Q: How long (in years) will it take to quadruple it earns 0.03 compounded semiannually?

A: compound interest formula, which is A = P(1 + r/n)^(nt).

Q: Assume US dollars and Canadian dollars are at 1SUS = C$1.08. You have C$1,000,000 at your disposal.…

A: The equivalent Mexican Pesos for one million Canadian dollars is $ 483,000,000.

Q: Unit VIII question 12

A: Answer- Working Note - Computation of capital cost of hoist - Particulars Amount Purchase…

Q: Mary made an initial investment of $41,290. The investment grows at 3% per year compounded…

A: Initial investment (PV) = $41,290 Interest rate = 3% Quarterly interest rate (i) = 3%/4 = 0.75%…

Q: shareholders be the owners

A: A firm refers to a profit-making organization such as a sole proprietorship, partnership, company,…

Q: STRIPS are: a) Government-backed schemes that allow investors to hedge against market risk.…

A: STRIPS (Separate Trading of Registered Interest and Principal Securities) was established to give…

Q: Kyle wants $20,000 in 4 years. He can invest in a fund that earns 6% and compounds quarterly. How…

A: N - Number of Compounding Periods = 4 Years * 4 quarters = 16 I% - Annual Interest (as a %) = 6%…

Q: You wish to evaluate which of the two equity funds delivered a better risk adjusted return in terms…

A: Sharpe ratios is calculated as excess return over the risk free rate divided by the standard…

Q: A retailer buys an alarm set for RM 850. Operating expenses are 5 % based on cost. The retailer…

A: Cost per alarm = RM850 Operating expenses on cost = 5% Profit ratio on selling price = 30%

Q: ruz Corporation has $100 billion of debt outstanding. An otherwise identical firm has no debt and…

A: Corporate tax rate = 28% Personal tax rate = 17% Tax rate on debt = 29%

Q: You are a portfolio manager of a global equity fund of funds UITF. You decided to hold a portfolio…

A: The portfolio expected return is calculated as sum of weighted return of each investment. Weight of…

Q: For the following alternatives compute the Delta B/C ratio of Alternative D minus Alternative A. Use…

A:

Q: The following are the cash flows of two independent projects: Year Project A Project B 0 $…

A: Cost of capital = 12% Year Project A Project B 0 -270 -270 1 150 170 2 150 170 3 150 170…

Q: A $8500 bond bearing interest at 4.3% payable semi-annually is due in 7 years. Money is worth 5.9%…

A: Par value = $8500 Coupon rate = 4.3% Frequency of payment = Semi annual

Q: A. 20Y5 Annual net cash flow is incorrect. B. Present value of annual net cash flow Less…

A:

Q: A $13,000 loan is to be amortized for 10 years with quarterly payments of $414.98. If the interest…

A: Information Loan amount (PV) = $13000 Quarterly payment (P) = $414.98 Interest rate = 5% Quarterly…

Q: 2 of the VLN, how do you determine the annuity cash flow (the bond interest payment) from an annual…

A: Interest payment annual cash flows which is paid to the bond holders regularly till bonds are…

Q: Bank of America Card uses 16account numbers, with the 16th digit being a formula check digitthe best…

A: Mastercard cards begin with a 5 and have a total of 16 digits. American Express cards have 15 digits…

Q: A series of equal semi-annual payments of $2200 for 3 years is equivalent to what present amount at…

A: Given, Interest rate = 12 % per annum. Semi-annual Interest rate =122 = 6 %. Time period, = 3 × 2 =…

Q: A concrete hollow blocks (CHB) plant has an overhead cost of P150,000 per month. The material cost…

A: Break-even Point: The break-even point is that level of sales at which the operating income (EBIT)…

Q: INTERMEDIATE (Questions 18–33) 18. Bond Price Movements Bond X is a premium bond making semiannual…

A: A bond is a sort of financial asset in which the issuer owes the holder a debt and is required to…

Q: What is the holding company's beta?

A: Beta refers to the concept of measuring the expected movement of stock in the overall market as a…

Q: With a present value of $125,000, what is the size of the withdrawals that can be made at the end of…

A: Present value (PV) = $125,000 Period = 10 Years Quarterly periods (n) = 10*4 = 40 Interest rate =…

Q: Unit VIII question 12

A: Data given: Purchase price of automobile hoist =$ 36,900 Salvage value = $3000 Installation cost =…

Q: A company wants to have $30,000 at the beginning of each 6-month period for the next 4 1/2 years. If…

A: Semi annual payment = $30,000 Period = 4 1/2 = 4.50 Years Semi annual period = 4.50*2 = 9 Interest…

Q: Why does financial planning usually equated with projections?

A: Financial planning is a stage process way of accomplishing individual's lifestyle goals. A financial…

Q: payback period for Project A and Project B

A: Net present value refers to the amount of discounted cash flow that is used to calculate the present…

Q: A company has an outstanding issue of perpetual preferred stock with an annual dividend of $8.85 per…

A: Annual dividend = $8.85 Required return = 9.1%

Q: Fusion Energy Co’s earnings before interest and taxes (EBIT) was $275 million. Assuming Fusion…

A: NOPAT is calculated as EBIT less taxes

Q: A project requires an initial outlay of P 100 000. The relevant inflows associated with the project…

A: The difference between the present value of cash inflows and outflows over time is known as net…

Q: Cash Flow (1,650,000) 330,000 365,000 380,000 415,000 405,000 370000 294,000 Insert your…

A: Required rate of return = 15% Year Cash flow 0 -1650000 1 330000 2 365000 3 380000 4…

Q: If you are willing to loan someone $100 and expect to be paid back $200 and earn 12% on your…

A: Given Loan amount is $100 Amount to be paid back is $200 Rate of return is 12%

Q: Two different alternatives are being compared. Using Net Present Worth Analysis which alternative is…

A: Ne Present Worth: It Is the difference between the present value of cash outflow and inflows over…

Q: Consider a 30-year fixed-rate home loan of $565,500 with an interest rate of 4.25%. What is the…

A: The total amount of interest paid is calculated as the total payment made over the loan tenure less…

Q: Dome Metals has credit sales of $450,000 yearly with credit terms of net 45 days, which is also the…

A: Decrease in accounts receivable = Average accounts receivable without discount- Average accounts…

Q: Falk Enterprises borrowed $8,500 at 6.25% compounded semiannually to purchase a new forklift. The…

A: The question is asking about computation of amortization schedule. Amortization schedule is…

Q: 2?The seller has agreed to let the buyer move into the property two days prior to the date of…

A: Homeowners Insurance policy is specific to the current home that is insured. Every detail of the…

Q: . If Reuben accepts the offer, what will the effect on profit be?

A: Presently the total cost to make the rolls = 0.24 + 0.39 + 0.15 + 0.20 = $ 0.98 Potential seller is…

Q: 2. When using the stable growth model for terminal value calculations; name 3 considerations that…

A: The terminal value (TV) of a business or project is the value of the business or project after the…

Q: What rate are you earning if you agree to pay $100 today for an IOU for $500 due in 20 years? A) 4%…

A: Here, Present value (PV) = $100 Future value (FV) = $500 Time to maturity = 20 years To Find: Rate…

Q: A large city in the midwest needs to acquire a street-cleanıng machine to keep its roads looking…

A: Breakeven point (BEP) is the term that is used in the different business areas of the finance as…

Q: A $1,000,000 lottery prize pays $50,000 per year for the next 20 years. If the current rate of…

A: The value of the lottery prize today is calculated as present value of annuity

Q: Suppose that you invested $100 in a bank account that earned an annual rate of return of 10%. How…

A: Deposited amount (PV) is $100 Annual rate of return (r) is 10% Time period(t) is 10 years To Find:…

Q: a. Last year, Lagenda paid a dividend of RM0.065. The dividend growth is expected to be 5.1% next…

A: Dividend discount model refers to a stock valuation model which is used by the company for…

Q: QUESTION 16 There are two mutual fund managers. Manager 1eamed 21% in the past year wherean manager…

A: The Capital Asset Pricing Model is the model where we find out the effect of systemic risk on the…

Q: Auto Tires, Inc. sells tires to service stations for an average of $45 each. The variable costs of…

A: Break even level is calculated as ratio of fixed costs and contribution margin per tire

Q: Your boss has asked you to look into optimizing the commercial van ownership strategy for your…

A: Data given : Cost price of van = $85,600 Miles per year = 29,500 miles Operating cost per mile =…

Q: For the following alternatives compute the Delta B/C ratio of Alternative D minus Alternative A. Use…

A: Initial investment = C Salvage value = S Annual benefit = A Useful life = n MARR = r = 11%

Q: b) You can invest in taxable bonds that are paying a yield of 9.50% or a municipal bond paying a…

A: A security bond is a legally enforceable promise to pay the government if you or your employee…

Q: b. Bank Islam Malaysia Bhd (BIMB) plan to invest in Malaysian Islamic Treasury Bills which has a…

A: Concept Treasury Bills are short term money market instruments.

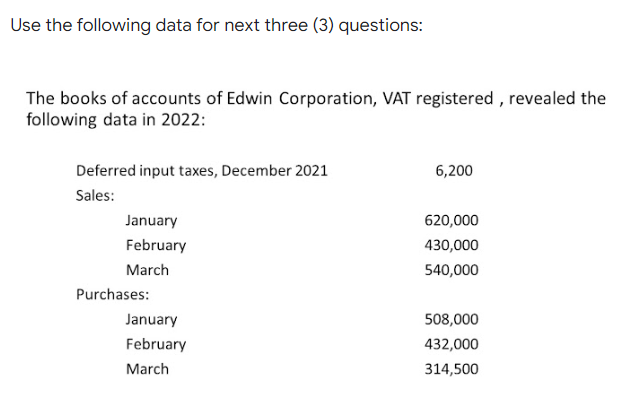

1. The VAT payable for January is?

2. The VAT payable for February is

3. The VAT payable for March is?

Step by step

Solved in 2 steps

- Consider the following accounts and determine if the account is a current liability, a noncurrent liability, or neither. A. cash B. federal income tax payable this year C. long-term note payable D. current portion of a long-term note payable E. note payable due in four years F. interest expense G. state income taxRhodes Corporations financial statements are shown after part f. Suppose the federal-plus-state tax corporate tax is 25%. Answer the following questions. a. What is the net operating profit after taxes (NOPAT) for 2020? b. What are the amounts of net operating working capital for both years? c. What are the amounts of total net operating capital for both years? d. What is the free cash flow for 2020? e. What is the ROIC for 2020? f. How much of the FCF did Rhodes use for each of the following purposes: after-tax interest, net debt repayments, dividends, net stock repurchases, and net purchases of short-term investments? (Hint: Remember that a net use can be negative.) Rhodes Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) Rhodes Corporation: Balance Sheets as of December 31 (Millions of Dollars)How do the all events and economic performance requirements apply to the following transactions by an accrual basis taxpayer? a. The company guarantees its products for six months. At the end of 2019, customers had made valid claims for 600,000 that were not paid until 2020. Also, the company estimates that another 400,000 in claims from 2019 sales will be filed and paid in 2020. b. The accrual basis taxpayer reported 200,000 in corporate taxable income for 2019. The state income tax rate was 6%. The corporation paid 7,000 in estimated state income taxes in 2019 and paid 2,000 on 2018 state income taxes when it filed its 2018 state income tax return in March 2019. The company filed its 2019 state income tax return in March 2020 and paid the remaining 5,000 of its 2019 state income tax liability. c. An employee was involved in an accident while making a sales call. The company paid the injured victim 15,000 in 2019 and agreed to pay the victim 15,000 a year for the next nine years.

- Cee Co.s fiscal year begins April 1. At the beginning of its fiscal year, Cee Co. estimates that it will owe 17,400 in property taxes for the year. On June 1, its property taxes are assessed at 17,000, which it pays immediately. Prepare the related journal entries for April 1, May 1, and June 1. Then compute the monthly property tax expense that Cee Co. would record during June through March.Payroll Accounting McLaughlin Manufacturing has the following data available for its March 31, 2019, payroll: *All Subject to Social Security and Medicare matching and withholding at 6.2% and 1.45%, re9eetivety. Federal unemployment taxes of 0.50% and state unemployment taxes of 0.80% are payable on the first $1,000,000. Required: 1. Compute the taxes payable and wages that will be paid to employees. Then prepare the journal entries to record the wages earned and the payroll taxes. ( Note: Round to the nearest penny) 2. CONCEPTUAL CONNECTION McLaughlin Manufacturing would like to hire a new employee at a salary of $80,000. Assuming payroll taxes are as described above (with unemployment taxes paid on the first $7,000) and fringe benefits (e.g., health insurance, retirement, etc.) are 28% of gross pay, what will be the total cost of this employee for McLaughlin?for calender year 2020, power inc. had net income before income taxes in the amount of $10,000. Tax rates are 20% Federal, 9% NY State, and 8% NY City . Wowee adjusts its books annually. A. Prepare the AJE, if any, on 12/31/20. B. Record the payment of the taxes on 3/15/21

- Additional Information: - income tax expenses were included in other general expenses for the two years. tax expenses for 2022 were $15,650,000 and 2021 were $11,435,000. - income tax payable as of 31 December 2022 was included underneath Provisions section and amount was $2,950,000 REQUIRED : THIS SOCI IS WRONG PLEASE PREPARE THE RIGHT ONEAt the beginning of 2021, Pitman Co. had pretax financial income of $1,200,000. Additionally, there was a timing difference of $300,000 due to an accounts receivable that will not be collected until the following year. The tax rate us 30%. A. Calculate the total taxable income for 2021. B. Calculate Income tax expense, income tax payable, and the deferred amount for 2021, and create the journal entry.ABC Corporation provides you with the following information for the 2020 tax year, which was the company’s first year of operation:Book Income Before Taxes $100,000,000Book Depreciation $ 5,000,000MACRS Depreciation $ 7,500,000Foreign Sourced Income $ 40,000,000Assume a federal tax rate of 21%, disregard state taxes.a. Calculate federal taxable income.b. Calculate the federal tax payable and federal tax expense.c. Given your answer above in b., is a deferred tax asset or a deferred tax liability created? Provide the journal entry needed to reflect this.

- The following tax expenses related to business were paid by Palmyra Trading in 2022:Business taxes, other than VAT, P20,000Documentary stamp taxes, P1,000Automobile registration fees, P3,000Import duty taxes, P50,000Postage stamp taxes, P500Stock transaction tax, P2,500Income tax, P600,000Value-added tax, P240,000Donor’s tax, P8,000How much is the amount of taxes deductible from gross income? a. P73,500 b. P73,000 c. P74,500 d. P76,00019.At 30 June 2023, Barry Ltd estimates it will be required to pay income tax expenses of $62 000 during the following financial year. The correct journal entry to provide for this income tax estimate at 30 June 2023 is: Group of answer choices 1.DR Income tax expense $62 000; CR Current tax liability $62 000 2.DR Current tax liability $62 000; CR Income tax expense $62 000 3.DR Income tax expense $62 000; CR Retained earnings $62 000 4.DR Income tax expense $62 000; CR Bank $62 000