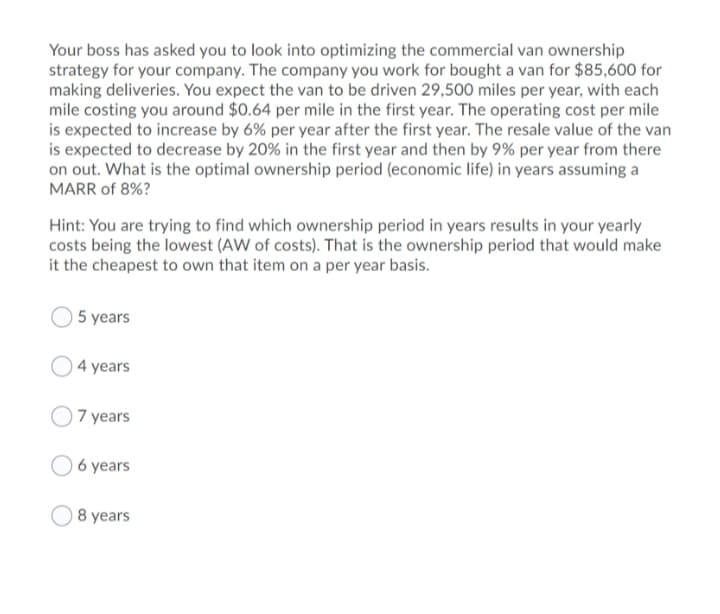

Your boss has asked you to look into optimizing the commercial van ownership strategy for your company. The company you work for bought a van for $85,600 for making deliveries. You expect the van to be driven 29,500 miles per year, with each mile costing you around $0.64 per mile in the first year. The operating cost per mile is expected to increase by 6% per year after the first year. The resale value of the van is expected to decrease by 20% in the first year and then by 9% per year from there on out. What is the optimal ownership period (economic life) in years assuming a MARR of 8%? Hint: You are trying to find which ownership period in years results in your yearly costs being the lowest (AW of costs). That is the ownership period that would make it the cheapest to own that item on a per year basis. 5 years 4 years 7 years O 6 years 8 years

Your boss has asked you to look into optimizing the commercial van ownership strategy for your company. The company you work for bought a van for $85,600 for making deliveries. You expect the van to be driven 29,500 miles per year, with each mile costing you around $0.64 per mile in the first year. The operating cost per mile is expected to increase by 6% per year after the first year. The resale value of the van is expected to decrease by 20% in the first year and then by 9% per year from there on out. What is the optimal ownership period (economic life) in years assuming a MARR of 8%? Hint: You are trying to find which ownership period in years results in your yearly costs being the lowest (AW of costs). That is the ownership period that would make it the cheapest to own that item on a per year basis. 5 years 4 years 7 years O 6 years 8 years

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 18P

Related questions

Question

M3

Transcribed Image Text:Your boss has asked you to look into optimizing the commercial van ownership

strategy for your company. The company you work for bought a van for $85,600 for

making deliveries. You expect the van to be driven 29,500 miles per year, with each

mile costing you around $0.64 per mile in the first year. The operating cost per mile

is expected to increase by 6% per year after the first year. The resale value of the van

is expected to decrease by 20% in the first year and then by 9% per year from there

on out. What is the optimal ownership period (economic life) in years assuming a

MARR of 8%?

Hint: You are trying to find which ownership period in years results in your yearly

costs being the lowest (AW of costs). That is the ownership period that would make

it the cheapest to own that item on a per year basis.

5 years

4 years

O 7 years

6 years

8 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning