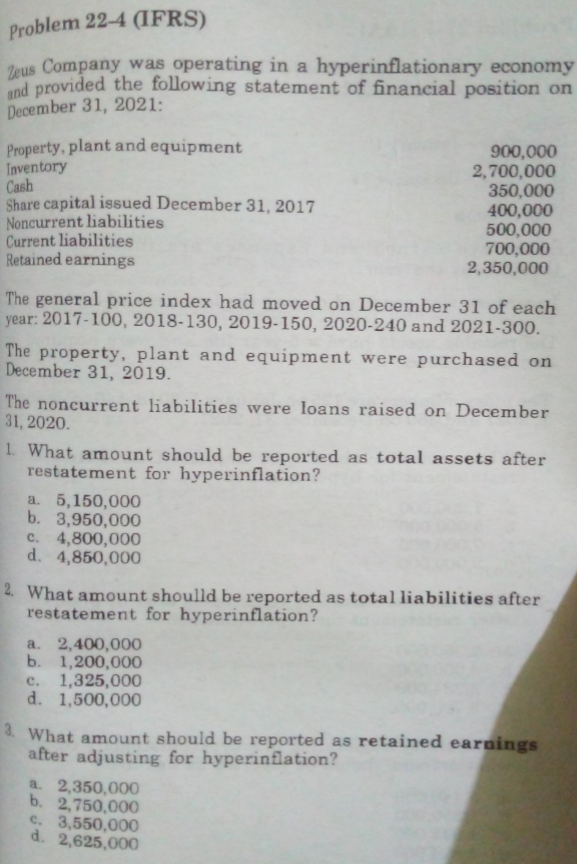

1. What amount should be reported as total assets after restatement for hyperinflation? a. 5,150,000 b. 3,950,000 c. 4,800,000 d. 4,850,000 2. What amount shoulld be reported as total liabilities after restatement for hyperinflation? a. 2,400,000 b. 1,200,00O c. 1,325,000 d. 1,500,000 4. What amount should be reported as retained earnings after adjusting for hyperinflation?

Q: Requirement Complete the chart for each of the following independent distributions. Assume that all…

A: Solution: 1) Partner's Fund Loss/Gain Property Shared Property's Basis to Partner…

Q: s basis was $1,800, and land in which interest was $25,000, gain or loss on the distribution?

A: In case of liquidating contribution, partner's basis must be reduced to zero in all cases. Cash,…

Q: 220,900| Bank of Ukraine currentaccount (in peso equivalent) Federal Bank of Arizona-Time deposit…

A: Cash and Cash Equivalent It is important for the business entity maintain the cash and cash…

Q: 29) The two ways that a c

A: The publicly held company, ownership is with the general public, and regulations imposed are strict…

Q: How to help improve or increase the current ratio of a rural bank? How to increase ROA and ROE?

A: Current ratio tells about the liquidity status of the organization, it can be ascertained…

Q: explain .After documenting internal control in an audit engagement, the auditor may perform tests on…

A: The following tests that the auditor might perform are presented in the order of the evidence that…

Q: Information for the Hi-Test company’s production process for September follows. Assume that all…

A: 1. Particulars Units % Materials EUP - Materials Units completed and transferred out 23,000…

Q: Draft a concise introduction, some background, and essential information of the cash flow statements…

A:

Q: In the eBook, NetSolutions calls their revenue earned from providing services __________________.…

A: Solution: Service revenue are the revenue earned by a business for providing services. It can be…

Q: On May 5, 2021, Christy purchased and placed in service a hotel. The hotel cost $10.8 million.…

A: A corporation does not record any profits from the a selling transaction under the cost recovery…

Q: Assets = Liabilities + Owner’s Equity is called the _______________________. Group of answer choices…

A: Accounting Equation: According to the accounting equation, the total assets of a corporation are…

Q: GENERAL LEDGER ACCOUNT TITLE CASH ACCOUNT…

A: Cash has a beginning debit balance of $50,000. Another debit in the cash is of $12,000. Total debits…

Q: B. While examining the accounts of Granny Co. on December 31, 2020, the following errors were…

A: Part1: Corrected Net Income of 2019 Unadjusted Net Income of 2019…

Q: What's the cash balance at the end of the month?

A: Budgets are the mainly called the estimates made for future period of time. Cash budget is one of…

Q: A static budget report

A: Introduction:- A Static budget is forecast a fixed amount in sales, revenue and expenses over a…

Q: Income Statement Bullseye, Incorporated's 2018 income statement lists the following income and…

A:

Q: The resources of value owned by a business are called _____________. Group of answer choices…

A: Business means the activity or occupation that is done to earn the revenues.

Q: xplain 3 reasons why a company should adapt environmental accounting in ther business

A: Introduction:- Environmental accounting is managing your environmental data, like material…

Q: January 1, 2019,

A: ET Mags Inc. should record the lease payments in the leasee's accounts. The current lease is a…

Q: April 2 Purchased $3,900 of merchandise from Lyon Company with credit terms of 2/15, n/60, invoice…

A: Business Translations: An economic event involving a third party that is documented in the…

Q: Required: • Explain how B Ltd should classify Alphablock in the financial statements up until 1…

A: As per IAS 40, Investment property is the property held by an individual with the purpose to earn…

Q: PROBLEM 30-5 ( AICPA ADAPTED ) At the beginning of current year , Trojan Company was organized with…

A:

Q: 27) Inder the cornor

A: Stockholders are the people associated with the company but have a separate entity so they are…

Q: Running Corporation reports the following components of stockholders’ equity at December 31, 2019…

A: Journal entries can be defined as the initial step of accounting because the business transactions…

Q: Amounts entered on the left side of an account in the journal are called what? Group of answer…

A: A journal record the business transaction with debit credit.

Q: The following information has been extracted from the financial statements of Muggie Pty. Ltd., a…

A: Quick ratio is a metric which is used to determine the company's ability to pay off its current…

Q: An information system that provides reports to stakeholders about the economic activities and…

A: Accounting: The practice of documenting financial transactions that are relevant to a company is…

Q: Required: - general ledger

A: Ledger is a principal book that includes all the accounts such as Assets Accounts, Liabilities…

Q: he General’s Favorite Fishing Hole Income Statement

A: An Income statement shows the financial position of the company It is an important statement that…

Q: distribution Ann receives cash of S s was $1,800, and land in which the part est was $25,000. r loss…

A: Given as, Received amount= $3,000, Inventory Partnership basis= $1,800, Land partnership basis=…

Q: On January 1, 2021, Morrow Inc. purchased a spooler at a cost of $40,000. The equipment is expected…

A: Depreciation expense per unit = (Cost- residual value)/Total expected units to produce

Q: After journalizing, the journal entries are transferred to a four-column record where the balances…

A: Ledger or General Ledger: Every account in an organization's chart of accounts gets its own ledger…

Q: A manufacturer reports the data below. Accounts payable Accounts receivable Iaventory Set sales Cost…

A: Cash conversion cycle shows the number of days in which the company could efficiently collect and…

Q: What will you tell them?

A: A partnership is a form of business where two or more persons come together to start a new venture…

Q: 1. What is the net cash provided by operating activities? a. 1,900,000 b. 2,900,000 c. 2,350,000 d.…

A:

Q: Hours Wait time 19.5 Process time 2,3 Inspection time 1.3 Move time 3.2 Queue time 10.3

A: Formula: Delivery cycle time = Wait time + Throughput time.

Q: Gene and Dixie, husband and wife (ages 35 and 32), bc gross income of $95,000 in 2017, and they are…

A: IRA contribution limitations and eligibility are determined by your modified adjusted gross income,…

Q: On September 18, 20Y4, Carbon Company purchased $8,710 of supplies on account. In Carbon Company’s…

A: In the question, the company has purchased the supplies on account. As per golden rules Debit What…

Q: A was the designated managing partner in the Articles of Partnership. One day, A received an order…

A: A was the designated managing partner in the Articles of Partnership. One day, A received an order…

Q: What is the normal balance of cash? Group of answer choices This is an ambiguous question debit…

A: Current assets are cash and cash equivalent and include those assets which are expected to be used…

Q: Waterway Corporation’s December 31, 2020 balance sheet showed the following: 8% preferred stock,…

A: Paid in capital represents the shares issued and paid by the shareholders' equity of the company. It…

Q: What is the classification of shares that has privileges over any of the other classes of shares in…

A: Par value shares: These are those shares that have a face value per share also known as par value.…

Q: Consider the following balance sheet and income statement for Mmm Good Foods Incorporated (the…

A: A cash flow statement describes the cash flows into and out of the company. The primary focus of the…

Q: On April 2 a corporation purchased for cash 6,000 shares of its own $12 par common stock at $27 a…

A: Treasury stocks are repurchased shares of the company. The firm can reissue these stocks at a…

Q: The management of Kunkel Company is considering the purchase of a $27,000 machine that would reduce…

A: NPV is one of the capital budgeting technique which is used to analyze the investment projects i.e.…

Q: Yellow Company acquired a trademark for P10,000,000 from Orange Company on January 5, 2021. The…

A: The intangible assets are used in the business to generate revenues and these assets have a life of…

Q: Lovelyn Co. paid one half of its earnings in dividends. Its earnings increased by 50% and the amount…

A: The dividend payout ratio is calculated by dividing the dividend per share by the earnings per…

Q: A concept of accounting that indicates that the financial records of the business should be kept…

A: In accounting, business is treated as a separate entity from the owner.

Q: Bonita Corporation’s December 31, 2020 balance sheet showed the following: 9% preferred stock, $10…

A: Stockholders' equity represents the difference of total assets and total liabilities of the company.…

Q: What is the difference between book value accounting and market value accounting? How do interest…

A: Here discuss about the details of the book value of accounting and the market value of accounting.…

Step by step

Solved in 2 steps with 2 images

- ADDITIONAL FUNDS NEEDED Morrissey Technologies Inc.s 2016 financial statements are shown here. Morrissey Technologies Inc.: Balance Sheet as of December 31, 2016 Morrissey Technologies Inc.: Income Statement for December 31, 2016 Sales 3,600,000 Operating costs including depredation 3,279,720 EBIT 320,280 Interest 20,280 EBT 300,000 Taxes (40%) 120,000 Net Income 180,000 Per Share Data: Common stock price 45.00 Earnings per share (EPS) 1.80 Dividends per share (DPS) 1.08 Suppose that in 2017, sales increase by 10% over 2016 sales. The firm currently has 100,000 shares outstanding. It expects to maintain its 2016 dividend payout ratio and believes that its assets should grow at the same rate as sales. The firm has no excess capacity. However, the firm would like to reduce its operating costs/sales ratio to 87.5% and increase its total liabilities-to-assets ratio to 30%. (It believes its liabilities-to-assets ratio currently is too low relative to the industry average.) The firm will raise 30% of the 2017 forecasted interest- bearing debt as notes payable, and it will issue long-term bonds for the remainder. The firm forecasts that its before-tax cost of debt (which includes both short- and long-term debt) is 12.5%. Assume that any common stock issuances or repurchases can be made at the firms current stock price of 45. a. Construct the forecasted financial statements assuming that these changes are made. What are the firms forecasted notes payable and long-term debt balances? What is the forecasted addition to retained earnings? b. If the profit margin remains at 5% and the dividend payout ratio remains at 60%, at what growth rate in sales will the additional financing requirements be exactly zero? In other words, what is the firms sustainable growth rate? (Hint: Set AFN equal to zero and solve for g.)26. Jamison Corp.'s balance sheet accounts as of December 31, 2021 and 2020 and information relating to 2021 activities are presented below. December 31, 2021 2020 Assets Cash $ 440,000 $ 200,000 Short-term investments 600,000 — Accounts receivable (net) 1,020,000 1,020,000 Inventory 1,380,000 1,200,000 Long-term investments…Problem 43. The following assets are acquired on January 1, 2015, when the general price index is 200:Inventory P1,000,000Property, plant and equipment 2,000,000Investment in Bonds Receivable 3,000,000The company is reporting in a hyperinflationary economy. On December 31, 2015, the general priceindex is 300. How shall the assets above be presented in the 12/31/2015 Statement of FinancialPosition? Problem 44. The statement of financial position of ART Inc. before translation to hyperinflationaryeconomy is presented as follows:Cash 1,000,000 Accounts payable 1,000,000Accounts receivable 2,000,000 Unearned revenue (1/1/2015) 1,500,000Inventory (1/1/2015) 3,000,000 Ordinary share (1/1/2015) 2,000,000PPE (7/1/2015) 4,000,000 Retained earnings 500,000The general price index are provided for the following dates:1/1/2015 – 100 7/1/2015 – 200 12/31/2015 – 300How much retained earnings shall be presented in the translated statement of financialposition of ART Inc. in a hyperinflationary…

- 15) Financial statements of Ehrlich Co. for 2022 and 2021 are provided below. BALANCE SHEETS 12/31/22 12/31/21 Cash $408,000 $ 192,000 Accounts receivable 360,000 216,000 Inventory 384,000 480,000 Property, plant and equipment $608,000 $960,000 Less accumulated depreciation (320,000) 288,000 (304,000) 656,000 $1,440,000 $1,544,000 Accounts payable…41 Problem No. 1 AACA Corporation was incorporated on Dec. 1, 2021, and began operations one week later. Before closing the books for the fiscal year ended Nov. 30, 2022, the controller prepared the following financial statements: AACA Corporation Statement of Financial Position November 30, 2022 Assets Current assets Cash P150,000 Marketable securities, at cost 60,000 Accounts receivable 450,000 Allowance for doubtful accounts ( 59,000) Inventories 430,000 Prepaid insurance 15,000 Total current assets 1,046,000 Property, plant and equipment 426,000 Less accumulated depreciation ( 40,000) Property, plant and equipment, net 386,000 Research and development costs 120,000 Total assets P1,552,000 Liabilities and Shareholders' Equity Current liabilities Accounts payable and accrued…15. Selected information about income statement accounts for the Reed Company is presented below (the company's fiscal year ends on December 31): 2021 2020 Sales revenue $ 4,450,000 $ 3,550,000 Cost of goods sold 2,870,000 2,010,000 Administrative expense 810,000 685,000 Selling expense 370,000 312,000 Interest revenue 151,000 141,000 Interest expense 202,000 202,000 Loss on sale of assets of discontinued component 52,000 — On July 1, 2021, the company adopted a plan to discontinue a division that qualifies as a component of an entity as defined by GAAP. The assets of the component were sold on September 30, 2021, for $52,000 less than their book value. Results of operations for the component (included in the above account balances) were as follows: 1/1/2021–9/30/2021 2020 Sales revenue $ 410,000 $ 510,000 Cost of goods sold (295,000 ) (326,000 ) Administrative expense (51,000 )…

- CP 14-8Assume the following income statement and balance sheet information:Service revenue (all cash) Operating expenses Salaries (all cash) Net income$17585$90Current assets 2020 2019 Cash $1,250 $1,600 Short-term invest. 100 200 $1,350 $1,800 Liabilities Borrowings 600 1,000 Stockholders' equity Common stock 200 300 Retained earnings 550 500 750 800 $1,350 $1,800Other information: The short-term investments are riskless and will be converted to a known amount of cash in 60 days. Borrowings are non-current. No gain or loss occurred when common stock was repurchased.Required: 1. Calculate cash flow from operating activities. 2. Prepare the 2020 statement of changes in equity. 3. Calculate cash flow from financing activities. 4. (Appendix) Prepare a cash flow table. Show that cash effects net to a $450 outflow.TB Problem 21-167 (Algo) The Murdock Corporation reported the following balance sheet data for 2021 and 2020: 2021 2020 Cash $ 96,245 $ 33,155 Available-for-sale debt securities (not cash equivalents) 24,000 102,000 Accounts receivable 97,000 83,550 Inventory 182,000 160,300 Prepaid insurance 3,030 3,700 Land, buildings, and equipment 1,284,000 1,142,000 Accumulated depreciation (627,000 ) (589,000 ) Total assets $ 1,059,275 $ 935,705 Accounts payable $ 91,640 $ 165,670 Salaries payable 26,800 33,000 Notes payable (current) 40,300 92,000 Bonds payable 217,000 0 Common stock 300,000 300,000 Retained earnings 383,535 345,035 Total liabilities and shareholders' equity $ 1,059,275 $ 935,705 Additional information for 2021: (1) Sold available-for-sale debt securities costing…TB Problem 21-167 (Algo) The Murdock Corporation reported the following balance sheet data for 2021 and 2020: 2021 2020 Cash $ 96,245 $ 33,155 Available-for-sale debt securities (not cash equivalents) 24,000 102,000 Accounts receivable 97,000 83,550 Inventory 182,000 160,300 Prepaid insurance 3,030 3,700 Land, buildings, and equipment 1,284,000 1,142,000 Accumulated depreciation (627,000 ) (589,000 ) Total assets $ 1,059,275 $ 935,705 Accounts payable $ 91,640 $ 165,670 Salaries payable 26,800 33,000 Notes payable (current) 40,300 92,000 Bonds payable 217,000 0 Common stock 300,000 300,000 Retained earnings 383,535 345,035 Total liabilities and shareholders' equity $ 1,059,275 $ 935,705 Additional information for 2021: (1) Sold available-for-sale debt securities costing…

- E23.10B (L0 1,4) (Classification of Transactions) Following are selected balance sheet accounts of BioLazer Corp. at December 31, 2020 and 2019, and the increases or decreases in each account from 2019 to 2020. Also presented is selected income statement information for the year ended December 31, 2020, and additional information. Increase Selected balance sheet accounts 2020 2019 (Decrease)AssetsAccounts receivable $154,000 $120,000 $34,000Property, plant, and equipment 631,000 581,000 50,000Accumulated…Q41 The Sleep Company had the following operating results for 2021-2022. In addition, the company paid dividends in both 2021 and 2022 of $61,800 per year and made capital expenditures in both years of $30,000 per year. The company's stock price in 2021 was $8 and $7 in 2022. The industry average earnings multiple for the mattress industry was 9 in 2022 and the free cash flow and sales multiples were 18 and 1.5, respectively. The company is publicly owned and has 1,000,000 shares of outstanding stock at the end of 2022. Balance Sheet, December 31, 2022 2021 Cash $ 346,000 $ 106,000 Accounts Receivable $ 356,000 $ 406,000 Inventory $ 256,000 $ 306,000 Total Current Assets $ 958,000 $ 818,000 Long-lived Assets 1,140,000 1,160,000 Total Assets $ 2,098,000 $ 1,978,000 Current Liabilities $ 206,000 $ 306,000 Long-term Debt 606,000 506,000 Shareholder Equity 1,286,000 1,166,000 Total Debt and Equity $ 2,098,000 $ 1,978,000 Income Statement, for year…10. The January 31, 2022 Statement of Financial Position of Pink Corporation follows: Cash 800,000 Accounts receivable ( net of P2,000 allowance for bad debts) 3,800,000 Inventory 1,600,000 Property, plant and equipment (net of P6,000,000 accumulated dep'n) 4,000,000 Total assets 10,200,000 Accounts payable 8,250,000 Ordinary shares 5,000,000 Retained earnings (Deficit) (3,050,000) Total Liabilities and Shareholders' equity…