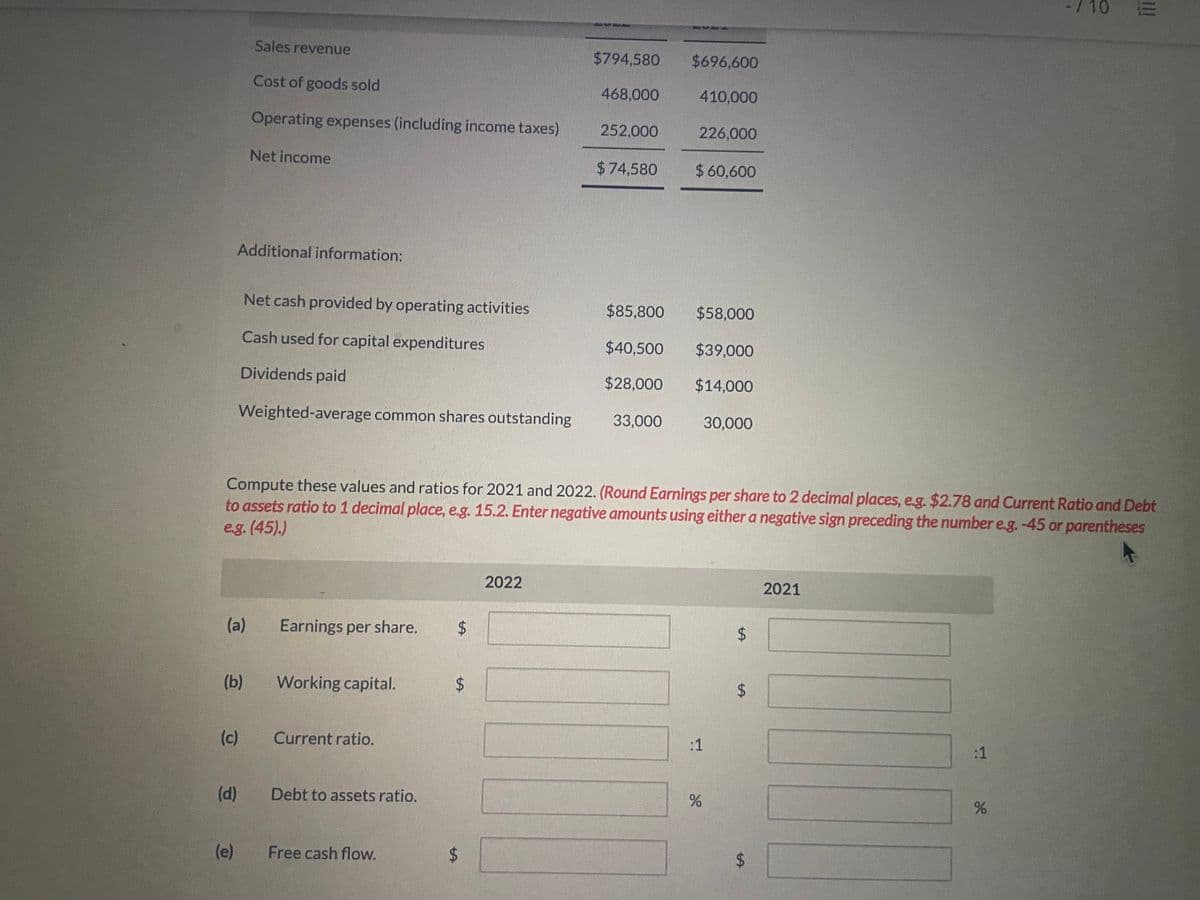

-/ 10 Sales revenue $794,580 $696,600 Cost of goods sold 468,000 410,000 Operating expenses (including income taxes) 252,000 226,000 Net income $74,580 $60,600 Additional information: Net cash provided by operating activities $85,800 $58,000 Cash used for capital expenditures $40,500 $39,000 Dividends paid $28,000 $14,000 Weighted-average common shares outstanding 33,000 30,000 Compute these values and ratios for 2021 and 2022. (Round Earnings per share to 2 decimal places, eg. $2.78 and Current Ratio and Debt to assets ratio to 1 decimal place, e.g. 15.2. Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45).) 2022 2021 (a) Earnings per share. $ $ (b) Working capital. 24 $4 (c) Current ratio. :1 :1 (d) Debt to assets ratio. (e) Free cash flow. 2$ $

-/ 10 Sales revenue $794,580 $696,600 Cost of goods sold 468,000 410,000 Operating expenses (including income taxes) 252,000 226,000 Net income $74,580 $60,600 Additional information: Net cash provided by operating activities $85,800 $58,000 Cash used for capital expenditures $40,500 $39,000 Dividends paid $28,000 $14,000 Weighted-average common shares outstanding 33,000 30,000 Compute these values and ratios for 2021 and 2022. (Round Earnings per share to 2 decimal places, eg. $2.78 and Current Ratio and Debt to assets ratio to 1 decimal place, e.g. 15.2. Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45).) 2022 2021 (a) Earnings per share. $ $ (b) Working capital. 24 $4 (c) Current ratio. :1 :1 (d) Debt to assets ratio. (e) Free cash flow. 2$ $

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 19P

Related questions

Question

Compute these values and ratios for 2021 and 2022. (Round Earnings per share to 2 decimal places, e.g. $2.78 and

Transcribed Image Text:/10

Sales revenue

$794,580

$696,600

Cost of goods sold

468,000

410,000

Operating expenses (including income taxes)

252,000

226,000

Net income

$74,580

$ 60,600

Additional information:

Net cash provided by operating activities

$85,800

$58,000

Cash used for capital expenditures

$40,500

$39,000

Dividends paid

$28,000

$14,000

Weighted-average common shares outstanding

33,000

30,000

Compute these values and ratios for 2021 and 2022. (Round Earnings per share to 2 decimal places, e.g. $2.78 and Current Ratio and Debt

to assets ratio to 1 decimal place, e.g. 15.2. Enter negative amounts using either a negative sign preceding the number e.g.-45 or parentheses

e.g. (45).)

2022

2021

(a)

Earnings per share.

(b)

Working capital.

(c)

Current ratio.

:1

:1

(d)

Debt to assets ratio.

(e)

Free cash flow.

I!

%24

%24

%24

%24

%24

%24

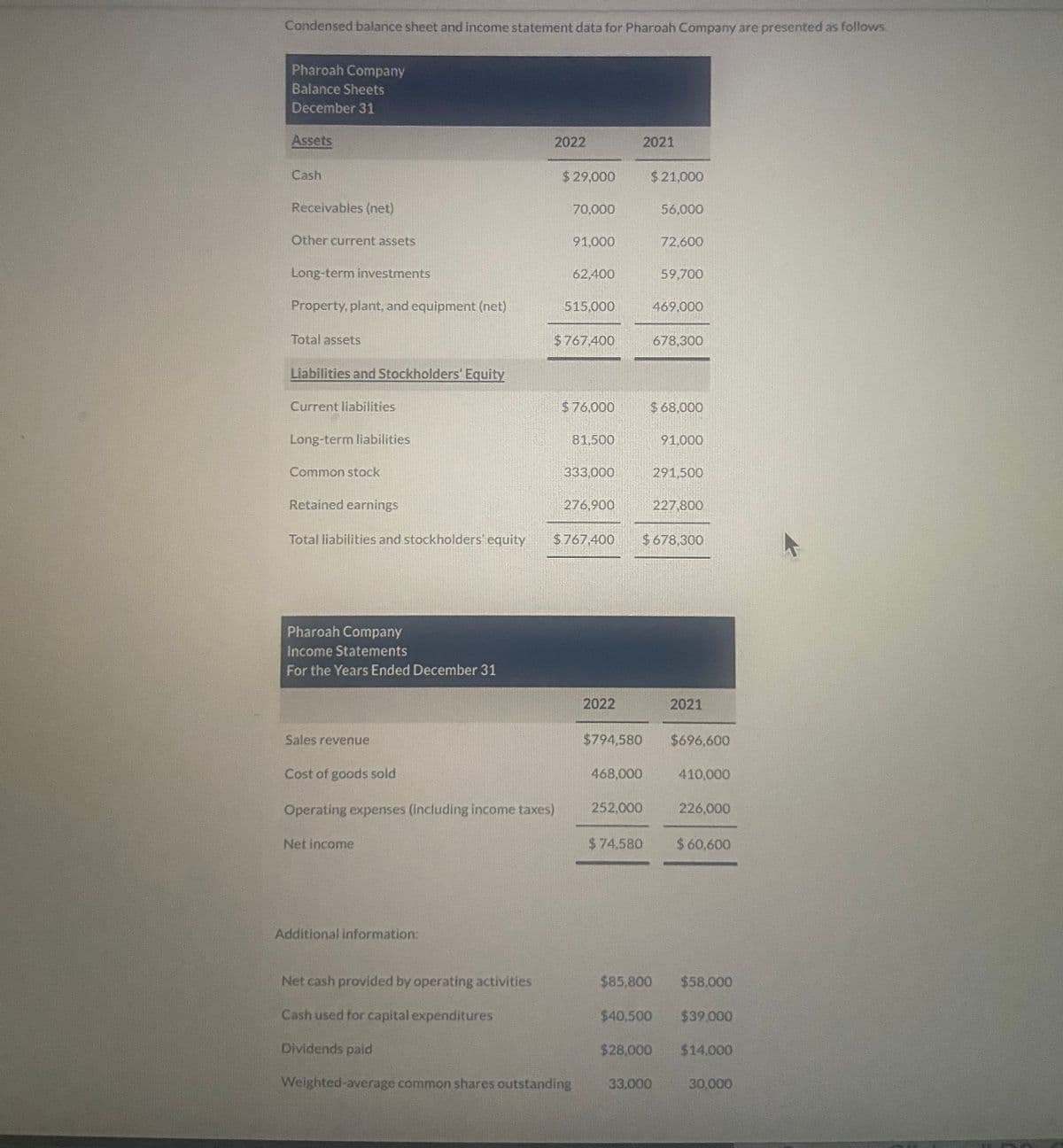

Transcribed Image Text:Condensed balance sheet and income statement data for Pharoah Company are presented as follows.

Pharoah Company

Balance Sheets

December 31

Assets

2022

2021

Cash

$29,000

$21,000

Receivables (net)

70,000

56,000

Other current assets

91,000

72,600

Long-term investments

62,400

59,700

Property, plant, and equipment (net)

515,000

469,000

Total assets

$767,400

678,300

Liabilities and Stockholders' Equity

Current liabilities

$76,000

$68,000

Long-term liabilities

81,500

91,000

Common stock

333,000

291,500

Retained earnings

276,900

227,800

Total liabilities and stockholders' equity

$767,400

$ 678,300

Pharoah Company

Income Statements

For the Years Ended December 31

2022

2021

Sales revenue

$794,580

$696,600

Cost of goods sold

468,000

410,000

Operating expenses (including income taxes)

252,000

226,000

Net income

$74,580

$ 60,600

Additional information:

Net cash provided by operating activities

$85,800

$58,000

Cash used for capital expenditures

$40,500

$39.000

Dividends paid

$28,000

$14,000

Weighted-average common shares outstanding

33,000

30,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning