construct a fully labelled balance sheet for NK: (e) calculate NK's gross profit margin (show all your working); (d) calculate NK's forecasted gearing ratio for Option A and for Option B (show all your working).

1. The total cost of the equipment is $800 000. K is considering two different sources of finance: • (Option A) a seven-year $720 000 bank loan. •(Option B) selling S800 000 in shares. Financial information for NK, for the year ending 31 May 2014: Cash S176 000 Cost of goods sold $3 900 000 Creditors $230 000 Debtors $674 000 Expenses $3 800 000 Interest $120 000 Loan capital Net fixed sets $2 600 000 Retained profit $970 000 Share capital $300 000 Sales revenue $8 200 000 Short-term borrowing $270 000 Stock $320 000 Tax $70 000 Using data from the table: (a) calculate loan capital X (show all your working); (b) construct a fully labelled balance sheet for NK: (e) calculate NK's gross profit margin (show all your working); (d) calculate NK's forecasted gearing ratio for Option A and for Option B (show all your working).

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 10RE

Related questions

Question

Transcribed Image Text:1. The total cost of the equipment is $800 000. NK is considering two different sources of

finance:

• (Option A) a seven-year $720 000 bank loan.

• (Option B) selling S800 000 in shares.

Financial information for NK, for the year ending 31 May 2014:

Cash

S176 000

Cost of goods sold

$3 900 000

Creditors

$230 000

Debtors

S674 000

Expenses

S3 800 000

Interest

$120 000

Loan capital

Net fixed assets

$2 600 000

Retained profit

$970 000

Share capital

$300 000

Sales revenue

$8 200 000

Short-tem borrowing

$270 000

Stock

$320 000

Тах

$70 000

Using data from the table:

(a) calculate loan capital X (show all your working);

(b) construct a fully labelled balance sheet for NK;

(e) calculate NKs gross profit margin (show all your working);

(d) calculate NK's forecasted gearing ratio for Option A and for Option B (show

all your working)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning