Suppose the central bank subscribes to a monetarist approach to monetary policy. The central bank believes that the velocity of money grows at a predictable rate of 2% per year and that potential real GDP grows at 4% per year. If the central bank observes a monetary policy rule that stipulates money supply growth of 5% per year, it will expect an inflation rate of 11% Y per year and nominal GDP growth of y per year. Suppose that actual growth in the velocity of money unexpectedly rises to 2.5%. If the central bank continues to adhere to money supply growth of 5% per year and potential real GDP continues to grow at 4% per year, the inflation rate will be than anticipated, and nominal GDP growth will be than anticipated.

Suppose the central bank subscribes to a monetarist approach to monetary policy. The central bank believes that the velocity of money grows at a predictable rate of 2% per year and that potential real GDP grows at 4% per year. If the central bank observes a monetary policy rule that stipulates money supply growth of 5% per year, it will expect an inflation rate of 11% Y per year and nominal GDP growth of y per year. Suppose that actual growth in the velocity of money unexpectedly rises to 2.5%. If the central bank continues to adhere to money supply growth of 5% per year and potential real GDP continues to grow at 4% per year, the inflation rate will be than anticipated, and nominal GDP growth will be than anticipated.

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter22: Money Growth And Inflation

Section: Chapter Questions

Problem 1PA

Related questions

Question

Transcribed Image Text:28. The Monetary Policy Rule and the Velocity of Money

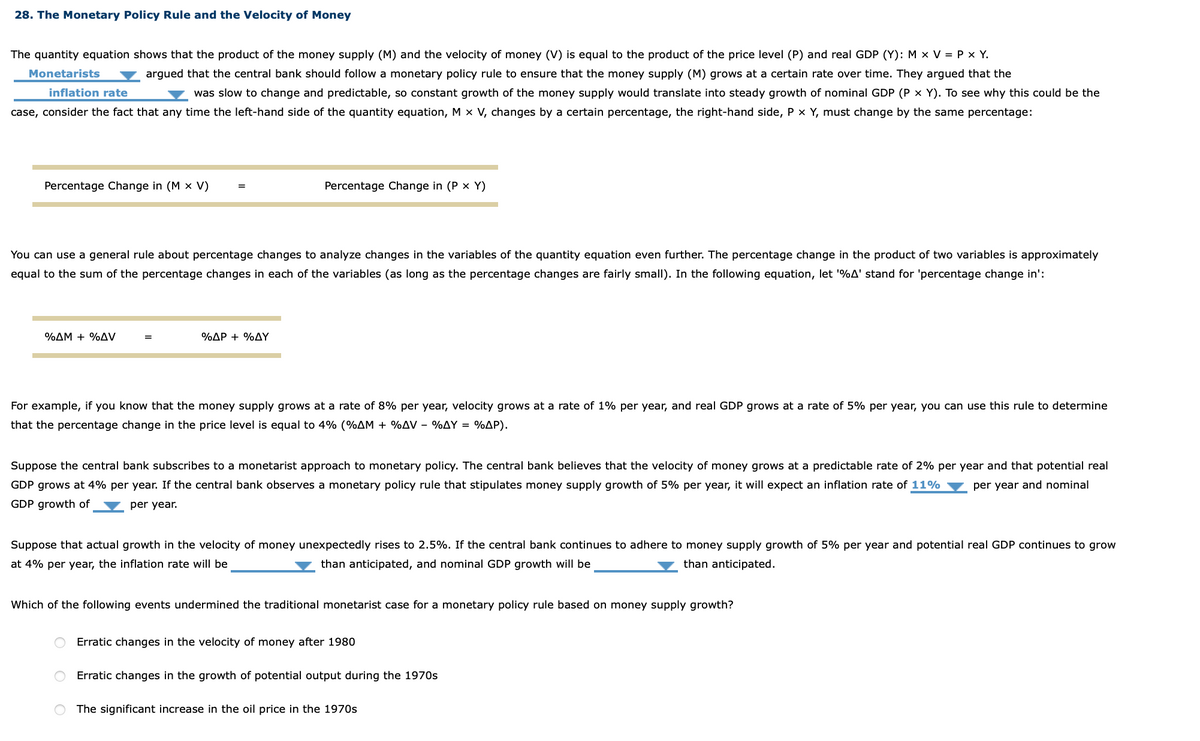

The quantity equation shows that the product of the money supply (M) and the velocity of money (V) is equal to the product of the price level (P) and real GDP (Y): M × V = P × Y.

Monetarists

argued that the central bank should follow a monetary policy rule to ensure that the money supply (M) grows at a certain rate over time. They argued that the

inflation rate

was slow to change and predictable, so constant growth of the money supply would translate into steady growth of nominal GDP (P x Y). To see why this could be the

case, consider the fact that any time the left-hand side of the quantity equation, M × V, changes by a certain percentage, the right-hand side, P x Y, must change by the same percentage:

Percentage Change in (M x V)

Percentage Change in (P x Y)

You can use a general rule about percentage changes to analyze changes in the variables of the quantity equation even further. The percentage change in the product of two variables is approximately

equal to the sum of the percentage changes in each of the variables (as long as the percentage changes are fairly small). In the following equation, let '%A' stand for 'percentage change in':

%AM + %AV

%AP + %AY

For example, if you know that the money supply grows at a rate of 8% per year, velocity grows at a rate of 1% per year, and real GDP grows at a rate of 5% per year, you can use this rule to determine

that the percentage change in the price level is equal to 4% (%AM + %AV - %AY = %AP).

Suppose the central bank subscribes to a monetarist approach to monetary policy. The central bank believes that the velocity of money grows at a predictable rate of 2% per year and that potential real

GDP grows at 4% per year. If the central bank observes a monetary policy rule that stipulates money supply growth of 5% per year, it will expect an inflation rate of 11%

per year and nominal

GDP growth of

per year.

Suppose that actual growth in the velocity of money unexpectedly rises to 2.5%. If the central bank continues to adhere to money supply growth of 5% per year and potential real GDP continues to grow

at 4% per year, the inflation rate will be

than anticipated, and nominal GDP growth will be

than anticipated.

Which of the following events undermined the traditional monetarist case for a monetary policy rule based on money supply growth?

Erratic changes in the velocity of money after 1980

Erratic changes in the growth of potential output during the 1970s

The significant increase in the oil price in the 1970s

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning