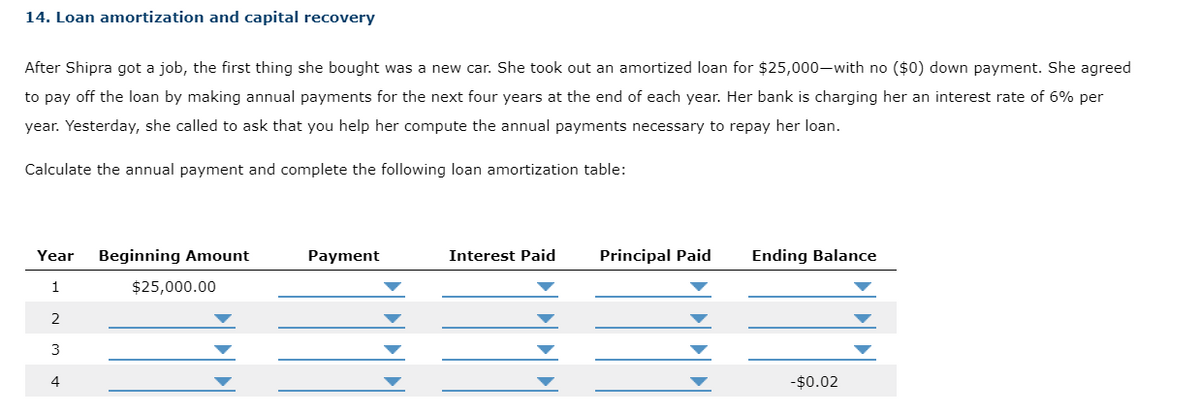

14. Loan amortization and capital recovery After Shipra got a job, the first thing she bought was a new car. She took out an amortized loan for $25,000-with no ($0) down payment. She agreed to pay off the loan by making annual payments for the next four years at the end of each year. Her bank is charging her an interest rate of 6% per year. Yesterday, she called to ask that you help her compute the annual payments necessary to repay her loan. Calculate the annual payment and complete the following loan amortization table: Year Beginning Amount 1 2 3 4 $25,000.00 Payment Interest Paid Principal Paid Ending Balance -$0.02

14. Loan amortization and capital recovery After Shipra got a job, the first thing she bought was a new car. She took out an amortized loan for $25,000-with no ($0) down payment. She agreed to pay off the loan by making annual payments for the next four years at the end of each year. Her bank is charging her an interest rate of 6% per year. Yesterday, she called to ask that you help her compute the annual payments necessary to repay her loan. Calculate the annual payment and complete the following loan amortization table: Year Beginning Amount 1 2 3 4 $25,000.00 Payment Interest Paid Principal Paid Ending Balance -$0.02

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 23PROB

Related questions

Question

Transcribed Image Text:14. Loan amortization and capital recovery

After Shipra got a job, the first thing she bought was a new car. She took out an amortized loan for $25,000-with no ($0) down payment. She agreed

to pay off the loan by making annual payments for the next four years at the end of each year. Her bank is charging her an interest rate of 6% per

year. Yesterday, she called to ask that you help her compute the annual payments necessary to repay her loan.

Calculate the annual payment and complete the following loan amortization table:

Year Beginning Amount

1

2

3

4

$25,000.00

Payment

Interest Paid

Principal Paid

Ending Balance

-$0.02

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning