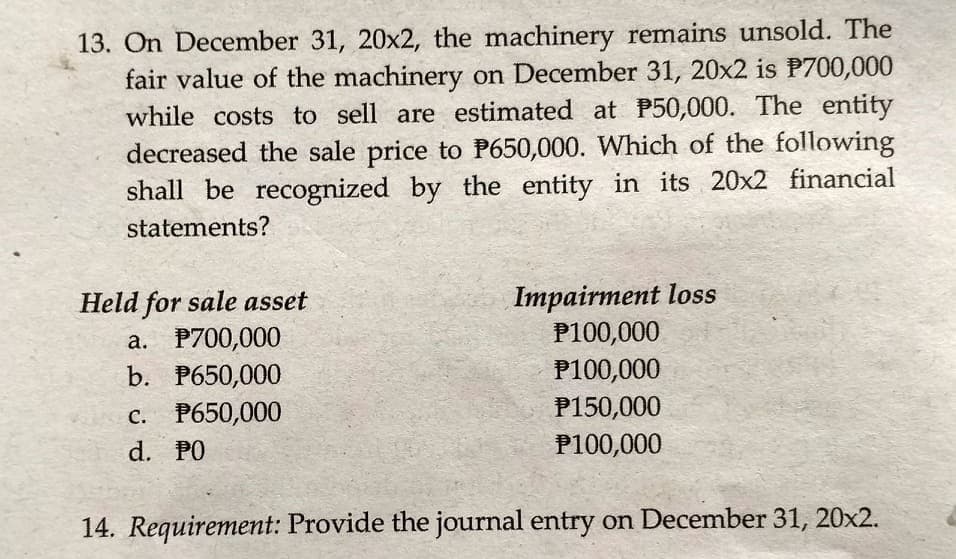

13. On December 31, 20x2, the machinery remains unsold. The fair value of the machinery on December 31, 20x2 is P700,000 while costs to sell are estimated at P50,000. The entity decreased the sale price to P650,000. Which of the following shall be recognized by the entity in its 20x2 financial statements? Held for sale asset a. P700,000 b. P650,000 Impairment loss P100,000 P100,000 C. P650,000 P150,000 с. d. PO P100,000

13. On December 31, 20x2, the machinery remains unsold. The fair value of the machinery on December 31, 20x2 is P700,000 while costs to sell are estimated at P50,000. The entity decreased the sale price to P650,000. Which of the following shall be recognized by the entity in its 20x2 financial statements? Held for sale asset a. P700,000 b. P650,000 Impairment loss P100,000 P100,000 C. P650,000 P150,000 с. d. PO P100,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 11MCQ

Related questions

Question

Topic: Non-Current Assets Held for Sale and Discontinued Operations

13. Which of the following shall be recognized by the entity in its 20x2 financial statements?

Held for ale asset Impairment loss

a. P700,000 P100,000

b. P650,000 P100,000

c. P650,000 P150,000

d. P0 P100,000

13. Requirement: Provide the

Transcribed Image Text:13. On December 31, 20x2, the machinery remains unsold. The

fair value of the machinery on December 31, 20x2 is P700,000

while costs to sell are estimated at P50,000. The entity

decreased the sale price to P650,000. Which of the following

shall be recognized by the entity in its 20x2 financial

statements?

Held for sale asset

a. P700,000

b. P650,000

Impairment loss

P100,000

P100,000

P150,000

c. P650,000

d. PO

P100,000

14. Requirement: Provide the journal entry on December 31, 20x2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub