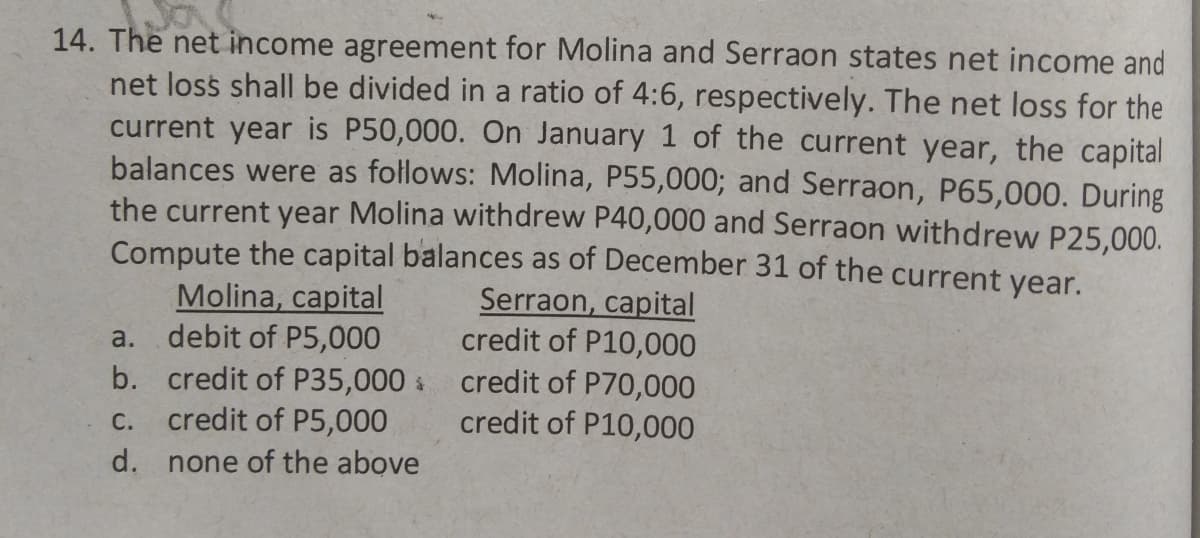

14. The net income agreement for Molina and Serraon states net income and net loss shall be divided in a ratio of 4:6, respectively. The net loss for the current year is P50,000. On January 1 of the current year, the capital balances were as follows: Molina, P55,000; and Serraon, P65,000. During the current year Molina withdrew P40,000 and Serraon withdrew P25,000. Compute the capital balances as of December 31 of the current year. Molina, capital a. debit of P5,000 b. credit of P35,000 & credit of P70,000 credit of P5,000 Serraon, capital credit of P10,000 credit of P10,000 С. d. none of the above

14. The net income agreement for Molina and Serraon states net income and net loss shall be divided in a ratio of 4:6, respectively. The net loss for the current year is P50,000. On January 1 of the current year, the capital balances were as follows: Molina, P55,000; and Serraon, P65,000. During the current year Molina withdrew P40,000 and Serraon withdrew P25,000. Compute the capital balances as of December 31 of the current year. Molina, capital a. debit of P5,000 b. credit of P35,000 & credit of P70,000 credit of P5,000 Serraon, capital credit of P10,000 credit of P10,000 С. d. none of the above

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 28P

Related questions

Question

Transcribed Image Text:14. The net income agreement for Molina and Serraon states net income and

net loss shall be divided in a ratio of 4:6, respectively. The net loss for the

current year is P50,000. On January 1 of the current year, the capital

balances were as follows: Molina, P55,000; and Serraon, P65,000. During

the current year Molina withdrew P40,000 and Serraon withdrew P25,000.

Compute the capital balances as of December 31 of the current year.

Molina, capital

debit of P5,000

Serraon, capital

credit of P10,000

a.

b. credit of P35,000 credit of P70,000

credit of P5,000

С.

credit of P10,000

d.

none of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you