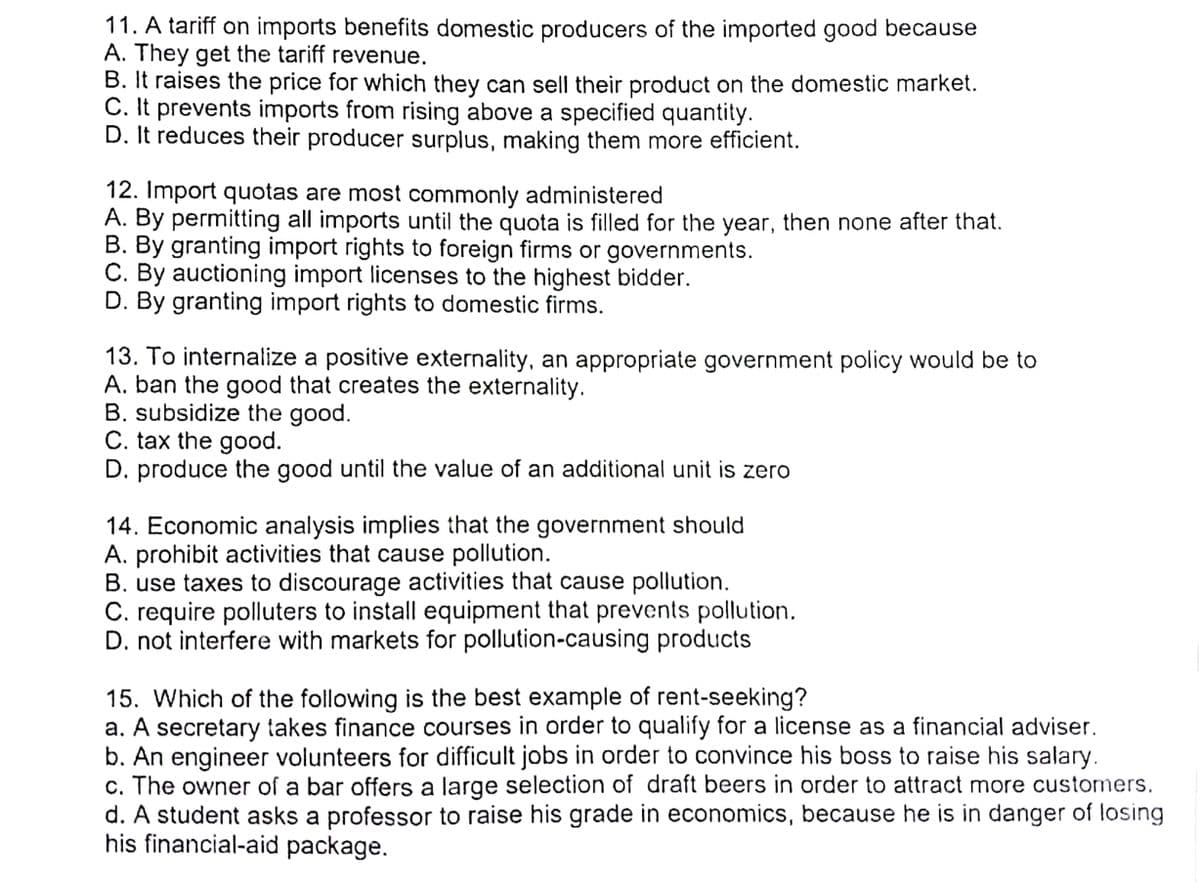

11. A tariff on imports benefits domestic producers of the imported good because A. They get the tariff revenue. B. It raises the price for which they can sell their product on the domestic market. C. It prevents imports from rising above a specified quantity. D. It reduces their producer surplus, making them more efficient. 12. Import quotas are most commonly administered A. By permitting all imports until the quota is filled for the year, then none after that. B. By granting import rights to foreign firms or governments. C. By auctioning import licenses to the highest bidder. D. By granting import rights to domestic firms. 13. To internalize a positive externality, an appropriate government policy would be to A. ban the good that creates the externality. B. subsidize the good. C. tax the good. D. produce the good until the value of an additional unit is zero

11. A tariff on imports benefits domestic producers of the imported good because A. They get the tariff revenue. B. It raises the price for which they can sell their product on the domestic market. C. It prevents imports from rising above a specified quantity. D. It reduces their producer surplus, making them more efficient. 12. Import quotas are most commonly administered A. By permitting all imports until the quota is filled for the year, then none after that. B. By granting import rights to foreign firms or governments. C. By auctioning import licenses to the highest bidder. D. By granting import rights to domestic firms. 13. To internalize a positive externality, an appropriate government policy would be to A. ban the good that creates the externality. B. subsidize the good. C. tax the good. D. produce the good until the value of an additional unit is zero

Chapter19: International Trade

Section: Chapter Questions

Problem 2.6P

Related questions

Question

100%

Please answer 11 to 15 questions and choose the correct answer.

Transcribed Image Text:11. A tariff on imports benefits domestic producers of the imported good because

A. They get the tariff revenue.

B. It raises the price for which they can sell their product on the domestic market.

C. It prevents imports from rising above a specified quantity.

D. It reduces their producer surplus, making them more efficient.

12. Import quotas are most commonly administered

A. By permitting all imports until the quota is filled for the year, then none after that.

B. By granting import rights to foreign firms or governments.

C. By auctioning import licenses to the highest bidder.

D. By granting import rights to domestic firms.

13. To internalize a positive externality, an appropriate government policy would be to

A. ban the good that creates the externality.

B. subsidize the good.

C. tax the good.

D. produce the good until the value of an additional unit is zero

14. Economic analysis implies that the government should

A. prohibit activities that cause pollution.

B. use taxes to discourage activities that cause pollution.

C. require polluters to install equipment that prevents pollution.

D. not interfere with markets for pollution-causing products

15. Which of the following is the best example of rent-seeking?

a. A secretary takes finance courses in order to qualify for a license as a financial adviser.

b. An engineer volunteers for difficult jobs in order to convince his boss to raise his salary.

c. The owner of a bar offers a large selection of draft beers in order to attract more customers.

d. A student asks a professor to raise his grade in economics, because he is in danger of losing

his financial-aid package.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning