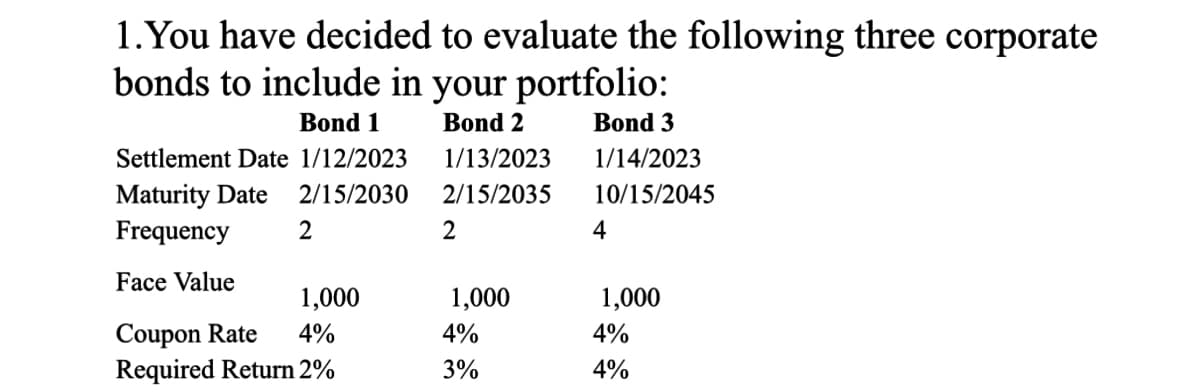

1. You have decided to evaluate the following three corporate bonds to include in your portfolio: Bond 1 Bond 2 Bond 3 1/14/2023 10/15/2045 Settlement Date 1/12/2023 Maturity Date 2/15/2030 Frequency Face Value 2 1,000 Coupon Rate 4% Required Return 2% 1/13/2023 2/15/2035 2 1,000 4% 3% 4 1,000 4% 4%

Q: Pasqually Mineral Water, Inc., will pay a quarterly dividend per share of $1.10 at the end of each…

A: Stock Price: The price of a stock in the market represents the current value to the buyer and…

Q: Storico Co. just paid a dividend of $2.00 per share. The company will increase its dividend by 20…

A: The Dividend Discount Model (DDM) is a valuation method used to estimate the intrinsic value of a…

Q: What caused amazon stocks to drop in 2023? Why is amazon a good long term investment?

A: Investing is the act of allocating funds with the expectation of generating a profit or earning a…

Q: Give typing answer with explanation and conclusion What is the change in the NPV of a one-year…

A: Explanation : NPV is also known as Net Present Value. It is a Capital Budgeting techniques which…

Q: What is the effective cost of the following combined loan? Loan amount 180,000 40,000 220,000 Term…

A: To find the effective cost of the combined loan, we need to first calculate the total amount…

Q: You have taken a loan of $55,000.00 for 30 years at 4.9% compounded quarterly. Fill in the table…

A:

Q: On May 1, 2004, we requested a loan from Banamex for the amount of $250,000.00, payable in 16…

A: Here, Loan Amount is $250,000.00 Time Period of Loan is 16 months Interest Rate is 1.5% per month

Q: Please answer this question 1. Sustainable growth rate, what must a firm do to grow faster a. Issue…

A: The sustainable growth rate (SGR) is the rate at which a company can grow using only its own…

Q: Marla has $25,000 invested in a stock with a beta of 0.75, $15,000 invested in a stock with a beta…

A: The beta of a portfolio is the weighted average beta of all the individual stocks. So we will have…

Q: Assuming the following: 1.4mm outstanding shares 2. $40mm of pre-tax Net Income 3. $9mm of…

A: To calculate the market value of equity, we can use the formula: Market Value of Equity = (Net…

Q: We take a 10-year mortgage for $300,000 at 7.75% p.a. It is to be repaid in monthly repayments.…

A: Repayment amount refers to the amount that is paid on a periodic basis for the repayment of loan…

Q: Use logarithms to solve the problem. How long will it take $11,000 to grow to $19,000 if the…

A: Compound = monthly = 12 Present value = pv = $11,000 Future value = fv = $19,000 Interest rate = r =…

Q: 2/5 of the crayons in a bag were red and the rest were blue and yellow. 20% of the blue crayons and…

A: Let's start by using algebra to solve the problem. Let x be the total number of crayons in the bag,…

Q: If gasoline prices have increased over the past 32 years from 25.9 cents per gallon to $3.459 per…

A: The inflation rate refers to the increase in the price of a commodity over time. It is used to…

Q: Bob is researching variables like age, religion, gender and work occupation in his area. Which force…

A: To put it another way, external environmental elements are those that are not under the control of…

Q: The 2-month interest rates in Switzerland and the United States are, respectively, 1% and 2% per…

A: The actual futures price is the same as the spot price, $1.0500. Since the theoretical futures price…

Q: Frank deposited $8,500 into an account earning 4.5% interest compounded monthly. How much will…

A: We can determine the amount Frank will have in 5 years using the Future Value formula as below. This…

Q: Expected cash dividends are $4.00, the dividend yield is 6%, flotation costs are 4% of price, and…

A: The cost of common stock refers to the returns earned by the company. Common stock describes the…

Q: You have just been offered a commercial paper with a face value of ¢45,000,000 which bears a…

A: Commercial paper is a type of short-term, unsecured debt instrument that is issued by corporations,…

Q: You have a portfolio consisting solely of stock A and stock B. The portfolio has an expected return…

A: In this we have to calculate weighted average return of portfolio. The portfolio consist of stock…

Q: Complete solution for letters ABC please

A: A list of projects with their IRR has been provided. The sources of capital are known with their…

Q: Assume a $100,000 interest-only ARM with a 30-year maturity and an initial rate of 6 percent. If at…

A: Loan Amount = $100,000 New interest rate = 8% Compound = monthly = 12

Q: Dimitri operates Downtown Discount Pharmacy, a sole proprietorship. Downtown Discount Pharmacy…

A: Net income = $205,000 Self-employment taxes = $21,263 Salary contribution = 15%

Q: Sarah secured a bank loan of $150,000 for the purchase of a house. The mortgage is to be amortized…

A: A mortgage is a loan used to purchase a property or real estate. The property serves as collateral…

Q: A bond that matures in 7.5 years and pays semi-annual payments of 20.1 is priced at 98.70. What is…

A: A coupon rate is the fixed interest rate that an issuer of a bond promises to pay to the bondholder…

Q: Matheson Electronics has just developed a new electronic device that it believes will have broad…

A: Net Present Value: It represents the profit generated by the firm in absolute terms after…

Q: No more payment is required after the seventh birthday. The policy will pay Anna's child $300,000 on…

A: We need to compound every payment Anna made to FV at age 60. This can be determined with the formula…

Q: Calculate the present worth for a CNC machining center that has an initial cost of $75,000, a life…

A: Explanation : Present worth of the machine is that which is depend upon the future cash outflow like…

Q: How much interest is earned over the 65 year period?

A: Annuity ordinary means the payment is starting at end of the period for a specific period. Monthly…

Q: Walter is terminally ill and has a 20-year level term life insurance policy with a face value of…

A: When Walter sells his life insurance policy to a viatical settlement company, he receives a lump-sum…

Q: A loan of $1,000 is made at an interest rate of 11% compounded quarterly. The loan is to be repaid…

A: A loan is a contract between two parties where an amount is forwarded in exchange for a promise of…

Q: A stock has an expected return of 0.15, its beta is 0.52, and the expected return on the market is…

A: Expected return = 0.15 Beta = 0.52 Market return = 0.08

Q: Paula and Jim recently applied for life insurance with Shirley, a life insurance agent. For years,…

A: When completing a life insurance application, applicants are required to answer a series of…

Q: One year ago, you purchased a stock at a price of $57.81 per share. Today, you sold your stock at a…

A: The dividends paid by a company refer to the profits that the company disburses to its shareholders…

Q: Code 71046

A: Given : APC weight = 1.56 Conversion factor CF = $80.79 Wage Index = 0.9445

Q: The next dividend payment by Im, Incorporated, will be $3.25 per share. The dividends are…

A: Required return on stock is calculated using following equation Required return = D1P0+g Where, D1…

Q: The company you work for is considering building a new warehouse and manufacturing facility. The…

A: Capital budgeting is the process of analyzing and evaluating potential long-term investments or…

Q: Your client's federal marginal tax rate is 36%, and the state marginal rate is 7%. The client does…

A: The taxable equivalent yield is the yield that a taxable investment must offer to provide the same…

Q: ABC Corporation Comparative Income Statements in € For the Years Ended December 31, 20X3 and 20X2…

A: Financial ratio analysis can be used for comparison of ratios of firms in the same industry or for…

Q: Kindly break down how you got terminal cashflow at the end of the project. 2. Explain how you…

A: Initial cost includes the cost of equipment, installation cost, and increase in net working capital.…

Q: Write a note on Core Banking ,its features and benefits

A: Core banking is a service provided by banks that lets customers access their accounts and carry out…

Q: Is it good, fair or bad if price earning ratio is higher than industry average in terms of…

A: In terms of cross-sectional evaluation, a higher price-earnings ratio (P/E ratio) than the industry…

Q: Carl is the beneficiary of a $28,000 trust fund set up for him by his grandparents. Under the terms…

A: Annuity = Present Value / PVA of $1

Q: A property is expected to have NOI of $100,000 the first year. The NOI is expected to increase by 5…

A: To compute the BURR (Blended Internal Rate of Return) after ten years, we need to calculate the cash…

Q: How to find the current market price of a market portfolio according to No Arbitrage condition?

A: The no-arbitrage condition is an economic principle that states that in a market with perfectly…

Q: Square Hammer Corporation shows the following information on its 2018 income statement: Sales =…

A: Cash flow to stockholders: It represents the cash paid to the shareholders by the company. This…

Q: Assuming the following: 1.4mm outstanding shares 2. $40mm of pre-tax Net Income 3. $9mm of…

A: To calculate the market value of equity with the given information, we need to first calculate the…

Q: 1. Ginny took out a 3-year loan of $5800 for her son's wedding at an annual interest rate of 4.1%…

A: Present value is the estimation of the current value of future cash value which is likely to be…

Q: A financial company, AAA Inc. wants to earn an effective annual rate of 9% on its loan. If the…

A: There are two options of loan. For one of them, the effective annual rate (EAR) is available, the…

Q: A $23,970 loan is to be settled by making payments of $6,999 at the end of every six months. The…

A: Here,

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

- The table below gives you some information with respect to bonds. Calculate the yield-to-maturity for all these bonds. Assume you hold till maturity what would you pick? Company Settlement Price Maturity Coupon YTM Morgan Stanley 2/10/2023 100.85 2/25/2023 3.75 ? Fidelity 2/10/2023 99.839 3/01/2023 0.375 ? Caterpillar 2/10/2023 100.00 3/01/2023 2.625 ? NextEra Energy 2/10/2023 99.889 3/01/2023 0.650 ? BNP Paribas 2/10/2023 100.08 3/03/2023 3.250 ?Consider the following three-bond portfolio in which all the bonds are option free: Bond Price Par Value Yield Market Value Duration 9% 5-year $122.4565 $5 million 4% $6,122,823 4.142 5% 20-year $113.6777 $2 million 4% $2,273,555 13.087 5.5% 30-year $126.0707 $2 million 4% $2,521,413 16.290 What is Bond 1’s (9% 5-year) contribution to portfolio duration? A. 3.23 B. 2.33 C. 4.33 D. 3.00Assume that the financial anagement corporation'shas 1000 par value bond had a 5.70% coupon, matures on May 15,2020, has a current price quote of 97.708 and has yield to maturity (YTM) of 6.034%. Answer the following question:1. What was the dollar price of bond?2. What is the bond's current yield?3. Is the bond selling at par, at discount or at a premium?4. Compare the bond's current yield calculated in part B to its YTM and explain why its differ. using excel

- The following information pertains to a portfolio of a company on 12/31/21: Security Cost at 12/31/21 Fair value at 12/31/21 X $220,000 $159,000 Y 246,000 190,000 Total: (figure out the total on your own) What is the balance of the Fair Value Adjustment account for these securities at December 31, 2021? (Very Important: just enter the amount. DO NOT put a plus or minus sign in front of the amount.)Consider the following three-bond portfolio in which all the bonds are option free: Bond Price Par Value Yield Market Value Duration 9% 5-year $122.4565 $5 million 4% $6,122,823 4.142 5% 20-year $113.6777 $2 million 4% $2,273,555 13.087 5.5% 30-year $126.0707 $2 million 4% $2,521,413 16.290 What is the portfolio duration? A. 7.81 B. 8.81 C. 6.80 D. 8.0Assignement B Abacus Ltd is an investment fund that specializes in fixed income securities. At the end of2010 the fund’s bond portfolio has the following information BOND YIELD TO MATURITY PRICE DURATION CONVEXITY A 12% 1045 2.35 16.46 B 14% 2265 4.26 22.80 C 8% 1430 3.45 11.96 D 10% 1100 4.20 15.56 Assume that the yield to maturity on each bond increases by 4%, calculate(i) The percentage by which the price of each bond will decrease(ii) The amount in cedis by which the price of each bond will decrease (iii) The percentage and the cedi decrease in the total value of the portfolio.

- Problem5: OnJanuary1,2021,BLITZENCompanyissued10%bondsdatedJanuary1,2021withafaceamountof ₱8,000,000.ThebondsmatureonDecember31,2026.Forbondsofsimilarriskandmaturity,the marketyieldis14%.Interestispaidsemi-annuallyonJune30andDecember31.(Useatmost,4decimal placesforPVfactors) Preparethejournalentriesfor2021 Computeorprovidetheanswersforthefollowing: DeterminethepriceofthebondsonJanuary1,2021. Howmuchistheinterestexpensefortheyearended,December31,2021? Howmuchistheinterestexpensefortheyearended,December31,2022? WhatisthecarryingamountofthebondsonDecember31,2022?The following is a T-bond quote (par value $1,000) from the WSJ (8/31/2018). Use the information in the quote to answer the question. Maturity Coupon Bid Asked Chg Asked Yield 8/31/2,033 5.35 98:15 98:20 -14 ??? What is the purchase price of the bond? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16))Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, AA-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 2% for the next 2 years, 3% for the following 4 years, and 4% thereafter. The maturity risk premium is estimated by this formula: MRP = 0.02(t - 1)%. The liquidity premium (LP) for the corporate bond is estimated to be 0.3%. You may determine the default risk premium (DRP), given the company's bond rating, from the following table. Remember to subtract the bond's LP from the corporate spread given in the table to arrive at the bond's DRP. Corporate Bond Yield Rate Spread = DRP + LP U.S. Treasury 0.73 % — AAA corporate 0.93 0.20 % AA corporate 1.33 0.60 A corporate 1.75 1.02 What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: 10.533 % 7-year Corporate yield: 9.597% Given…

- Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, AA-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 2% for the next 2 years, 3% for the following 4 years, and 4% thereafter. The maturity risk premium is estimated by this formula: MRP = 0.02(t - 1)%. The liquidity premium (LP) for the corporate bond is estimated to be 0.3%. You may determine the default risk premium (DRP), given the company's bond rating, from the following table. Remember to subtract the bond's LP from the corporate spread given in the table to arrive at the bond's DRP. Corporate Bond Yield Rate Spread = DRP + LP U.S. Treasury 0.73 % — AAA corporate 0.93 0.20 % AA corporate 1.33 0.60 A corporate 1.75 1.02 What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: 6.553%----->correct 7-year Corporate yield: ? %…Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, AA-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 3% for the next 2 years, 4% for the following 4 years, and 5% thereafter. The maturity risk premium is estimated by this formula: MRP = 0.02(t - 1)%. The liquidity premium (LP) for the corporate bond is estimated to be 0.2%. You may determine the default risk premium (DRP), given the company's bond rating, from the following table. Remember to subtract the bond's LP from the corporate spread given in the table to arrive at the bond's DRP. Corporate Bond Yield Rate Spread = DRP + LP U.S. Treasury 0.83 % — AAA corporate 1.03 0.20 % AA corporate 1.39 0.56 A corporate 1.75 0.92 What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: fill in the blank 7 % 7-year Corporate yield: fill in the blank 8 %Given the following information, why is one bond’s yield higher than the other’s? Which bond is riskier? Why? Please also indicate whether each bond is traded at par, discount, or premium and explain why. Issuer Name Coupon Maturity Rating Moody's/S&P/Fitch Yield % GENERAL MOTORS 7.000% Nov 2025 Ba1/BB+/BB+ 6.313 GENERAL MOTORS 8.000% Nov 2031 Ba1/BB+/BB+ 6.838