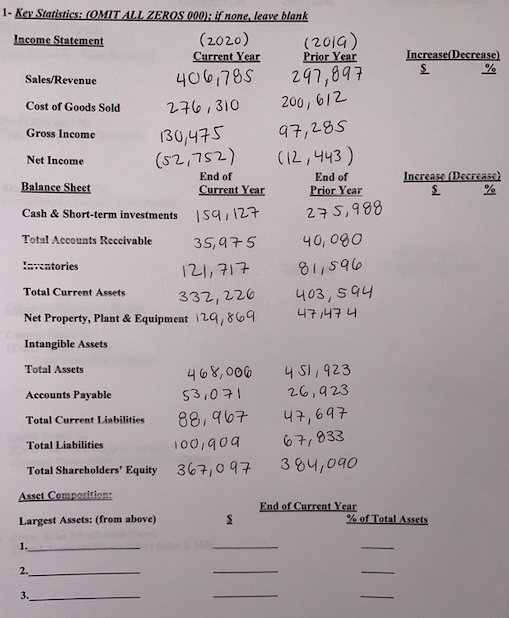

1- Key Statistics: (OMIT ALL ZEROS 000); if none, leave blank Income Statement (2020) Current Year 406,785 (201G) Prior Year Increase(Decreas. 297,897 200, 612 Sales/Revenue 2구6,310 Cost of Goods Sold Gross Income 130,475 (52,752) 97,285 (12,443) Net Income Balance Sheet End of Increass (Decrая End of Current Year Prior Year Cash & Short-term investments |s9,127 275,988 Total Accounts Reccivable 35,975 40, 090 arcatories 12, 귀구 81,596 Total Current Assets 332,226 Net Property, Plant & Equipment (29,869 403, 594 47/4구 니 Intangible Assets Total Assets 4 SI,923 26,923 ५०४,००० Accounts Payable 53,071 88,967 4구,697 Total Current Linbilities Total Liabilities 100,909 67,833 Total Shareholders' Equity 367,097 384,090 Asset Composition: End of Current Year Largest Assets: (from above) % of Total Assets 1. 2.

1- Key Statistics: (OMIT ALL ZEROS 000); if none, leave blank Income Statement (2020) Current Year 406,785 (201G) Prior Year Increase(Decreas. 297,897 200, 612 Sales/Revenue 2구6,310 Cost of Goods Sold Gross Income 130,475 (52,752) 97,285 (12,443) Net Income Balance Sheet End of Increass (Decrая End of Current Year Prior Year Cash & Short-term investments |s9,127 275,988 Total Accounts Reccivable 35,975 40, 090 arcatories 12, 귀구 81,596 Total Current Assets 332,226 Net Property, Plant & Equipment (29,869 403, 594 47/4구 니 Intangible Assets Total Assets 4 SI,923 26,923 ५०४,००० Accounts Payable 53,071 88,967 4구,697 Total Current Linbilities Total Liabilities 100,909 67,833 Total Shareholders' Equity 367,097 384,090 Asset Composition: End of Current Year Largest Assets: (from above) % of Total Assets 1. 2.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 28CE: Inventory Errors McLelland Inc. reported net income of $175,000 for 2019 and $210,000 for 2020....

Related questions

Question

Based on the information in the image, calculate the percentage+ dollar increase for each row and list the 3 largest assets, including the dollar ($) amount and percentage (%) increase.

Transcribed Image Text:1- Key Statistics: (OMIT ALL ZEROS 000: if none, leave blank

Income Statement

(2020)

Current Year

(201G)

Prior Year

Increase(Decrease)

406,785

297,897

Sales/Revenue

Cost of Goods Sold

276,310

200, 612

9구,285

(12,443)

Gross Income

130,475

(52,752)

Net Income

Balance Sheet

End of

End of

Increase (Decrease)

Current Year

Prior Year

Cash & Short-term investments

ISq,12구

275,988

Total Accounts Reccivable

35,975

40, 090

entories

121, 귀구

81,596

Total Current Assets

332,226

Net Property, Plant & Equipment i29,869

403, 594

니구/4구 니

Intangible Assets

Total Assets

4 SI, 923

26,923

468,006

Accounts Payable

53,071

88,967

47,697

Total Current Liabilities

100,90a

67,833

Total Liabilities

Total Shareholders' Equity

367,097

384,090

Asset Composition:

End of Current Year

Largest Assets: (from above)

% of Total Assets

1.

2.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,