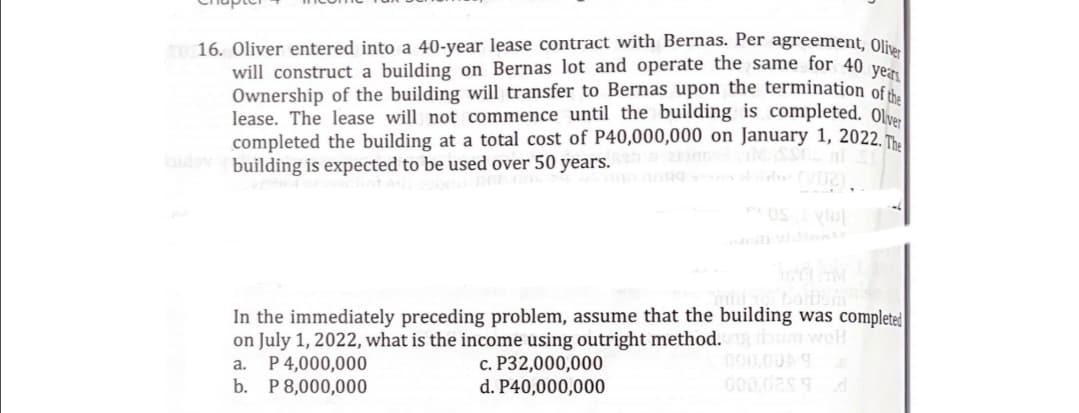

16. Oliver entered into a 40-year lease contract with Bernas. Per agreement, Oli will construct a building on Bernas lot and operate the same for 40 ver Ownership of the building will transfer to Bernas upon the termination of lease. The lease will not commence until the building is completed. 0l completed the building at a total cost of P40,000,000 on January 1, 2022. building is expected to be used over 50 years. In the immediately preceding problem, assume that the building was completed on July 1, 2022, what is the income using outright method. um welH c. P32,000,000 d. P40,000,000 a. P4,000,000 b. P8,000,000 000,00A9 000 02s9

Q: se the following information for the next five questions:On January 1, 2021, ABC Co. acquired all of...

A: solution given Number of ABC co’s share 60000 Par value per share 40 Fair value of i...

Q: You were able to gather the following from the December 31, 2020 trial balance of Should Corporation...

A: Cash and cash equivalent are shown as a line item on the balance sheet of the entity. Cash and cash ...

Q: 5. What is the overhead cost per unit produced? 6. What is the fixed overhead cost per unit? 7. What...

A: Total overhead cost refers to the cost or amount incurred by the company in production of its goods ...

Q: Explain: Understanding the intentions of accounting students to pursue career as a professional acco...

A: Answer: There are wide variety of scope for accounting field. Accounting field students have career...

Q: At the beginning of November, Yoshi Inc.'s inventory consists of 63 units with a cost per unit of $9...

A: Inventory cost refers to the price paid for the inventory in addition to any other costs that are in...

Q: On January 1, 2021, ABC Co. acquired all of the identifiable assets and assumed all of the liabiliti...

A: Goodwill = Consideration paid - fair value assets + fair value of liabilities.

Q: Give examples of differences in corporate governance in different countries ( Continental Europe &am...

A: A set of rules, policies, regulations, processes, and practices used to control, regulate, and direc...

Q: PROBLEM: MAY 1 Mr. Tan obtained the funds to start the business by withdrawing P900,000 from his per...

A: Accounting equation refers to the equation which provide basics of bookkeeping as it allows to recor...

Q: TRANSACTION SUMMARY TABLE ASSETS LIABILITIES OWNER'S EQUITY Date Transaction Cash Equpment Accounts ...

A: The accounting equation states that assets equal to sum of liabilities and equity. The equity is cal...

Q: E11-2 Recording note payable transactions [5–10 min] Record the following note payable transactions ...

A: Journal entries are the initial step of accounting cycle process, under which atleast one account is...

Q: Indicate the financial statement on which each of the following items appears: income statement, sta...

A: income statement is a statement that is prepared by the company to know the net income on by the com...

Q: Karel Inc. was assessed by the BIR for improperly accumulating profits. Karel Inc. reported the foll...

A: Answer: IAET is penalty that is 10% calculated on improperly disclosed income by any assessee. This ...

Q: company's designers have discovered a market for a new clear plastic covering with college logos for...

A: manufacturing cost is all the cost that is needed to make a product . IT include: direct material, ...

Q: The following transactions took place at the Cook Employment Agency during November 20X1. DATE TRANS...

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal....

Q: First Quarter First Quarter Second Quarter Second Quarter 25-Dec-21 25-Sep-21 25-Dec-21 25-Sep-21 26...

A: Vertical analysis is an analysis method in which each figure of the financial statement is compared ...

Q: In preparing a statement of cash flows, which of the following transactions would be considered an i...

A: solution concept cash flow statement consists of -cash flow from operating activitie...

Q: Wheels N Cogs is a small business that designs gear for a variety clients including those that produ...

A: Break even point is point of sales volume where there is no profit no loss situation. That means con...

Q: What is the amount of service department cost allocated to P1 and P2 using the direct method

A: solution concept Direct method of service cost allocation Direct method of service c...

Q: Using the pre-determined overhead rate calculated above, calculate the overhead that would be alloca...

A: >Predetermined Overhead rate is calculated at the beginning of the period to allocate the overhea...

Q: Lola Girl brought her granddaughter to Jollibee for a treat. Her granddaughter requested that they b...

A: The VAT is equivalent to a uniform rate of 12%, based on the gross selling price of goods or propert...

Q: Part A Anne York is a sole trader who started the business of buying and selling furniture in Brig...

A: Disclaimer:- “Since you have asked multiple question having multiple sub-parts we will solve the fir...

Q: What total amount should be included in the determination of the net income or loss for the six-mont...

A: Total amount P1,200,000 should be included in the determination of the net income or loss for the si...

Q: b. and d. Enter a debit balance of $840 as of September 1, 2019 in the supplies general ledger accou...

A: Ledgers - After recording transactions in the journal next step is to transfer them into ledgers. Le...

Q: Ryan Company's income statement for the year ended December 31, 2015, reported net income of P360,00...

A: The cash flow from operating activities include the cash flow from day to day or regular activities ...

Q: XYZ Co had the following accounts at the time it was acquired by ABC Inc (see image below). ABC paid...

A: Cost of acquisition means total expenses incurred by entity to acquire new business or assets. cost ...

Q: How much is the patient services revenue? How much is the operating revenue? How much is the total n...

A: Patient revenue services includes charges for direct patient care such as doctor's fees,room charges...

Q: The following information is extracted from a recent year's financial records of a company which mak...

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or str...

Q: In the Invoice Lookup, when view

A: Answer: SAGE 50 is the accounting software that is used by many business to record their day to day ...

Q: 1. Ian holds 100 shares in Big Bank Pty Ltd. The company paid a fully franked dividend of $4 per sh...

A: Solution note Dear student as per the Q&A guideline we are required to answer the first question...

Q: Required information [The following information applies to the questions displayed below.] The trans...

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is recor...

Q: Comparative financial statement data for Oriole Corporation and Pharoah Corporation, two competitors...

A: Net income refers to the earnings of the company after accounting for all the operating and non-oper...

Q: PLKO Co. factored P160,000 accounts receivable to NCD Financing Corp on a with recourse basis on Jan...

A: Factoring is the facility wherein the company sells its account receivable to third party called fac...

Q: Which is used by the government to determine eligibility for the Federal GST/HST credit payment? A T...

A: For GST/HST credit, the individual must be Canadian resident for income tax purposes. It is designed...

Q: Cheyenne Appliance Co. manufactures low-price, no-frills appliances that are in great demand for ren...

A: A journal entry is a form of accounting entry that is used to report a business transaction in a com...

Q: 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0...

A: The answer is stated below:

Q: ,420 ₹ 25,097 136% 3.51% Vendor C ₹ 41,270 ₹ 94,000 ₹ 77,720 ₹ 23,937

A: The vendor is given as,

Q: 6. ABC and XYZ Inc had the following balance sheets on December 31, 2021: (see image below) On Janua...

A: Consolidated financial statements are being prepared for combining and consolidating two entities, i...

Q: esearch articles that deal with the benefits which might be derived from the Statement of Cash Flows...

A: In accounting cash flow statement is that financial statement that shows different soucres of cash c...

Q: You are buying your first house for $220,000 and are paying $30,000 as a down payment. You have arra...

A: Answer) Calculation of monthly payment Installments are to be paid monthly Amount Borrowed $19...

Q: A local Barnes and Noble paid a $79.88 net price for each hardbound atlas. The publisher of publishe...

A:

Q: On January 1, 2021, ABC Co. acquired all of the identifiable assets and assumed all of the liabiliti...

A: SOLUTION GOODWILL = PURCHASE PRICE OF TARGET COMPANY -(FAIR MARKET VALUE OF ASSETS - FAIR MARKET VAL...

Q: Explain and provide two examples of quick assets.

A: Quick assets are those assets which can be converted into cash easily or they are already in a cash ...

Q: Centurion Company had the following accounts and balances at December 31: Account Debit Credit $ 11,...

A: Formula to calculate Net Income: Net Income = Revenue - Expenses

Q: Following are the transactions of Sustain Company. June 1 T. James, owner, invested $16,000 cash in ...

A: The practice of capturing commercial transactions for the first time in the account books is known a...

Q: If the future value of an ordinary, 7-year annuity is $6,500 and interest rates are 8.5 percent, wha...

A: Future value (FV) = $6500 Interest rate (r) = 8.5% Period (n) = 7 Years

Q: Prepare the company’s journal entries for (a) the January 1 issuance, (b) the July 1 interest paymen...

A: Effective Interest rate refers to the compounded interest rate that the bond holder actually pays as...

Q: Matthew Martin, the owner of Innovation Consulting, started the business by investing $58,000 cash. ...

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal....

Q: UBERCRUMMIE & FRITCH CO. CONSOLIDATED BALANCE SHEETS Formulas/Links Common Size Analysis Trend Analy...

A: Trend analysis is that financial statement analysis, under which increase or decrease is calculated ...

Q: Q 8: King Kong Limited acquired a piece of land for setting up a factory for Rs. 15 million on 1st O...

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: Walton Manufacturing started in Year 2 with the following account balances. Cash $ 5,800 Com...

A: Income statement: It is the statement showing the income earned and expenses incurred during the per...

Step by step

Solved in 2 steps

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Caswell Company signs a 10-year cancelable (at the option of either party) agreement to lease a storage building from Wake Company. The following information pertains to this lease agreement: 1. The agreement requires rental payments of 100,000 at the beginning of each year. 2. The cost and fair value of the building on January 1, 2019, is 2 million. The storage building has not been specialized for Caswell. 3. The building has an estimated economic life of 50 years, with no residual value. Caswell depreciates similar buildings according to the straight-line method. 4. The lease does not contain a renewable option clause. At the termination of the lease, the building reverts to the lessor. 5. Caswells incremental borrowing rate is 14% per year. Wake set the annual rental to ensure a 16% rate of return (the loss in service value anticipated for the term of the lease). Caswell knows the implicit interest rate. 6. Executory costs of 7,000 annually, related to taxes on the property, are paid by Caswell directly to the taxing authority on Dec. 31 of each year. Required: 1. Determine what type of lease this is for the lessee. 2. Prepare appropriate journal entries on the lessees books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease for the years 2019 and 2020.Lessee and Lessor Accounting Issues Diego Leasing Company agrees to provide La Jolla Company with equipment under a noncancelable lease for 5 years. The equipment has a 5-year life, cost Diego 25,000, and will have no residual value when the lease term ends. The fair value of the equipment is 30,000. La Jolla agrees to pay all executory costs (500 per year) throughout the lease period directly to a third party. On January 1, 2019, the equipment is delivered. Diego expects a 14% return on its net investment. The five equal annual rents are payable in advance starting January 1, 2019. Required: 1. Assuming this is a sales-type lease for the Diego and a finance lease for the La Jolla, prepare a table summarizing the lease and interest payments suitable for use by either party. 2. Next Level On the assumption that both companies adjust and close books each December 31, prepare journal entries relating to the lease for both companies through December 31, 2020, based on data derived in the table. Assume that La Jolla depreciates similar equipment by the straight line methodComprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.

- Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.

- Use the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would make in the first year of the lease assuming the lease is classified as a sales-type lease. Assume that the lessee is required to make payments on December 31 each year. Also assume that Richie had purchased the equipment at a cost of 200,000.Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.

- Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.Lease Income and Expense Reuben Company retires a machine from active use on January 2, 2019, for the express purpose of leasing it. The machine had a carrying value of 900,000 after 12 years of use and is expected to have 10 more years of economic life. The machine is depreciated on a straight-line basis. On March 2, 2019, Reuben leases the machine to Owens Company for 180,000 a year for a 5-year period ending February 28, 2024. Under the provisions of the lease, Reuben incurs total maintenance and other related costs of 20,000 for the year ended December 31, 2019. Owens pays 180,000 to Reuben on March 2, 2019. The lease was properly classified as an operating lease. Required: 1. Compute the income before income taxes derived by Reuben from this lease for the calendar year ended December 31, 2019. 2. Compute the amount of rent expense incurred by Owens from this lease for the calendar year ended December 31, 2019.Use the information in RE20-3. Prepare the journal entries that Garvey Company would make in the first year of the lease assuming the lease is classified as a finance lease. However, assume that Garvey is now required to make the 65,949.37 payments on January 1 each year and that the fair value at the lease inception is now 275,000 (65,949:37 4:169865).