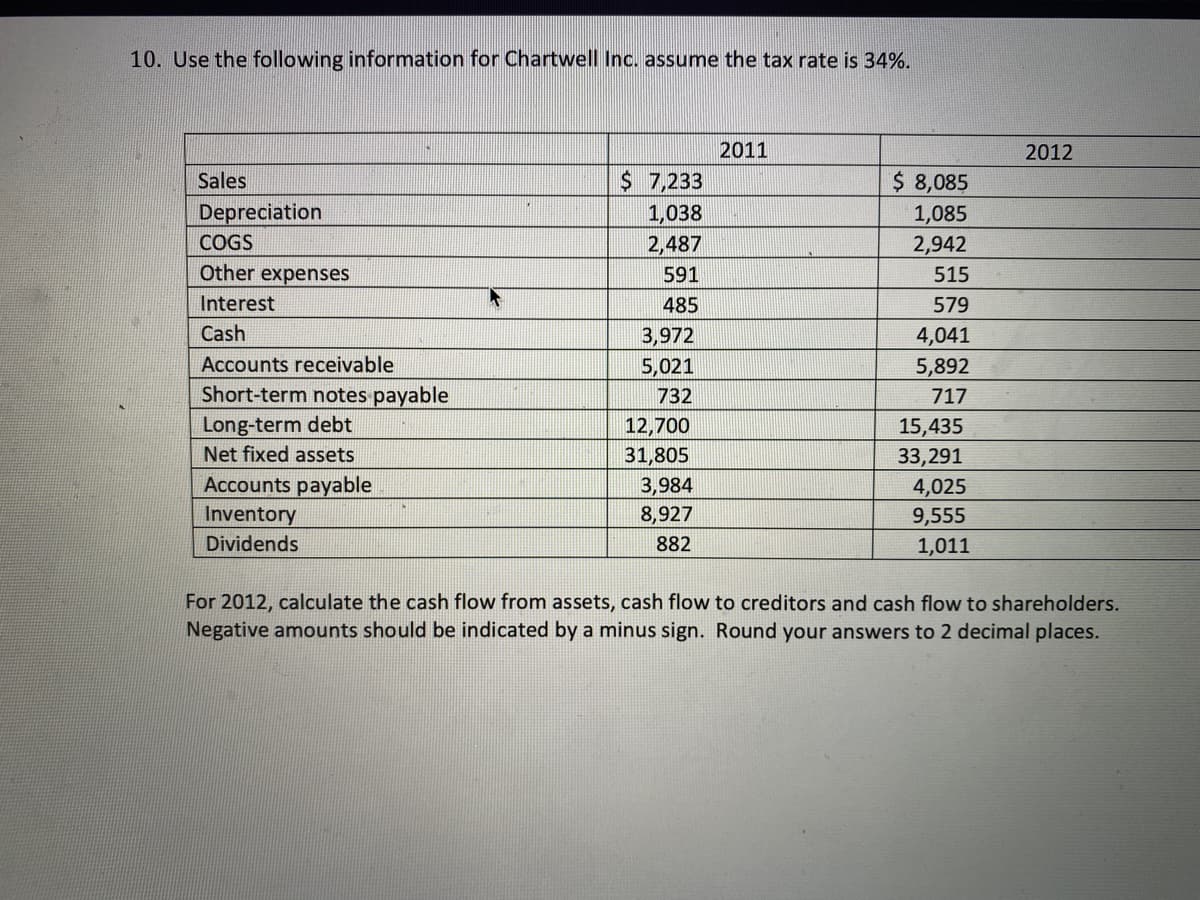

10. Use the following information for Chartwell Inc. assume the tax rate is 34%. 2011 2012 Sales $ 7,233 $ 8,085 Depreciation 1,038 1,085 COGS 2,487 2,942 Other expenses 591 515 Interest 485 579 Cash 3,972 4,041 Accounts receivable 5,021 5,892 Short-term notes payable 732 717 Long-term debt Net fixed assets 12,700 31,805 15,435 33,291 4,025 9,555 1,011 Accounts payable Inventory 3,984 8,927 Dividends 882 For 2012, calculate the cash flow from assets, cash flow to creditors and cash flow to shareholders. Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.

10. Use the following information for Chartwell Inc. assume the tax rate is 34%. 2011 2012 Sales $ 7,233 $ 8,085 Depreciation 1,038 1,085 COGS 2,487 2,942 Other expenses 591 515 Interest 485 579 Cash 3,972 4,041 Accounts receivable 5,021 5,892 Short-term notes payable 732 717 Long-term debt Net fixed assets 12,700 31,805 15,435 33,291 4,025 9,555 1,011 Accounts payable Inventory 3,984 8,927 Dividends 882 For 2012, calculate the cash flow from assets, cash flow to creditors and cash flow to shareholders. Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter6: Accounting For Financial Management

Section: Chapter Questions

Problem 3P

Related questions

Question

Transcribed Image Text:10. Use the following information for Chartwell Inc. assume the tax rate is 34%.

2011

2012

Sales

$ 7,233

$.

$ 8,085

1,085

2,942

Depreciation

1,038

COGS

2,487

Other expenses

591

515

Interest

485

579

Cash

3,972

4,041

5,892

Accounts receivable

5,021

Short-term notes payable

Long-term debt

Net fixed assets

732

717

12,700

15,435

31,805

33,291

Accounts payable

3,984

4,025

Inventory

Dividends

8,927

9,555

882

1,011

For 2012, calculate the cash flow from assets, cash flow to creditors and cash flow to shareholders.

Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning