Please Correct answer and Do not Give solution in image format

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 11P: Olson Company adopted the dollar-value LIFO method for inventory valuation at the beginning of 2015....

Related questions

Question

Please Correct answer and Do not Give solution in image format

Transcribed Image Text:1.

Show Transcribed Text

2.

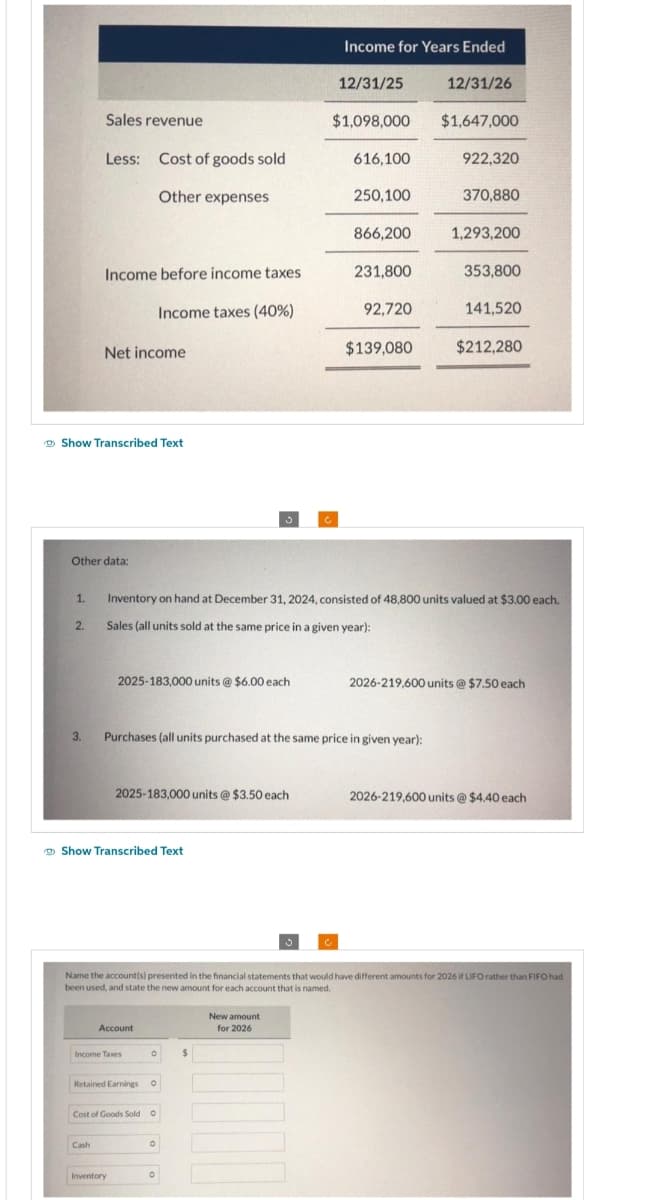

Sales revenue

Less: Cost of goods sold

Other expenses

Other data:

3.

Income before income taxes

Income taxes (40%)

Net income

Cash

2025-183,000 units @ $6.00 each

Show Transcribed Text

2025-183,000 units @ $3.50 each

Account

Income Taxes

Retained Earnings O

Inventory

O

Cost of Goods Sold O

O

Purchases (all units purchased at the same price in given year):

O

Income for Years Ended

C

$

12/31/25

$1,098,000

New amount

for 2026

616,100

250,100

Inventory on hand at December 31, 2024, consisted of 48,800 units valued at $3.00 each.

Sales (all units sold at the same price in a given year):

866,200

231,800

92,720

$139,080

12/31/26

Name the account(s) presented in the financial statements that would have different amounts for 2026 if LIFO rather than FIFO had

been used, and state the new amount for each account that is named.

$1,647,000

922,320

370,880

1,293,200

353,800

141,520

$212,280

2026-219,600 units @ $7.50 each

2026-219,600 units @ $4.40 each

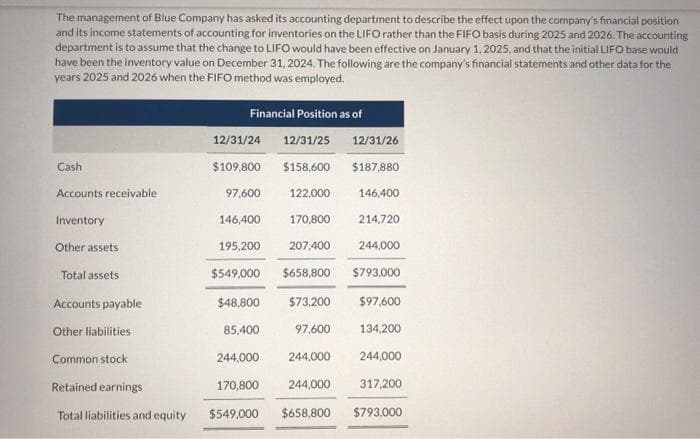

Transcribed Image Text:The management of Blue Company has asked its accounting department to describe the effect upon the company's financial position

and its income statements of accounting for inventories on the LIFO rather than the FIFO basis during 2025 and 2026. The accounting

department is to assume that the change to LIFO would have been effective on January 1, 2025, and that the initial LIFO base would

have been the inventory value on December 31, 2024. The following are the company's financial statements and other data for the

years 2025 and 2026 when the FIFO method was employed.

Cash

Accounts receivable

Inventory

Other assets.

Total assets

Accounts payable

Other liabilities

Common stock

Retained earnings

Total liabilities and equity

Financial Position as of

12/31/24

12/31/25

$109,800 $158,600

97,600

146,400 170,800

195.200

207,400

$549,000

$658,800

$793,000

$48.800

$73,200 $97,600

85,400

97,600

244,000 244,000

170,800

244,000

$549,000

122,000

12/31/26

$187,880

146,400

214,720

244,000

134,200

244,000

317,200

$658,800 $793,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College