1.1: (2 pts) Straight-line. 1.2: (3 pts) Sum of the year's digits.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 67E

Related questions

Question

Transcribed Image Text:D

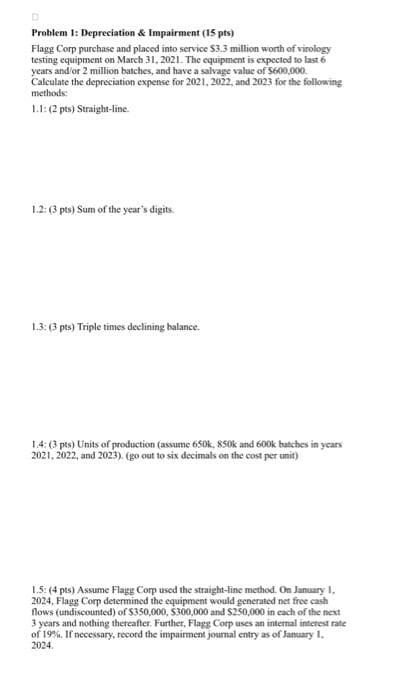

Problem 1: Depreciation & Impairment (15 pts)

Flagg Corp purchase and placed into service $3.3 million worth of virology

testing equipment on March 31, 2021. The equipment is expected to last 6

years and/or 2 million batches, and have a salvage value of $600,000.

Calculate the depreciation expense for 2021, 2022, and 2023 for the following

methods:

1.1: (2 pts) Straight-line.

1.2: (3 pts) Sum of the year's digits.

1.3: (3 pts) Triple times declining balance.

1.4: (3 pts) Units of production (assume 650k, 850k and 600k batches in years

2021, 2022, and 2023). (go out to six decimals on the cost per unit)

1.5: (4 pts) Assume Flagg Corp used the straight-line method. On January 1,

2024, Flagg Corp determined the equipment would generated net free cash

flows (undiscounted) of $350,000, $300,000 and $250,000 in each of the next

3 years and nothing thereafter. Further, Flagg Corp uses an internal interest rate

of 19%. If necessary, record the impairment journal entry as of January 1.

2024.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning