1,000 hours of legal services performed. Howe bills P160 per hour for his legal b) East Company issued 1,000 shares with P5 par to Howe as compensation for services. By what amount should the share premium accoùnt increase as a ro of the transaction? 25

1,000 hours of legal services performed. Howe bills P160 per hour for his legal b) East Company issued 1,000 shares with P5 par to Howe as compensation for services. By what amount should the share premium accoùnt increase as a ro of the transaction? 25

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 3P: On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a...

Related questions

Question

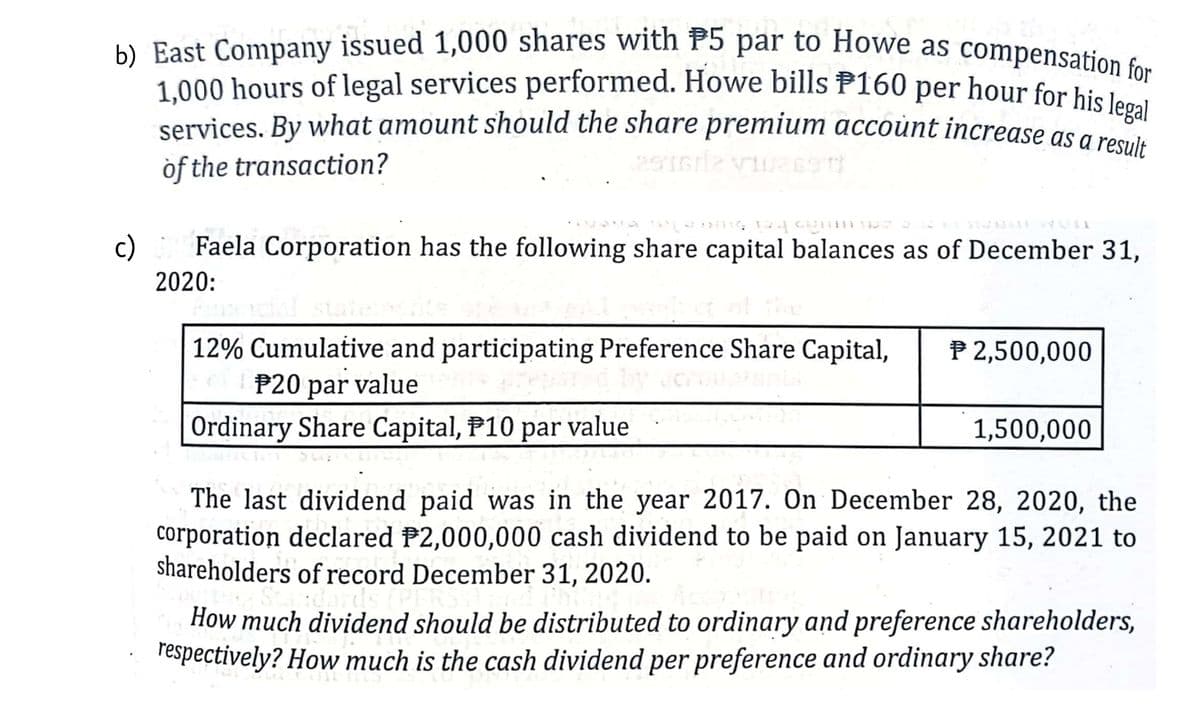

Transcribed Image Text:b) East Company issued 1,000 shares with P5 par to Howe as compensation for

1,000 hours of legal services performed. Howe bills P160 per hour for his legal

1,000 hours of legal services performed. Howe bills P160 per hour for hiei 1or

services. By what amount should the share premium accoùnt increase as a resule

òf the transaction?

c)

Faela Corporation has the following share capital balances as of December 31,

2020:

12% Cumulative and participating Preference Share Capital,

P20 par

P 2,500,000

value

Ordinary Share Capital, P10 par value

1,500,000

The last dividend paid was in the year 2017. On December 28, 2020, the

corporation declared P2,000,000 cash dividend to be paid on January 15, 2021 to

shareholders of record December 31, 2020.

How much dividend should be distributed to ordinary and preference shareholders,

respectively? How much is the cash dividend per preference and ordinary share?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College