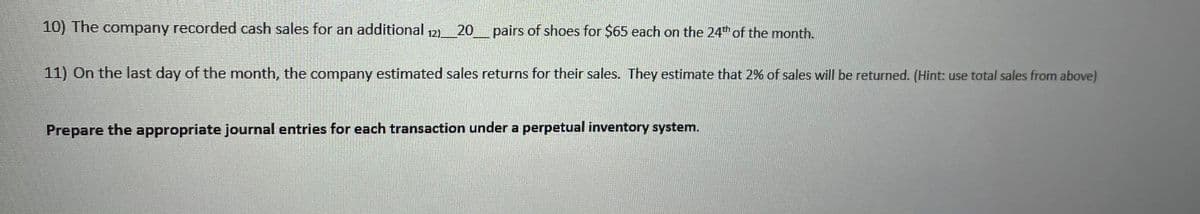

10) The company recorded cash sales for an additional 12)_20_pairs of shoes for $65 each on the 24th of the month. 11) On the last day of the month, the company estimated sales returns for their sales. They estimate that 2% of sales will be returned. (Hint: use total sales from above) Prepare the appropriate journal entries for each transaction under a perpetual inventory system.

10) The company recorded cash sales for an additional 12)_20_pairs of shoes for $65 each on the 24th of the month. 11) On the last day of the month, the company estimated sales returns for their sales. They estimate that 2% of sales will be returned. (Hint: use total sales from above) Prepare the appropriate journal entries for each transaction under a perpetual inventory system.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter14: Adjustments For A Merchandising Business

Section: Chapter Questions

Problem 2MC: Under the periodic inventory system, what account is debited when an estimate is made for sales made...

Related questions

Question

Transcribed Image Text:10) The company recorded cash sales for an additional 12)

20 pairs of shoes for $65 each on the 24th of the month.

11) On the last day of the month, the company estimated sales returns for their sales. They estimate that 2% of sales will be returned. (Hint: use total sales from above)

Prepare the appropriate journal entries for each transaction under a perpetual inventory system.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning