17. Statement 1: Unexpended balance of petty cash and change fund are considered as "cash on hand" Statement 2: Consigned foods although these are within the premise of our business are excluded in the physical inventory count. a. Both statements are true b. Only Statement 1 is true c. Only Statement 2 is true d. Both statements are false

17. Statement 1: Unexpended balance of petty cash and change fund are considered as "cash on hand" Statement 2: Consigned foods although these are within the premise of our business are excluded in the physical inventory count. a. Both statements are true b. Only Statement 1 is true c. Only Statement 2 is true d. Both statements are false

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter10: Auditing Cash, Marketable Securities, And Complex Financial Instruments

Section: Chapter Questions

Problem 6RQSC

Related questions

Question

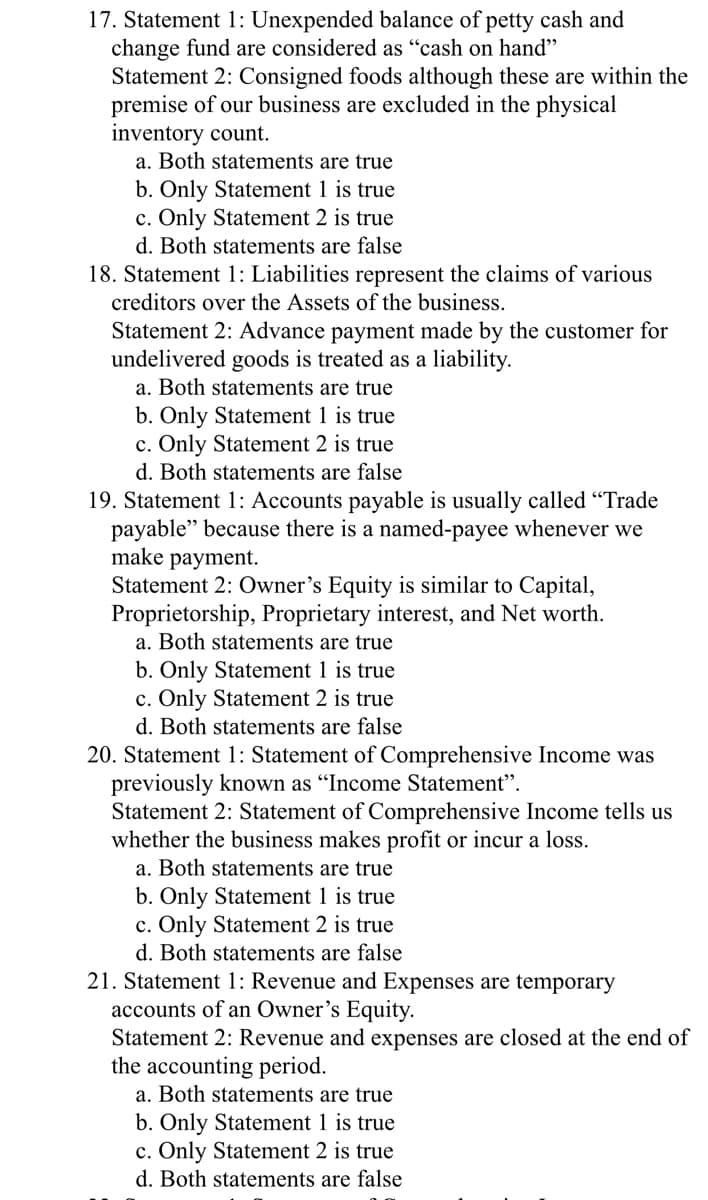

Transcribed Image Text:17. Statement 1: Unexpended balance of petty cash and

change fund are considered as "cash on hand"

Statement 2: Consigned foods although these are within the

premise of our business are excluded in the physical

inventory count.

a. Both statements are true

b. Only Statement 1 is true

c. Only Statement 2 is true

d. Both statements are false

18. Statement 1: Liabilities represent the claims of various

creditors over the Assets of the business.

Statement 2: Advance payment made by the customer for

undelivered goods is treated as a liability.

a. Both statements are true

b. Only Statement 1 is true

c. Only Statement 2 is true

d. Both statements are false

19. Statement 1: Accounts payable is usually called "Trade

payable" because there is a named-payee whenever we

make payment.

Statement 2: Owner's Equity is similar to Capital,

Proprietorship, Proprietary interest, and Net worth.

a. Both statements are true

b. Only Statement 1 is true

c. Only Statement 2 is true

d. Both statements are false

20. Statement 1: Statement of Comprehensive Income was

previously known as "Income Statement".

Statement 2: Statement of Comprehensive Income tells us

whether the business makes profit or incur a loss.

a. Both statements are true

b. Only Statement 1 is true

c. Only Statement 2 is true

d. Both statements are false

21. Statement 1: Revenue and Expenses are temporary

accounts of an Owner's Equity.

Statement 2: Revenue and expenses are closed at the end of

the accounting period.

a. Both statements are true

b. Only Statement 1 is true

c. Only Statement 2 is true

d. Both statements are false

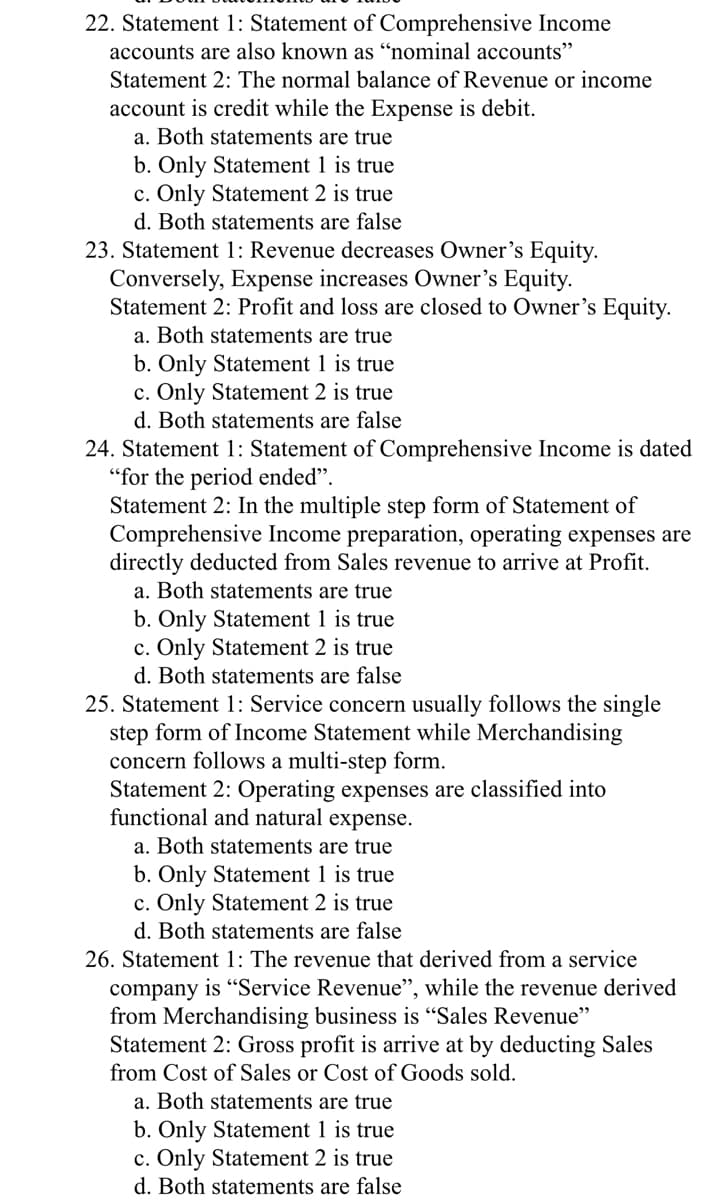

Transcribed Image Text:22. Statement 1: Statement of Comprehensive Income

accounts are also known as “nominal accounts"

Statement 2: The normal balance of Revenue or income

account is credit while the Expense is debit.

a. Both statements are true

b. Only Statement 1 is true

c. Only Statement 2 is true

d. Both statements are false

23. Statement 1: Revenue decreases Owner's Equity.

Conversely, Expense increases Owner's Equity.

Statement 2: Profit and loss are closed to Owner's Equity.

a. Both statements are true

b. Only Statement 1 is true

c. Only Statement 2 is true

d. Both statements are false

24. Statement 1: Statement of Comprehensive Income is dated

"for the period ended".

Statement 2: In the multiple step form of Statement of

Comprehensive Income preparation, operating expenses are

directly deducted from Sales revenue to arrive at Profit.

a. Both statements are true

b. Only Statement 1 is true

c. Only Statement 2 is true

d. Both statements are false

25. Statement 1: Service concern usually follows the single

step form of Income Statement while Merchandising

concern follows a multi-step form.

Statement 2: Operating expenses are classified into

functional and natural expense.

a. Both statements are true

b. Only Statement 1 is true

c. Only Statement 2 is true

d. Both statements are false

26. Statement 1: The revenue that derived from a service

company is “Service Revenue", while the revenue derived

from Merchandising business is "Sales Revenue"

Statement 2: Gross profit is arrive at by deducting Sales

from Cost of Sales or Cost of Goods sold.

a. Both statements are true

b. Only Statement 1 is true

c. Only Statement 2 is true

d. Both statements are false

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning