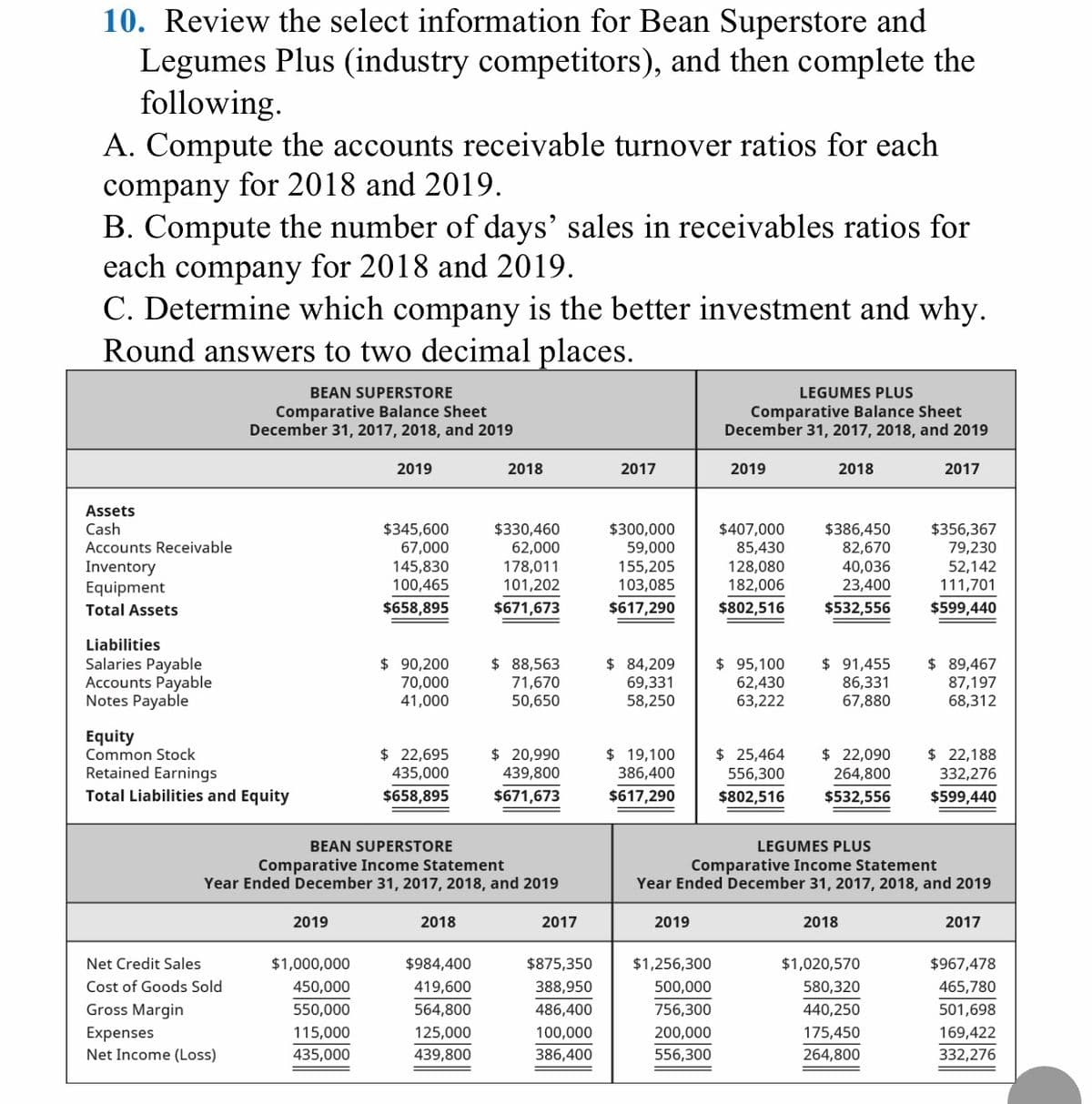

10. Review the select information for Bean Superstore and Legumes Plus (industry competitors), and then complete the following. A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019. B. Compute the number of days' sales in receivables ratios for each company for 2018 and 2019. C. Determine which company is the better investment and why. Round answers to two decimal places. BEAN SUPERSTORE LEGUMES PLUS Comparative Balance Sheet December 31, 2017, 2018, and 2019 Comparative Balance Sheet December 31, 2017, 2018, and 2019 2019 2018 2017 2019 2018 2017 Assets Cash Accounts Receivable Inventory Equipment $345,600 67,000 145,830 100,465 $330,460 62,000 178,011 101,202 $300,000 59,000 155,205 103,085 $407,000 85,430 128,080 182,006 $386,450 82,670 40,036 23,400 $356,367 79,230 52,142 111,701 Total Assets $658,895 $671,673 $617,290 $802,516 $532,556 $599,440 Liabilities Salaries Payable Accounts Payable Notes Payable $ 90,200 70,000 41,000 $ 88,563 71,670 50,650 $ 84,209 69,331 58,250 $ 95,100 62,430 63,222 $ 91,455 86,331 67,880 $ 89,467 87,197 68,312 Equity Common Stock Retained Earnings Total Liabilities and Equity $ 20,990 439,800 $ 22,090 264,800 $ 22,695 $ 19,100 386,400 $ 25,464 $ 22,188 332,276 435,000 556,300 $658,895 $671,673 $617,290 $802,516 $532,556 $599,440 BEAN SUPERSTORE LEGUMES PLUS Comparative Income Statement Year Ended December 31, 2017, 2018, and 2019 Comparative Income Statement Year Ended December 31, 2017, 2018, and 2019 2019 2018 2017 2019 2018 2017 Net Credit Sales $1,000,000 $984,400 $875,350 $1,256,300 $1,020,570 $967,478 Cost of Goods Sold 450,000 419,600 388,950 500,000 580,320 465,780 Gross Margin 550,000 564,800 486,400 756,300 440,250 501,698 125,000 175,450 169,422 Expenses Net Income (Loss) 115,000 100,000 200,000 435,000 439,800 386,400 556,300 264,800 332,276

10. Review the select information for Bean Superstore and Legumes Plus (industry competitors), and then complete the following. A. Compute the accounts receivable turnover ratios for each company for 2018 and 2019. B. Compute the number of days' sales in receivables ratios for each company for 2018 and 2019. C. Determine which company is the better investment and why. Round answers to two decimal places. BEAN SUPERSTORE LEGUMES PLUS Comparative Balance Sheet December 31, 2017, 2018, and 2019 Comparative Balance Sheet December 31, 2017, 2018, and 2019 2019 2018 2017 2019 2018 2017 Assets Cash Accounts Receivable Inventory Equipment $345,600 67,000 145,830 100,465 $330,460 62,000 178,011 101,202 $300,000 59,000 155,205 103,085 $407,000 85,430 128,080 182,006 $386,450 82,670 40,036 23,400 $356,367 79,230 52,142 111,701 Total Assets $658,895 $671,673 $617,290 $802,516 $532,556 $599,440 Liabilities Salaries Payable Accounts Payable Notes Payable $ 90,200 70,000 41,000 $ 88,563 71,670 50,650 $ 84,209 69,331 58,250 $ 95,100 62,430 63,222 $ 91,455 86,331 67,880 $ 89,467 87,197 68,312 Equity Common Stock Retained Earnings Total Liabilities and Equity $ 20,990 439,800 $ 22,090 264,800 $ 22,695 $ 19,100 386,400 $ 25,464 $ 22,188 332,276 435,000 556,300 $658,895 $671,673 $617,290 $802,516 $532,556 $599,440 BEAN SUPERSTORE LEGUMES PLUS Comparative Income Statement Year Ended December 31, 2017, 2018, and 2019 Comparative Income Statement Year Ended December 31, 2017, 2018, and 2019 2019 2018 2017 2019 2018 2017 Net Credit Sales $1,000,000 $984,400 $875,350 $1,256,300 $1,020,570 $967,478 Cost of Goods Sold 450,000 419,600 388,950 500,000 580,320 465,780 Gross Margin 550,000 564,800 486,400 756,300 440,250 501,698 125,000 175,450 169,422 Expenses Net Income (Loss) 115,000 100,000 200,000 435,000 439,800 386,400 556,300 264,800 332,276

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 7PA: Review the select information for Bean Superstore and Legumes Plus (industry competitors), and then...

Related questions

Question

Transcribed Image Text:10. Review the select information for Bean Superstore and

Legumes Plus (industry competitors), and then complete the

following.

A. Compute the accounts receivable turnover ratios for each

company

for 2018 and 2019.

B. Compute the number of days' sales in receivables ratios for

each company for 2018 and 2019.

C. Determine which company is the better investment and why.

Round answers to two decimal places.

BEAN SUPERSTORE

LEGUMES PLUS

Comparative Balance Sheet

December 31, 2017, 2018, and 2019

Comparative Balance Sheet

December 31, 2017, 2018, and 2019

2019

2018

2017

2019

2018

2017

Assets

Cash

$345,600

67,000

145,830

100,465

$330,460

62,000

178,011

101,202

$300,000

59,000

155,205

103,085

$407,000

85,430

128,080

182,006

$386,450

82,670

40,036

23,400

$356,367

79,230

52,142

111,701

Accounts Receivable

Inventory

Equipment

Total Assets

$658,895

$671,673

$617,290

$802,516

$532,556

$599,440

Liabilities

Salaries Payable

Accounts Payable

Notes Payable

$ 91,455

$ 90,200

70,000

41,000

$ 88,563

71,670

50,650

$ 84,209

69,331

58,250

$95,100

62,430

63,222

86,331

67,880

$ 89,467

87,197

68,312

Equity

Common Stock

Retained Earnings

$ 22,695

435,000

$ 19,100

386,400

$ 22,090

$ 20,990

439,800

$ 25,464

556,300

$ 22,188

332,276

264,800

Total Liabilities and Equity

$658,895

$671,673

$617,290

$802,516

$532,556

$599,440

BEAN SUPERSTORE

LEGUMES PLUS

Comparative Income Statement

Year Ended December 31, 2017, 2018, and 2019

Comparative Income Statement

Year Ended December 31, 2017, 2018, and 2019

2019

2018

2017

2019

2018

2017

Net Credit Sales

$1,000,000

$984,400

$875,350

$1,256,300

$1,020,570

$967,478

Cost of Goods Sold

450,000

419,600

388,950

500,000

580,320

465,780

Gross Margin

Expenses

Net Income (Loss)

550,000

564,800

486,400

756,300

440,250

501,698

115,000

125,000

100,000

200,000

175,450

169,422

435,000

439,800

386,400

556,300

264,800

332,276

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning