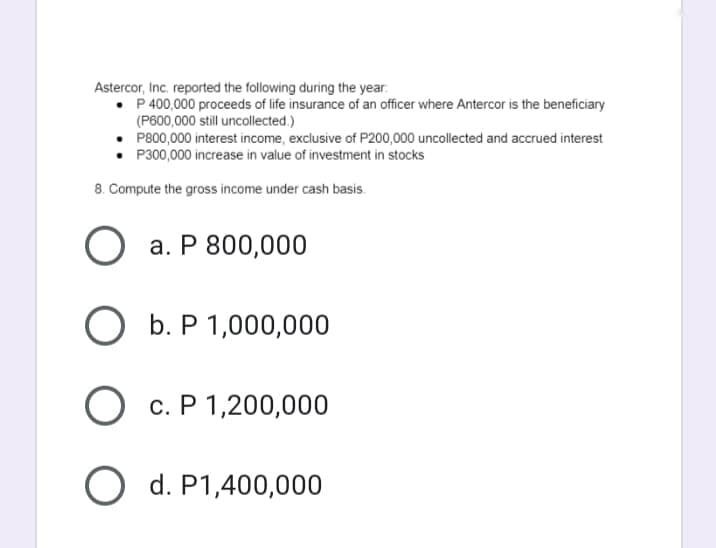

Astercor, Inc. reported the following during the year. • P 400,000 proceeds of life insurance of an officer where Antercor is the beneficiary (P600,000 still uncollected.) P800,000 interest income, exclusive of P200,000 uncollected and accrued interest P300,000 increase in value of investment in stocks 8. Compute the gross income under cash basis.

Astercor, Inc. reported the following during the year. • P 400,000 proceeds of life insurance of an officer where Antercor is the beneficiary (P600,000 still uncollected.) P800,000 interest income, exclusive of P200,000 uncollected and accrued interest P300,000 increase in value of investment in stocks 8. Compute the gross income under cash basis.

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 45P

Related questions

Question

Transcribed Image Text:Astercor, Inc. reported the following during the year.

• P 400,000 proceeds of life insurance of an officer where Antercor is the beneficiary

(P600,000 still uncollected.)

• P800,000 interest income, exclusive of P200,000 uncollected and accrued interest

• P300,000 increase in value of investment in stocks

8. Compute the gross income under cash basis.

а. Р 800,000

b. P

ОБ.Р1,000,000

c. P 1,200,000

O d. P1,400,000

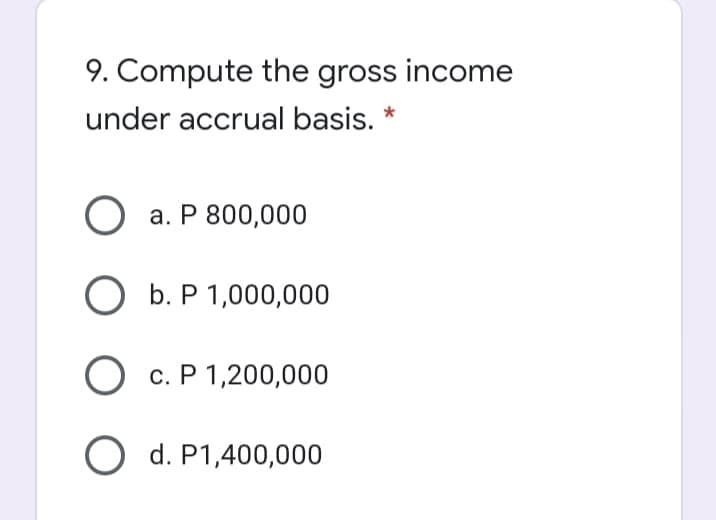

Transcribed Image Text:9. Compute the gross income

under accrual basis. *

О а. Р 800,000

O b. P 1,000,000

О с. Р 1,200,000

O d. P1,400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning