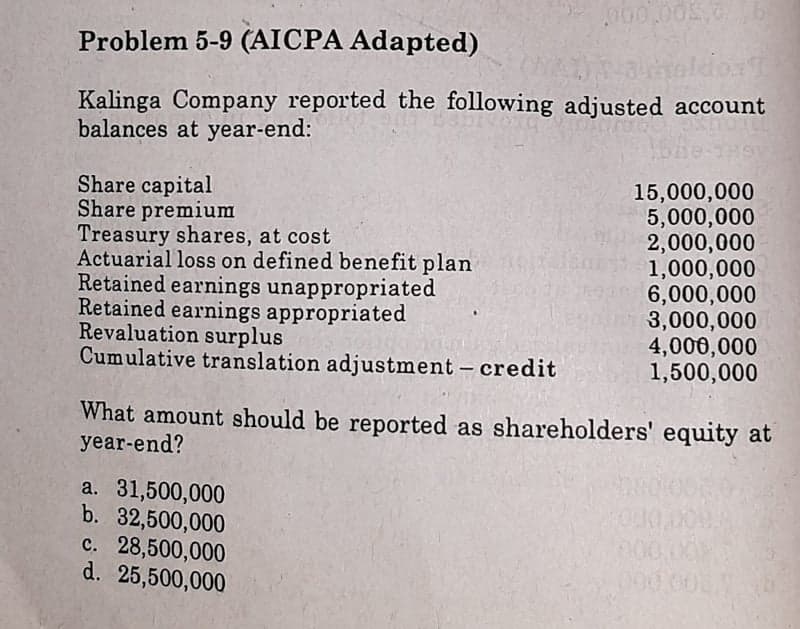

1,500,000 translation adjustment - credit What amount should be reported as shareholders' equity at year-end? a. 31,500,000 b. 32,500,000 c. 28,500,000 d. 25,500,000 00000

Q: 12/31/2018 12/31/2019 Current assets $79,000 $298,000 Current liabilities 49,000 166,000 Using the…

A: Formula: Working capital = Current Assets - current liabilities Deduction of current liabilities…

Q: 13.Surekha 's trial balance was as follows. Trial Balance for the year ended 31 March, 2008 Amt?…

A: based on the given details we submit the below trading and Profit & Loss and Balancesheet

Q: Q2. From the following particulars, you are required to calculate: (1 (d) Debt Equity Ratio (e)…

A: Proprietary ratio denotes the proportion of owner’s funds in the total capital of the firm. More…

Q: What is the shareholders' equity at year-end? a. 9,500,000 b. 8,900,000 c. 7,400,000 d. 7,500,000

A:

Q: Assets: Year 2 Year 1 Current assets $445 $280 Plant assets 680 520 Total assets $1,125…

A: Part-A Increase/(decrease) = Year 2 - Year 1 Increase/(decrease) percentage = Increase /…

Q: UE- GRADE 12. Show the solutions. Find the value. Owner's Equity Changes in year: Additional…

A: The Basic Accounting equation is Assets = Equity + Liabilities Ending Equity = Begnning Equity +…

Q: A business has $550,000 in current assets and a current ratio of 2.0. What is the balance of its…

A: A company's short-term financial commitments that are due in a year or within a typical operational…

Q: f the company’s cost of equity is 45%, Interest on Debt is OMR 10,000, market value of equity is OMR…

A: Net Operating Income approach: Under the Net Operating income approach , any change in the debt of…

Q: Question / Money 10,000,000, retained earnings 5,000,000, millions of financial reserves 4,000,000,…

A: Solution- Money 10000000 Retaining earning 5000000 financial reserves 4000000 Equity…

Q: 33. Lucerne Cómpany reported the following changes during the current year Increase Increase…

A: Income that is earned by the company after deducting all of its expenses and adding revenue is known…

Q: Liabilities P120,000 Equity, end 80,000 Revenues 250,000 290,000 Expenses 1. How much were total…

A: The fundamental accounting equation, also called the balance sheet equation, represents the…

Q: Cash 20,000 Accounts receivable 60,000 Inventory Prepaid insurance Long-term Assets Accounts payable…

A: Current Assets Amount Cash 20,000 Accounts Receivable 60,000 Inventory…

Q: The comparative accounts payable and long-term debt balances for a company follow. Current Year…

A: Formula: Amount change = Current year - Previous year.

Q: 1. What amount of accounts receivable wa 2020? a, 35,000 b. 30,000 c. 15,000 d. 10,000 2. What…

A: 1. The amount of Account Receivable written = Actual expense affecting accounts receivable -…

Q: Company A Company B Company C Company D Company E Beginning of year $ 64,080 44,215 $ 98,280 $…

A: As per accounting equation assets equal to sum of liabilities and equity. The equity gets effected…

Q: 1-Jan-20 100,000.00 800,000.00 26.00 Shs Outstanding SHE, in pesos MP per sh Div per sh Cost of…

A: Market value added: MVAs are depictions of the value produced by the management of a firm through…

Q: Equity ending 95,000 Income 120,000 Equity beginning 60,000 What is the amount of expense?

A: Equity is the total amount attributable to the owners of the business, All income is added to the…

Q: ancial Statements: Income Statement Items US$ venue 14,000 penses (A) Income 6,000 Statement of…

A: The balance sheet of the company shows the overall financial position of the company over the given…

Q: Owner's equity is OR150,000 and total liabilities are OR90,000. Total assets would be: Select one:…

A: Assets = Owner's equity + liabilities

Q: 18. Using the information in MC 17, under accrual basis, what amount should be reported as gross…

A: Accrual basis of accounting says that all expenses incurred in the particular period shoul be…

Q: Determine the missing amount from each of the separate situations a, b, and c below.

A: The Numerical has covered the Concept of Accounting Equation. The accounting equation shows that the…

Q: $175,000 $2,800 $297,000 $42,000 $7,400 $10,000 Cost of goods sold: Investment income: Net sales:…

A: Retained earnings = Net income- Dividends Gross Profit= Sales- COGS

Q: What is the firm's total change in cash from the prior year to the current year?

A: Cash: Cash is an asset that is shown in the balance sheet under current assets. Income statement: An…

Q: Assets Liabilities Shareholders' Equity ? $275,600.00 $305,600.00 a. $(30,000.00) O b. $581,200.00…

A: As per basic accounting equation, Assets = Liabilities + Equity

Q: Beginning balances: Assets Liabilities Ending Balances Assets Liabilities During the year: +Net…

A: Assets=Liabilities+Stockholder's Equity

Q: mоmmg uprаruma camештаuо The following data (in thousands) were taken from recent financial…

A: a. Calculate the working capital for year 2 and year 1

Q: Current assets and current liabilities for Brimstone Company follow: 20Υ4 20Y3 Current assets…

A: Current ratio =current assets /current liabilities Working capital =current assets - current…

Q: End of year 29,520 20,073 74,620 35,817 113,1 89,3 Assets 41,000 Liabilities 13,460 Changes during…

A: As per accounting equation, Assets = Liabilities + equity Equity = Stock issuance + income - loss -…

Q: A company's current ratio is 1.5. Its current liabilities are $150,000. What are its current assets?…

A: Current ratio = current assets / current liabilities

Q: 1- Key Statistics: (OMIT ALL ZEROS 000); if none, leave blank Income Statement (2020) Current Year…

A: The consistent financial statement helps the management to compare their financial performance with…

Q: ABFA1173 Principles of Accounting Statements of Financial Position as at 31 December. Year 1…

A: Formuale: Gross Profit Ratio=Gross ProfitSales×100 Net Profit Ratio=Net ProfitSales×100 Inventory…

Q: |48,500 Prepaid expenses Accounts and notes payable (short term) 700,000 Accumulated liabilities The…

A: Formula: Current ratio = Current Assets / Current liability

Q: Times interest earned Averill Products Inc. reported the following on the company’s income…

A: Solution:- a)Calculation of the times interest earned ratio for 20Y8 and 20Y9 as follows under:-…

Q: $800,000 $100,000 $120,000 $900,000 Net Income Assets at the beginning of the year Assets at the end…

A: Formulas to be used to solve this question: Return on Assets = Net Income / Average Net Assets…

Q: Item Prior year Current year Accounts payable 8,123.00 7,716.00 Accounts receivable 6,048.00…

A: Cash flow referred as the net value of cash and cash equivalent transferred as in and out of…

Q: Q: The following data belongs to one of the companies: -1- The net financial position in 1/1/2010…

A: Given that: Beginning net financial position = 20 dinars Closing net financial position = 2000…

Q: Times interest earned A company reports the following: Income before income tax expense $4,300,000…

A: Solution: Income before Interest and income tax expense = Income before income tax expense +…

Q: Company A Company B Company C Company D Company E Beginning of year $ 36,000 29,520 $ 28,080 19,656…

A: Solution 2c: Net income for the year depends on the change in total equity during the period and…

Q: balances and profit ratio on this date, follow Capital Bal. P 50,000 60,000 20,000 RR TT

A: The sharing of profit and loss in accordance with the profit and loss sharing ratio.it completely…

Q: 600,000 80,000 70,000 120,000 10,000 200,000 30,000 20,000 Inventories Short-term Liabilities…

A: Income statement is one of a financial statement which is used by stakeholders like, investors,…

Q: Year Net Income Cumulative (Loss) Net Income 2018 6,500,000 6,500,000 2019 400,000

A: Cumulative net income = Net income for 2018 + Net income for 2019

Q: Question 24 The selected financial statements' data of NGX Ltd. for the years ended 31 December 20x4…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. If you want…

Q: Appendix 1: Financial information Current year Previous year Turnover (£000) Net profit (£000)…

A: Growth: The turnover of the business organizations has a direct relationship with its growth i.e.…

Step by step

Solved in 2 steps

- 5. An entity provided the following data for the year ended December 1, 2019: Retained earnings unappreciated, January 1 P2 000 000 Overdepreciation of 2018 due to prior period, net of tax 400 000 Net Income 3 000 000 Retained earnings appreciated for treasury shares (original balance is P500 000 but reduced by P200 000 by reason of reissuance of the treasury shares) Retained earnings appropriated for contingencies (beginning balance P700 000 but increased by current appreciation of P100 000) Cash dividends paid to shareholders Change in accounting policy from FIFO to a average-credit, net of tax • What is the balance of unappreciated retained earnings on December 31, 2019?What should be the balances on the revaluation surplus and retained earnings after the restatement in accordance with PAS 29? Revaluation surplus – 100; Retained earnings – 400 Revaluation surplus – 350; Retained earnings – 150 Revaluation surplus – 500; Retained earnings – Zero Revaluation surplus – Zero; Retained earnings – 500Category Prior Year Current Year Accounts payable 3,147.00 5,976.00 Accounts receivable 6,925.00 8,910.00 Accruals 5,635.00 6,187.00 Additional paid in capital 19,527.00 13,950.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,974.00 18,270.00 Current portion long-term debt 500 500 Depreciation expense 975.00 976.00 Interest expense 1,278.00 1,155.00 Inventories 3,048.00 6,717.00 Long-term debt 16,569.00 22,919.00 Net fixed assets 75,968.00 73,882.00 Notes payable 4,045.00 6,584.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,870.00 34,759.00 Sales 46,360 45,347.00 Taxes 350 920 What is the firm's cash flow from operations? What is the firm's dividend payment in the current year? What is the firm's net income in the current year?

- Category Prior Year Current Year Accounts payable 3,123.00 5,969.00 Accounts receivable 6,987.00 8,940.00 Accruals 5,642.00 6,108.00 Additional paid in capital 19,885.00 13,325.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,986.00 18,120.00 Current portion long-term debt 500 500 Depreciation expense 1,035.00 988.00 Interest expense 1,290.00 1,167.00 Inventories 3,006.00 6,743.00 Long-term debt 16,856.00 22,001.00 Net fixed assets 75,521.00 74,000.00 Notes payable 4,072.00 6,540.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,244.00 34,874.00 Sales 46,360 45,055.00 Taxes 350 920 What is the firm's cash flow from financing?1. PGold Company provided the following trial balance on December 2020: Total credits amounting to P3,000,000 as follows; Bank overdraft P100,000, Accounts Payable P200,000, Accrued expenses P150,000, Ordinary share capital P1,500,000, Share premium P250,000, Retained earnings P800,000. Total debits of P3,000,000 composed the following; Accounts receivable P350,000, Inventory P600,000, Prepaid expenses P100,000, Land held for sale P1,000,000, Property, plant & equipment P950,000. Additional information: Checks amounting to 300,000 were written to vendors and recorded on December 29, 2020 resulting in a cash overdraft of P100,000. The checks were mailed on January 15, 2021. Land held for resale was sold for cash on January 31, 2021. The entity issued the financial statements on March 31, 2021. What is the total shareholders equity?1. PGold Company provided the following trial balance on December 2020: Total credits amounting to P3,000,000 as follows; Bank overdraft P100,000, Accounts Payable P200,000, Accrued expenses P150,000, Ordinary share capital P1,500,000, Share premium P250,000, Retained earnings P800,000. Total debits of P3,000,000 composed the following; Accounts receivable P350,000, Inventory P600,000, Prepaid expenses P100,000, Land held for sale P1,000,000, Property, plant & equipment P950,000. Additional information: Checks amounting to 300,000 were written to vendors and recorded on December 29, 2020 resulting in a cash overdraft of P100,000. The checks were mailed on January 15, 2021. Land held for resale was sold for cash on January 31, 2021. The entity issued the financial statements on March 31, 2021. What total amount should be reported as as current assets?

- 1. PGold Company provided the following trial balance on December 2020: Total credits amounting to P3,000,000 as follows; Bank overdraft P100,000, Accounts Payable P200,000, Accrued expenses P150,000, Ordinary share capital P1,500,000, Share premium P250,000, Retained earnings P800,000. Total debits of P3,000,000 composed the following; Accounts receivable P350,000, Inventory P600,000, Prepaid expenses P100,000, Land held for sale P1,000,000, Property, plant & equipment P950,000. Additional information: Checks amounting to 300,000 were written to vendors and recorded on December 29, 2020 resulting in a cash overdraft of P100,000. The checks were mailed on January 15, 2021. Land held for resale was sold for cash on January 31, 2021. The entity issued the financial statements on March 31, 2021. What total amount should be reported as as current liabilities?On 31 December 20X2, the balances of Argon Enterprises Inc.’s shareholders’ equity accounts were as follows (all are credit balances): Capital stock $ 303,000 Contributed surplus 5,230 Retained earnings 105,400 Currency translation differences 1,400 Mark-to-market adjustments on available for sale investments 26,700 Cash flow hedges 2,000 Actuarial gains and losses 1,400 $ 445,130 Argon’s statement of comprehensive income for the year ending 31 December 20X3 showed the following amounts, from “net profit for the year” through “comprehensive income”: 31 December 20X3 31 December 20X2 Net profit for the year $ 44,900 $ 68,300 Other comprehensive income (loss) net of applicable income tax: Currency translation differences (4,200 ) 2,800 Mark-to-market adjustments on available for sale investments (34,300 ) 8,000 Actuarial gains (losses) 2,100 (6,500 ) Cash…Profitability metrics The following selected data were taken from the financial statements of The O'Malley Group Inc. for December 31, 20Y5. 20Y4. and 20Y3: No dividends on common stock were declared between 20Y3 and 20Y5. a.Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity Tor the years 20Y4 and 20Y5. Round to one decimal place. b. What conclusions can be drawn from these data as to the company's profitability?

- Unusual income statement items Assume that the amount of each of the following items is material to the financial statements. Classify each item as either normally recurring (NR) or unusual (U) items. If unusual item, then specify if it is a discontinued operations item (DO). a. Interest revenue on notes receivable. b. Gain on sale of segment of the company's operations that manufactures bottling equipment. c.Loss on sale of investments in stocks and bonds. d. Uncollectible accounts expense. e. Uninsured flood loss. (Hood insurance is unavailable because of periodic Hooding in the area.)Urgently required answer to following: The following information related to stock investments of the Aladdin Corp at December 31, 2020 appears below. Name Cost Market Value A Corporation $35,000 $41,000 B Corporation 42,000 40,000 C Corporation 20,000 22,000 The balance in the fair value adjustment account prior to the 2020 year-end adjustment was a $2,000 debit balance. Instructions: 1. Determine the balance in the fair value adjustment account as of December 31, 2020 after adjustment 2. Prepare the adjusting journal entry at December 31, 2020 to record the unrealized gain or loss. 3. On April 15, 2021, A Corporation stock was sold for $43,000. Prepare the journal entry for the sale.Revenues and operating (marketing and administrative) expenses for the year 2021 are P7,500,000 and P4,000,000 respectively. How much is the change in Retained Earnings for the year 2021 due to the equity securities indicate whether increase or decrease?