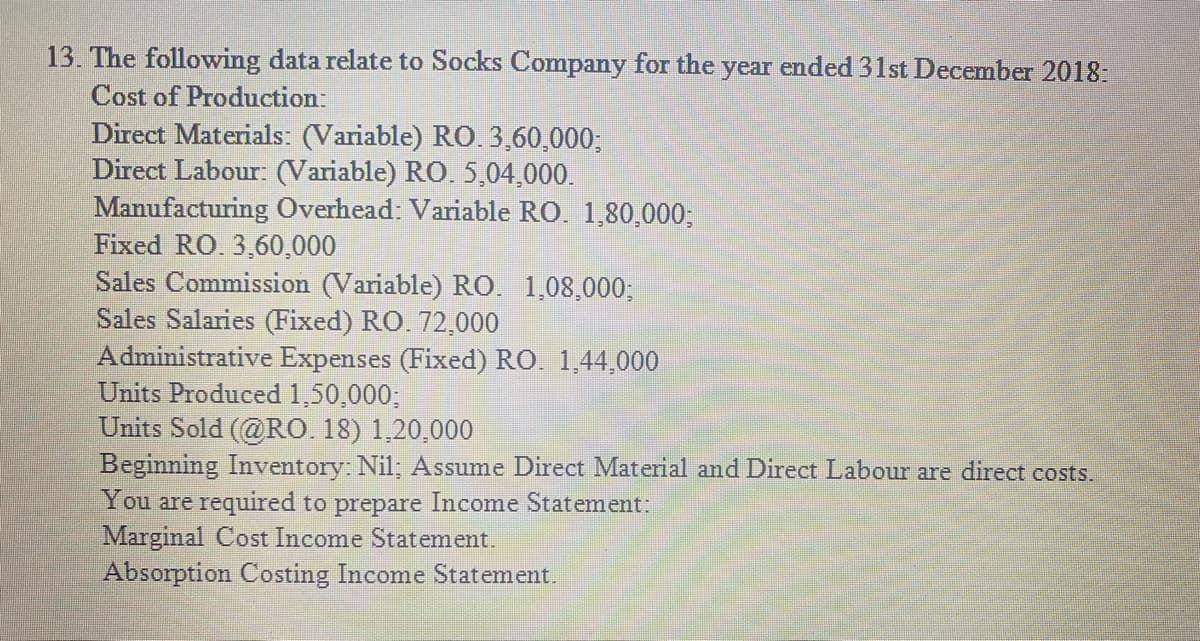

13. The following data relate to Socks Company for the year ended 31st December 2018: Cost of Production: Direct Materials: (Variable) RO.3,60,000; Direct Labour: (Variable) RO. 5,04,000. Manufacturing Overhead: Variable RO. 1,80,000; Fixed RO. 3,60,000 Sales Commission (Variable) RO. 1,08,000; Sales Salaries (Fixed) RO. 72,000 Administrative Expenses (Fixed) RO. 1,44,000 Units Produced 1,50,000; Units Sold (@RO. 18) 1,20,000 Beginning Inventory: Nil; Assume Direct Material and Direct Labour are direct costs. You are required to prepare Income Statement: Marginal Cost Income Statement. Absorption Costing Income Statement.

13. The following data relate to Socks Company for the year ended 31st December 2018: Cost of Production: Direct Materials: (Variable) RO.3,60,000; Direct Labour: (Variable) RO. 5,04,000. Manufacturing Overhead: Variable RO. 1,80,000; Fixed RO. 3,60,000 Sales Commission (Variable) RO. 1,08,000; Sales Salaries (Fixed) RO. 72,000 Administrative Expenses (Fixed) RO. 1,44,000 Units Produced 1,50,000; Units Sold (@RO. 18) 1,20,000 Beginning Inventory: Nil; Assume Direct Material and Direct Labour are direct costs. You are required to prepare Income Statement: Marginal Cost Income Statement. Absorption Costing Income Statement.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter7: Variable Costing For Management

analysis

Section: Chapter Questions

Problem 9E: The following data were adapted from a recent income statement of Caterpillar Inc. (CAT) for the...

Related questions

Question

Transcribed Image Text:13. The following data relate to Socks Company for the year ended 31st December 2018:

Cost of Production:

Direct Materials: (Variable) RO. 3,60,000;

Direct Labour: (Variable) RO. 5,04,000.

Manufacturing Overhead: Variable RO. 1,80,000;

Fixed RO. 3,60,000

Sales Commission (Variable) RO. 1,08,000;

Sales Salaries (Fixed) RO. 72,000

Administrative Expenses (Fixed) RO. 1,44,000

Units Produced 1,50,000;

Units Sold (@RO. 18) 1,20,000

Beginning Inventory: Nil; Assume Direct Material and Direct Labour are direct costs.

You are required to prepare Income Statement:

Marginal Cost Income Statement.

Absorption Costing Income Statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,