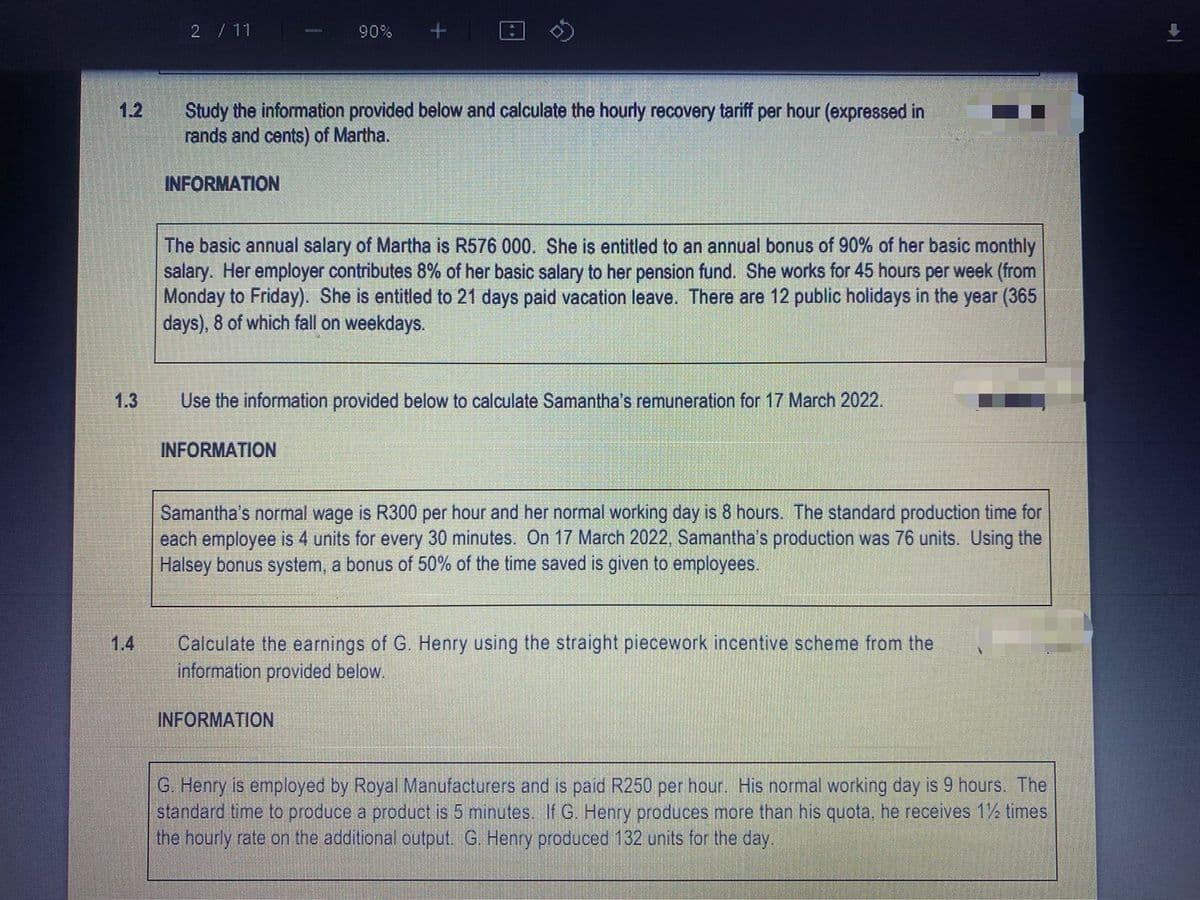

1.2 Study the information provided below and calculate the hourly recovery tariff per hour (expressed in rands and cents) of Martha. INFORMATION The basic annual salary of Martha is R576 000. She is entitled to an annual bonus of 90% of her basic monthly salary. Her employer contributes 8% of her basic salary to her pension fund. She works for 45 hours per week (from Monday to Friday). She is entitled to 21 days paid vacation leave. There are 12 public holidays in the year (365 days), 8 of which fall on weekdays.

1.2 Study the information provided below and calculate the hourly recovery tariff per hour (expressed in rands and cents) of Martha. INFORMATION The basic annual salary of Martha is R576 000. She is entitled to an annual bonus of 90% of her basic monthly salary. Her employer contributes 8% of her basic salary to her pension fund. She works for 45 hours per week (from Monday to Friday). She is entitled to 21 days paid vacation leave. There are 12 public holidays in the year (365 days), 8 of which fall on weekdays.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter8: Payroll Accounting: Employee Earnings And Deductions

Section: Chapter Questions

Problem 1CE

Related questions

Question

Hi can you please assist with this

Transcribed Image Text:1.2

1.3

1.4

2 / 11

Study the information provided below and calculate the hourly recovery tariff per hour (expressed in

rands and cents) of Martha.

INFORMATION

90%

The basic annual salary of Martha is R576 000. She is entitled to an annual bonus of 90% of her basic monthly

salary. Her employer contributes 8% of her basic salary to her pension fund. She works for 45 hours per week (from

Monday to Friday). She is entitled to 21 days paid vacation leave. There are 12 public holidays in the year (365

days), 8 of which fall on weekdays.

Use the information provided below to calculate Samantha's remuneration for 17 March 2022.

INFORMATION

Samantha's normal wage is R300 per hour and her normal working day is 8 hours. The standard production time for

each employee is 4 units for every 30 minutes. On 17 March 2022, Samantha's production was 76 units. Using the

Halsey bonus system, a bonus of 50% of the time saved is given to employees.

Calculate the earnings of G. Henry using the straight piecework incentive scheme from the

information provided below.

INFORMATION

G. Henry is employed by Royal Manufacturers and is paid R250 per hour. His normal working day is 9 hours. The

standard time to produce a product is 5 minutes. If G. Henry produces more than his quota, he receives 1½ times

the hourly rate on the additional output. G. Henry produced 132 units for the day.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning