12 000 4 000 1 nd fittings 1 000 2 000 50 000 10 000 2 30.000

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter9: Accounting For Purchases And Cash Payments

Section9.1: Subsidiary Ledgers And Controlling Accounts

Problem 1OYO

Related questions

Question

Transcribed Image Text:Financial Accounting II / © ICCG / Page 46

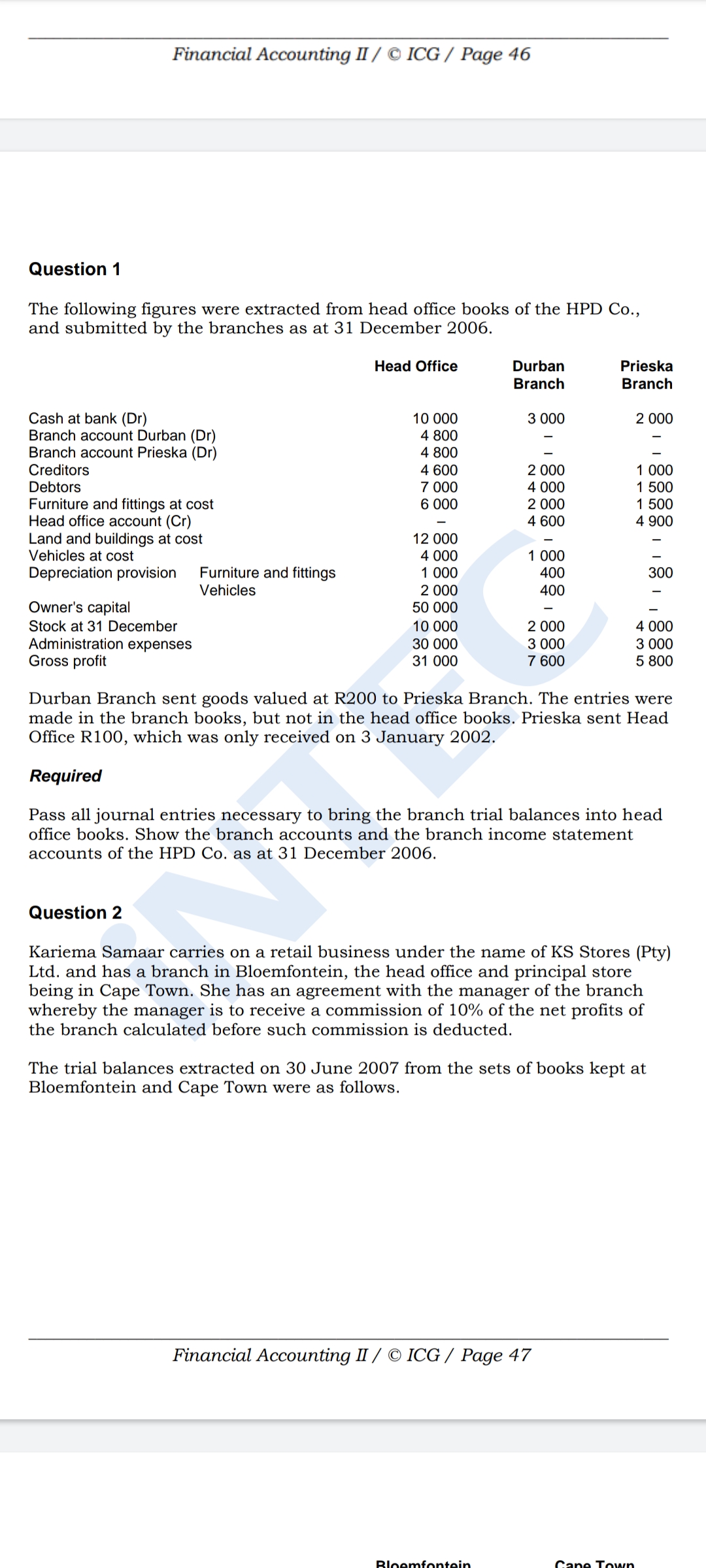

Question 1

The following figures were extracted from head office books of the HPD Co.,

and submitted by the branches as at 31 December 2006.

Head Office

Durban

Branch

Prieska

Branch

Cash at bank (Dr)

Branch account Durban (Dr)

Branch account Prieska (Dr)

Creditors

Debtors

Furniture and fittings at cost

Head office account (Cr)

Land and buildings at cost

Vehicles at cost

10 000

3 000

2 000

4 800

4 800

4 600

2 000

1 000

7 000

6 000

4 000

1 500

1 500

2 000

4 600

4 900

12 000

4 000

1 000

Depreciation provision

Furniture and fittings

1 000

400

300

Vehicles

2 000

400

Owner's capital

50 000

Stock at 31 December

Administration expenses

Gross profit

4 000

3 000

5 800

10 000

2 000

3 000

7 600

30 000

31 000

Durban Branch sent goods valued at R200 to Prieska Branch. The entries were

made in the branch books, but not in the head office books. Prieska sent Head

Office R100, which was only received on 3 January 2002.

Required

Pass all journal entries necessary to bring the branch trial balances into head

office books. Show the branch accounts and the branch income statement

accounts of the HPD Co. as at 31 December 2006.

Question 2

Kariema Samaar carries on a retail business under the name of KS Stores (Pty)

Ltd. and has a branch in Bloemfontein, the head office and principal store

being in Cape Town. She has an agreement with the manager of the branch

whereby the manager is to receive a commission of 10% of the net profits of

the branch calculated before such commission is deducted.

The trial balances extracted on 30 June 2007 from the sets of books kept at

Bloemfontein and Cape Town were as follows.

Financial Accounting II / © ICG / Page 47

Bloemfontein

Cane Town

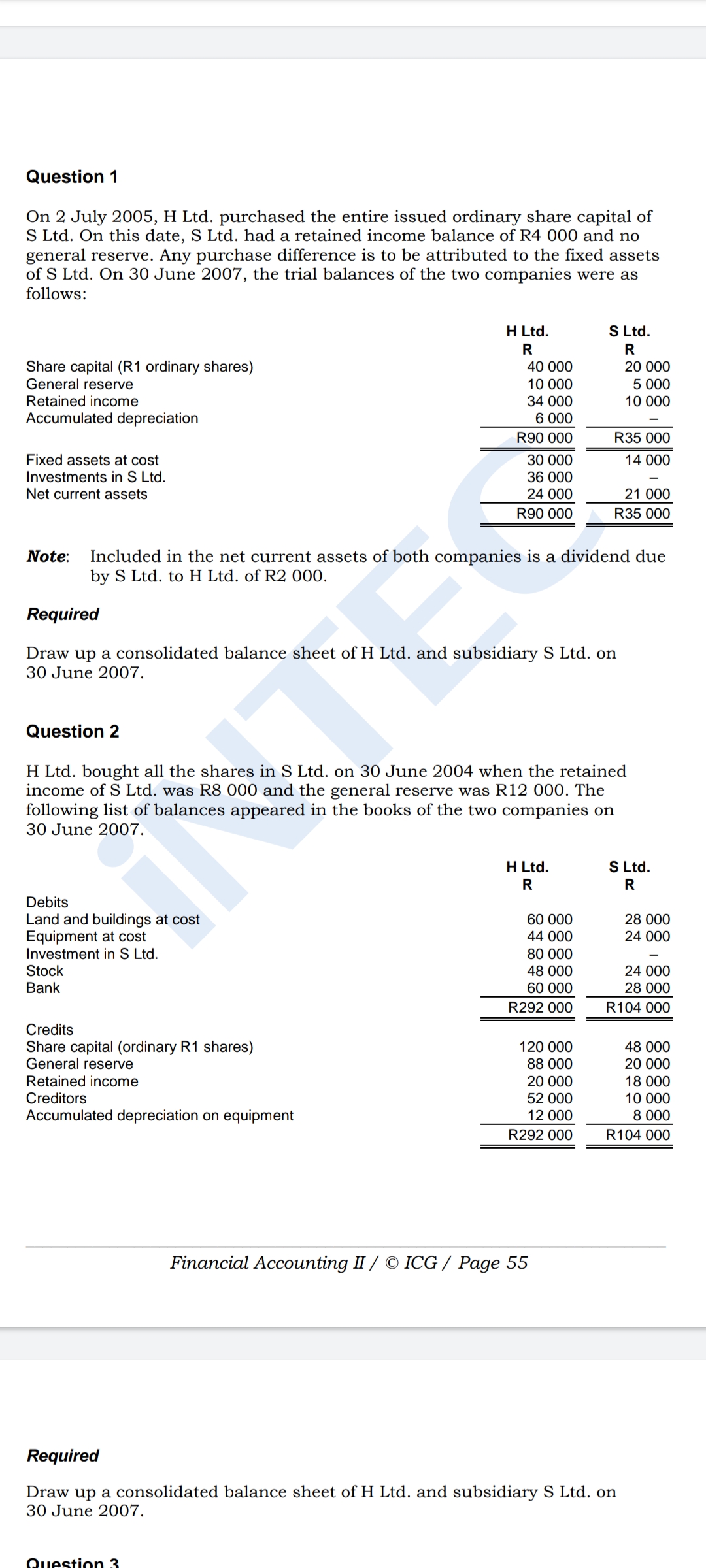

Transcribed Image Text:Question 1

On 2 July 2005, H Ltd. purchased the entire issued ordinary share capital of

S Ltd. On this date, S Ltd. had a retained income balance of R4 000 and no

general reserve. Any purchase difference is to be attributed to the fixed assets

of S Ltd. On 30 June 2007, the trial balances of the two companies were as

follows:

H Ltd.

S Ltd.

R

R

Share capital (R1 ordinary shares)

General reserve

Retained income

Accumulated depreciation

40 000

20 000

10 000

5 000

34 000

10 000

6 000

R90 000

R35 000

Fixed assets at cost

30 000

14 000

Investments in S Ltd.

36 000

Net current assets

24 000

21 000

R90 000

R35 000

Included in the net current assets of both companies is a dividend due

by S Ltd. to H Ltd. of R2 000.

Note:

Required

Draw up a consolidated balance sheet of H Ltd. and subsidiary S Ltd. on

30 June 2007.

Question 2

H Ltd. bought all the shares in S Ltd. on 30 June 2004 when the retained

income of S Ltd. was R8 000 and the general reserve was R12 000. The

following list of balances appeared in the books of the two companies on

30 June 2007.

H Ltd.

S Ltd.

R

R

Debits

Land and buildings at cost

Equipment at cost

Investment in S Ltd.

Stock

60 000

28 000

44 000

24 000

80 000

48 000

24 000

Bank

60 000

28 000

R292 000

R104 000

Credits

Share capital (ordinary R1 shares)

General reserve

Retained income

Creditors

Accumulated depreciation on equipment

120 000

48 000

88 000

20 000

20 000

18 000

52 000

10 000

12 000

8 000

R292 000

R104 000

Financial Accounting II / © ICG / Page 55

Required

Draw up a consolidated balance sheet of H Ltd. and subsidiary S Ltd. on

30 June 2007.

Question 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,