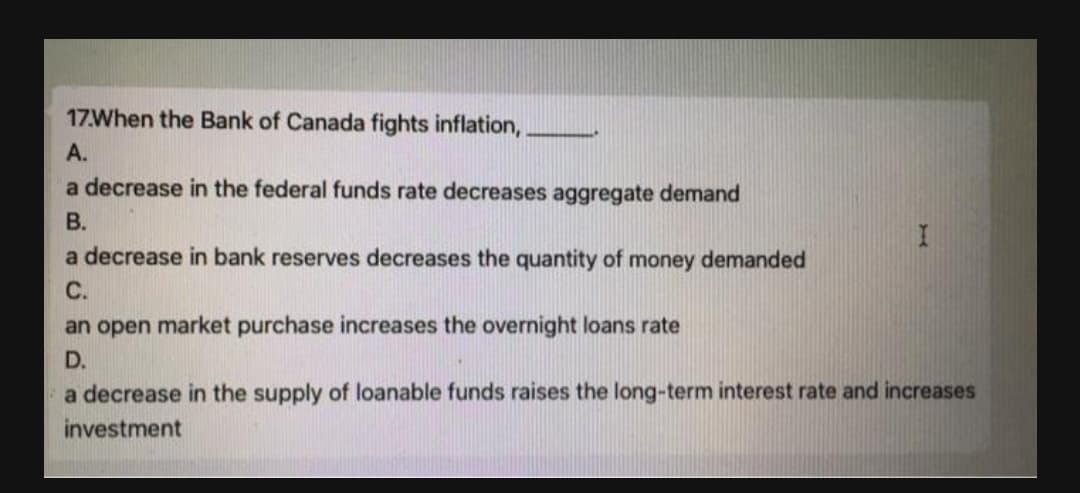

17.When the Bank of Canada fights inflation,. А. a decrease in the federal funds rate decreases aggregate demand В. a decrease in bank reserves decreases the quantity of money demanded С. an open market purchase increases the overnight loans rate D. a decrease in the supply of loanable funds raises the long-term interest rate and increases investment

Q: 34. In an economy, the money supply growth rate is 5.0%, the equilibrium real interest rate is 1.5%,…

A: Taylor rule: It refers to the rate that is used by the federal reserve to set the interest rate.…

Q: 1) List any two (2) characteristic of money. 2) State any two (2) reasons why e-monies are…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Discuss whether there is a liquidity trap in Turkey with 14% policy rate while inflation rate is…

A: Liquidity Trap A liquidity trap is an economic condition in which rates of interest are extremely…

Q: Assume a country’s inflation level is considered too high, and unemployment levels too low–Banks…

A: (Since you have a posted a question with multiple sub-parts, we will solve the first three sub-part…

Q: 1. Explain the tools of Monetary Policy. With a table and example. 2. if Reserve ratio is 10 %…

A: Disclaimer :- as you posted multipart questions we are supposed to solve the first 3 questions only…

Q: 39. How can the monetary aggregate L be represented? 1. MO + checking deposits + demand deposits 2.…

A: The money supply is the total supply of currency and liquid instruments available in the country on…

Q: 12. what factors motivate the central bank to require tge two selected Dls to hold minimum amounys…

A: Central bank The Central bank is considered an Apex body in a banking system of a country. Central…

Q: Section A Answer the following question. a) Assume that a country is suffering from rising inflation…

A: Answer a. The government can impact the level of economic activity by adopting proper monetary…

Q: Assume that this country's Real GDP is already at the Potential GDP level an the Central Bank wants…

A: Answer: If the fiscal deficit falls it means the demand for loanable funds by govt will decrease and…

Q: If C = 5 + 0.6Y, I = 4 – 0.2 r, G = 5, T = 6, X = 10 dan M = 10 + 0.3 Y, Ms = 20, Mdt = 0.1 Y and…

A: Given; Consumption Function; C= 5+0.6YInvestment function; I=4-0.2rGovernment expenditure; G=5Taxes;…

Q: Question 6. Assume that the demand for real money balance (M/P) is M/P = 0.6Y- 100i, where Y is…

A: Answer: Given, Equation of real money balances: MP=0.0Y-100iWhere,Y=national incomei=nominal…

Q: ie legal reserve ratio is 20 percent. Suppose that the Fed sells $500 of government securities to…

A: 20*500/100=100

Q: Recall the Application about the Fed's response to the collapse of the investment house Bear Steams…

A: Monetary policy is the policy taken by the central authority to control the nation's money…

Q: 17. When a Central Bank buys government bonds from banks, this is a. restrictive monetary policy b.…

A: Given: Suppose the central bank buys government bonds from the banks. Monetary policy and Fiscal…

Q: 6. Assume that the demand for real money balance (M/P) is M/P = 0.6Y- 100i, where Y is national…

A:

Q: 5. An economy is facing the recessionary gap shown in the accompanying diagram. To eliminate the…

A: The economy is said to be in its long-run equilibrium position at a point where all the three curves…

Q: Europe. 2. There are two channels through which the US crisis became a world crisis. The trade…

A: The most significant source of labor market distortion is the possibility for wage and unemployment…

Q: Banks Ordered to Hold More Capital U.K. banks must hold more capital as their holdings of consumer…

A: If a bank wants to expand its base of capital, it could do so through retaining of profits or…

Q: Explain each of these statements supported by reasonable reasoning: a) The effect of reducing…

A: In an economy, lot of things are important for the smooth functioning of the economy. For example…

Q: 2. Suppose an oil field is discovered, which curve(s) in the AD-AS graph will shift to which…

A: The AD-AS or total interest total stockpile model is a macroeconomic model that makes sense of value…

Q: Assume that the Saudi economy is in a recession and SAMA decides to implement an expansionary…

A: The monetary policies are those policies which are enacted by the central bank of a country to…

Q: In the Country A, the velocity of money is constant. The growth rate of real GDP is by 6% per year,…

A: According to Fisher's quantity theory of money, there is a direct relationship between the quantity…

Q: With the help of theory of liquidity preference describe, ‘why an increase in the money supply…

A: The theory of liquidity preference states that people demand money in order to remain liquid and…

Q: Japan's money supply is growing rapidly at a 5.54% while real GDP is increasing at 8.29%. Japan's…

A: The term "inflation rate" is defined as a rise in the economy's general price level. The nominal…

Q: Higher rates of inflation Select one: a. have no effect on real marginal tax rates, and no…

A: DISCLAIMER “Since you have asked multiple question, we will solve the first question for you as per…

Q: About the positive effects on investment About the autonomous spending multiplier The ratio of…

A: 1) The simple accelerator model is related to the effect of the change in output on the level of…

Q: 5. An economy is facing the recessionary gap shown in the accompanying diagram. To eliminate the…

A: The economy is said to be in its long-run equilibrium position at a point where all the three curves…

Q: Consumers would buy more cars, houses and other "big ticket" items that are usually bought "on…

A: DISCLAIMER “Since you have asked multiple question, we will solve the first question for you. If…

Q: John has nominal wealth of $100,000. He wants to invest his wealth in money (a chequing account) and…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: During the third quarter of 1997, Japanese GDP was falling at an annual rate of over 11 percent.…

A: The actions by the monetary authorities/government to either expand or tighten the economy in terms…

Q: Describe the outcomes. Monetary Policy Action Question output is $70 billion. M = 10 billion %3D V =…

A: Since we only answer upto 3 subparts, we will answer a, b and c only. Please resubmit the question…

Q: instructions: tackle question b only A. Given that in an economy, Given that in an economy, C =…

A: Answer: (B) Note: in the given question the import and export function has been interchanged so I…

Q: (a) Suppose the government of a country has run large budget deficits for several years in attempt…

A: When government raises its budget deficit in order to increase output, it leads to a rise in the…

Q: The demand for money is given by Md = $Y (0.3-i), where $Y = 120 and the supply of money is $30.…

A: Money market The quantity of financial assets that individuals seek to hold in the form of money is…

Q: State whether each statement below is TRUE or FALSE. Briefly explain each answer. a. If Canadian…

A: Since you have asked a question with multiple subparts, we will solve first three subparts for you…

Q: Problem Four Consider an increase in monetary policy rate from 14.5 to 16%. a) What type of monetary…

A: Here, it is given that the monetary policy rate is increased from 14.5% to 16%. It is the overnight…

Q: Question: Suppose that a central bank pursues expansionary monetary policy by purchasing bonds.…

A: Expansionary monetary policy is used to increase the supply of money. Under the expansionary…

Q: H6. How can the loan decisions of individuals and private bankers contribute to the instability in…

A: PLEASE FIND THE ANSWER BELOW. MACRO-ECONOMY: Macroeconomics is the branch of economics that deals…

Q: a. Suppose growth rate of Real GDP is 6% and the growth rate of velocity is 3%. If Bangladesh Bank…

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Step by step

Solved in 2 steps

- 4. When nominal interest rates are zero, the central bank can still lower them by printing moneyand purchasing bonds from banks. This increases the supply of loanable funds and stimulateslending.5. A pro-savings policy by the US would likely reduce the US trade deficit.6. When savings equals investment, reducing savings and increasing consumption is especiallyeffective in stimulating output.12 Assume that the Saudi economy is in a recession and SAMA decides to implement an expansionary monetary policy. Use appropriately labeled graphs to trace the impact of an expansionary monetary policy on the: the money market, market for loanable funds aggregate goods marketWhich of these is True? O. The world credit-money supply was hugely contracted before the crash, which is why homes were so expensive O. Central Banks create 'Base Money O. Central Banks create all the money supply O. The collapse of hte dollar is the reason the US housing market was flooded with loanable funds O. Central Banks promoted speculation (perhaps unwittingly with their tight money policy in the years of the pre 2008 bubble O. Private banks only pass on deposits when they make loans 8. Private banks create money. O. True O. False

- true/false explain 4. When nominal interest rates are zero, the central bank can still lower them by printing money and purchasing bonds from banks. This increases the supply of loanable funds and stimulates lending.According to the theory of liquidity preference, aneconomy’s interest rate adjustsa. to balance the supply and demand for loanablefunds.b. to balance the supply and demand for money.c. one-for-one to changes in expected inflation.d. to equal the interest rate prevailing in worldfinancial markets.instructions: tackle question b only A. Given that in an economy, Given that in an economy, C = 102+0.7Y, I=150-100r, MS =300, Mt = 0.4Y, and Mz=125-200r where, Y= income, C= consumption, I= investment, MS= money supply, Mt= transactional-precautionary money demand, Mz= speculative money demand and r= interest rate. Calculate;1. The equilibrium level of income and interest rate in this economy.2. The level of C, I, Mt, and Mz when the economy is in equilibrium. B. Now, assuming the economy is open with government (G) participation and external trade which is summarized as follows; export(X)= 100-0.10Y, import(M)=50, G=100, Taxes(T)= 100 and C, I, MS, Mt, and Mz the same as defined in (a) above. Calculate; i. The equilibrium income and interest rate in this new economy. ii. The level of C, I, Mt, and Mz when the economy is in equilibrium iii. What exchange rate policy should government implement in (iii) to enhance income and why?

- 1. Labor market rigidities and explain how they might cause the relatively high unemployment inEurope.2. There are two channels through which the US crisis became a world crisis. The trade channel and the financial channel.3. The multiplier illustrates the extent to which equilibrium output will change as a result of agiven change in autonomous demand. 4. Bonds are considered as assets for a central bank but for a bank as well. Explain the statements whether T/F elaborately...State whether each statement below is TRUE or FALSE. Briefly explain each answer. a. If Canadian assets become less liquid compared to European assets, Canadian dollar will depreciate. b. Suppose the economy is currently experiencing an inflationary gap, an autonomous monetary policy easing will bring RGDP back to its natural rate. c. Holding everything else constant, if stocks become riskier compared to bonds, interest rate will increase? d. Everything else held constant, suppose the economy is currently producing at the natural rate of output, increase in interest rate, in the short-run, decreases inflation rate and increases unemployment rate.If the U.S. government's budget deficits are increasing aggregate demand, and the economy is producing at a level that is substantially less than potential GDP, then: a) government borrowing is likely to crowd out private investment. b) an inflationary increase in the price level is in real danger. c) the central bank might react with an expansionary monetary policy. d) higher interest rates will crowd out private investment.

- In an economy where the central bank implements negative interest rates as a monetary policy tool, what is the most likely short-term impact on consumer savings behavior and bank profitability? A. An increase in consumer savings as people seek to safeguard their money and a rise in bank profitability due to increased lending. B. A decrease in consumer savings as the incentive to save diminishes and a decrease in bank profitability due to lower interest margins. C. No significant change in consumer savings behavior but an improvement in bank profitability due to lower borrowing costs. D. A shift in consumer investment towards riskier assets and challenges in bank profitability due to compressed interest margins. Please don't use chatgpt it is giving wrong answer and please provide valuable answerAs a result of the central bank’s open-market purchase of bonds, what is the dollar value of the maximum amount of new loans JMH Bank can make? Explain.If C = 5 + 0.6Y, I = 4 – 0.2 r, G = 5, T = 6, X = 10 dan M = 10 + 0.3 Y, Ms = 20, Mdt = 0.1 Y and Mds = 5 – 0.1 r where C is consumption expenditure, Y is income, I is investment, G is government expenditure, T is tax, X is export, M is import, Ms is money supply, Mdt is money demand for transactian and Mds money demand for speculation. Form the IS curve for the economy above.