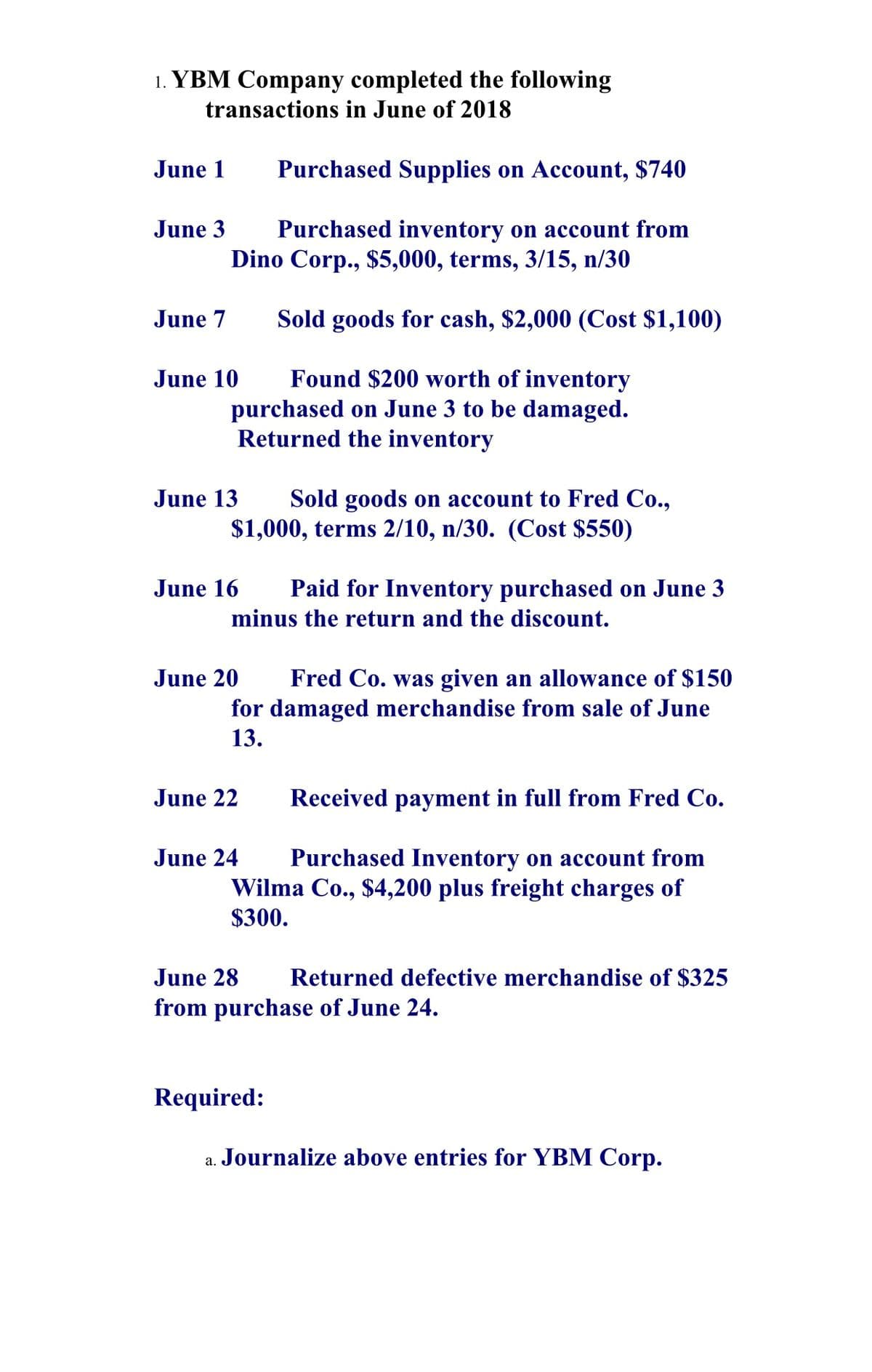

1. YBM Company completed the following transactions in June of 2018 June 1 Purchased Supplies on Account, $740 June 3 Purchased inventory on account from Dino Corp., $5,000, terms, 3/15, n/30 June 7 Sold goods for cash, $2,000 (Cost $1,100) Found $200 worth of inventory purchased on June 3 to be damaged. Returned the inventory June 10 Sold goods on account to Fred Co., $1,000, terms 2/10, n/30. (Cost $550) June 13 June 16 Paid for Inventory purchased on June 3 minus the return and the discount. June 20 Fred Co. was given an allowance of $150 for damaged merchandise from sale of June 13. June 22 Received payment in full from Fred Co. June 24 Purchased Inventory on account from Wilma Co., $4,200 plus freight charges of $300. June 28 Returned defective merchandise of $325 from purchase of June 24. Required: a. Journalize above entries for YBM Corp.

1. YBM Company completed the following transactions in June of 2018 June 1 Purchased Supplies on Account, $740 June 3 Purchased inventory on account from Dino Corp., $5,000, terms, 3/15, n/30 June 7 Sold goods for cash, $2,000 (Cost $1,100) Found $200 worth of inventory purchased on June 3 to be damaged. Returned the inventory June 10 Sold goods on account to Fred Co., $1,000, terms 2/10, n/30. (Cost $550) June 13 June 16 Paid for Inventory purchased on June 3 minus the return and the discount. June 20 Fred Co. was given an allowance of $150 for damaged merchandise from sale of June 13. June 22 Received payment in full from Fred Co. June 24 Purchased Inventory on account from Wilma Co., $4,200 plus freight charges of $300. June 28 Returned defective merchandise of $325 from purchase of June 24. Required: a. Journalize above entries for YBM Corp.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter4: Accounting For Retail Operations

Section: Chapter Questions

Problem 4.1P: Purchase-related transactions The following selected transactions were completed by Epic Co. during...

Related questions

Question

100%

Transcribed Image Text:1. YBM Company completed the following

transactions in June of 2018

June 1

Purchased Supplies on Account, $740

June 3

Purchased inventory on account from

Dino Corp., $5,000, terms, 3/15, n/30

June 7

Sold goods for cash, $2,000 (Cost $1,100)

Found $200 worth of inventory

purchased on June 3 to be damaged.

Returned the inventory

June 10

Sold goods on account to Fred Co.,

$1,000, terms 2/10, n/30. (Cost $550)

June 13

June 16

Paid for Inventory purchased on June 3

minus the return and the discount.

June 20

Fred Co. was given an allowance of $150

for damaged merchandise from sale of June

13.

June 22

Received payment in full from Fred Co.

June 24

Purchased Inventory on account from

Wilma Co., $4,200 plus freight charges of

$300.

June 28

Returned defective merchandise of $325

from purchase of June 24.

Required:

Journalize above entries for YBM Corp.

а.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning