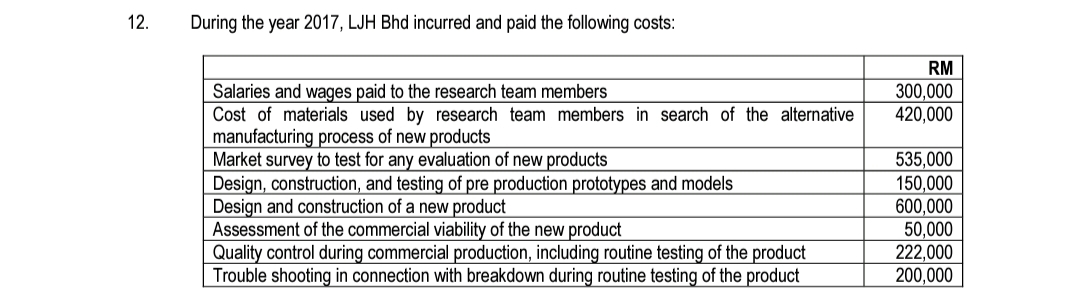

12. During the year 2017, LJH Bhd incurred and paid the following costs: RM Salaries and wages paid to the research team members Cost of materials used by research team members in search of the alternative manufacturing process of new products Market survey to test for any evaluation of new products Design, construction, and testing of pre production prototypes and models Design and construction of a new product Assessment of the commercial viability of the new product Quality control during commercial production, including routine testing of the product Trouble shooting in connection with breakdown during routine testing of the product 300,000 420,000 535,000 150,000 600,000 50,000 222,000 200,000

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

LJH Bhd used the cost method to record its intangible assets and estimated the useful life of the development costs to be five years beginning year 2017. Due to the low demand in the market for the new products, LJH Bhd estimated that the recoverable amount for the development costs was only RM450,000 at the end of the year 2018.

Required:

a) Calculate the amount of development costs that can be capitalized as at 31 December 2017.

B)Prepare the relevant

c)Briefly explain the appropriate accounting treatment if there is no foreseeable limit to the period over which the development cost is expected to generate net cash flows for LJH Bhd according to MFRS138 Intangible Assets.

Step by step

Solved in 4 steps