1. What would the manufacturing cost per unit be under absorption costing? 2. What would the manufacturing cost per unit be under variable costing? 3. What would the net income be under absorption costing? 4. What would the net income be under variable costing?

1. What would the manufacturing cost per unit be under absorption costing? 2. What would the manufacturing cost per unit be under variable costing? 3. What would the net income be under absorption costing? 4. What would the net income be under variable costing?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter6: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 3PB

Related questions

Question

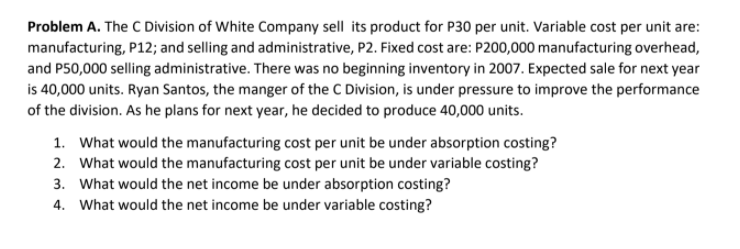

Transcribed Image Text:Problem A. The C Division of White Company sell its product for P30 per unit. Variable cost per unit are:

manufacturing, P12; and selling and administrative, P2. Fixed cost are: P200,000 manufacturing overhead,

and P50,000 selling administrative. There was no beginning inventory in 2007. Expected sale for next year

is 40,000 units. Ryan Santos, the manger of the C Division, is under pressure to improve the performance

of the division. As he plans for next year, he decided to produce 40,000 units.

1. What would the manufacturing cost per unit be under absorption costing?

2. What would the manufacturing cost per unit be under variable costing?

3. What would the net income be under absorption costing?

4. What would the net income be under variable costing?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning