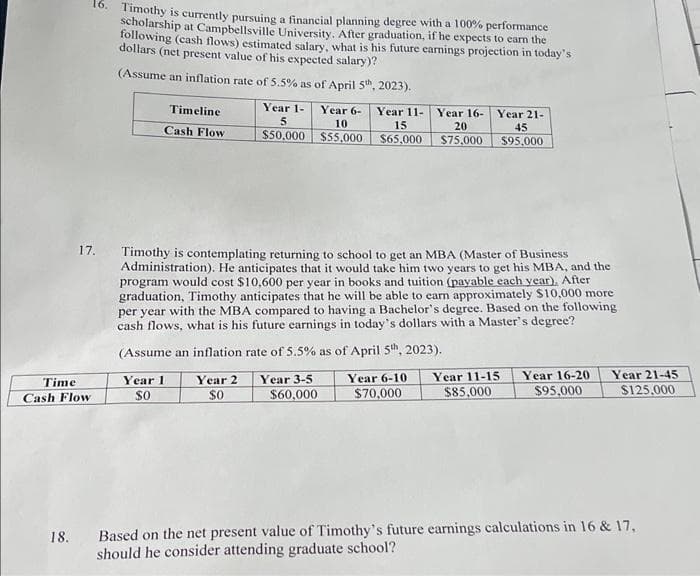

16. Timothy is currently pursuing a financial planning degree with a 100% performance scholarship at Campbellsville University. After graduation, if he expects to earn the following (cash flows) estimated salary, what is his future earnings projection in today's dollars (net present value of his expected salary)? (Assume an inflation rate of 5.5% as of April 5th, 2023). 18. Time Cash Flow Timeline Cash Flow Year 1 $0 17. Timothy is contemplating returning to school to get an MBA (Master of Business Administration). He anticipates that it would take him two years to get his MBA, and the program would cost $10,600 per year in books and tuition (payable each year). After graduation, Timothy anticipates that he will be able to earn approximately $10,000 more per year with the MBA compared to having a Bachelor's degree. Based on the following cash flows, what is his future earnings in today's dollars with a Master's degree? (Assume an inflation rate of 5.5% as of April 5th, 2023). Year 1- 5 $50,000 Year 2 $0 Year 6- 10 Year 11- Year 16- Year 21- 15 20 45 $55,000 $65,000 $75,000 $95,000 Year 3-5 $60,000 Year 6-10 $70,000 Year 11-15 $85,000 Year 16-20 $95,000 Year 21-45 $125,000 Based on the net present value of Timothy's future earnings calculations in 16 & 17, should he consider attending graduate school?

16. Timothy is currently pursuing a financial planning degree with a 100% performance scholarship at Campbellsville University. After graduation, if he expects to earn the following (cash flows) estimated salary, what is his future earnings projection in today's dollars (net present value of his expected salary)? (Assume an inflation rate of 5.5% as of April 5th, 2023). 18. Time Cash Flow Timeline Cash Flow Year 1 $0 17. Timothy is contemplating returning to school to get an MBA (Master of Business Administration). He anticipates that it would take him two years to get his MBA, and the program would cost $10,600 per year in books and tuition (payable each year). After graduation, Timothy anticipates that he will be able to earn approximately $10,000 more per year with the MBA compared to having a Bachelor's degree. Based on the following cash flows, what is his future earnings in today's dollars with a Master's degree? (Assume an inflation rate of 5.5% as of April 5th, 2023). Year 1- 5 $50,000 Year 2 $0 Year 6- 10 Year 11- Year 16- Year 21- 15 20 45 $55,000 $65,000 $75,000 $95,000 Year 3-5 $60,000 Year 6-10 $70,000 Year 11-15 $85,000 Year 16-20 $95,000 Year 21-45 $125,000 Based on the net present value of Timothy's future earnings calculations in 16 & 17, should he consider attending graduate school?

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter22: Inflation

Section: Chapter Questions

Problem 37P: Rosalie the Retiree knows that when she retires in 16 years, her company will give her a one-time...

Related questions

Question

Transcribed Image Text:Time

Cash Flow

18.

16. Timothy is currently pursuing a financial planning degree with a 100% performance

scholarship at Campbellsville University. After graduation, if he expects to earn the

following (cash flows) estimated salary, what is his future earnings projection in today's

dollars (net present value of his expected salary)?

(Assume an inflation rate of 5.5% as of April 5th, 2023).

Timeline

Cash Flow

Year 1

$0

Year 1-

5

Year 6-

10

$50,000 $55,000

17. Timothy is contemplating returning to school to get an MBA (Master of Business

Administration). He anticipates that it would take him two years to get his MBA, and the

program would cost $10,600 per year in books and tuition (payable each year). After

graduation, Timothy anticipates that he will be able to earn approximately $10,000 more

per year with the MBA compared to having a Bachelor's degree. Based on the following

cash flows, what is his future earnings in today's dollars with a Master's degree?

(Assume an inflation rate of 5.5% as of April 5th, 2023).

Year 2

$0

Year 11-

15

20

$65,000 $75,000

Year 3-5

$60,000

Year 16- Year 21-

45

$95,000

Year 6-10 Year 11-15 Year 16-20.

$70,000 $85,000 $95.000

Year 21-45

$125,000

Based on the net present value of Timothy's future earnings calculations in 16 & 17,

should he consider attending graduate school?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax