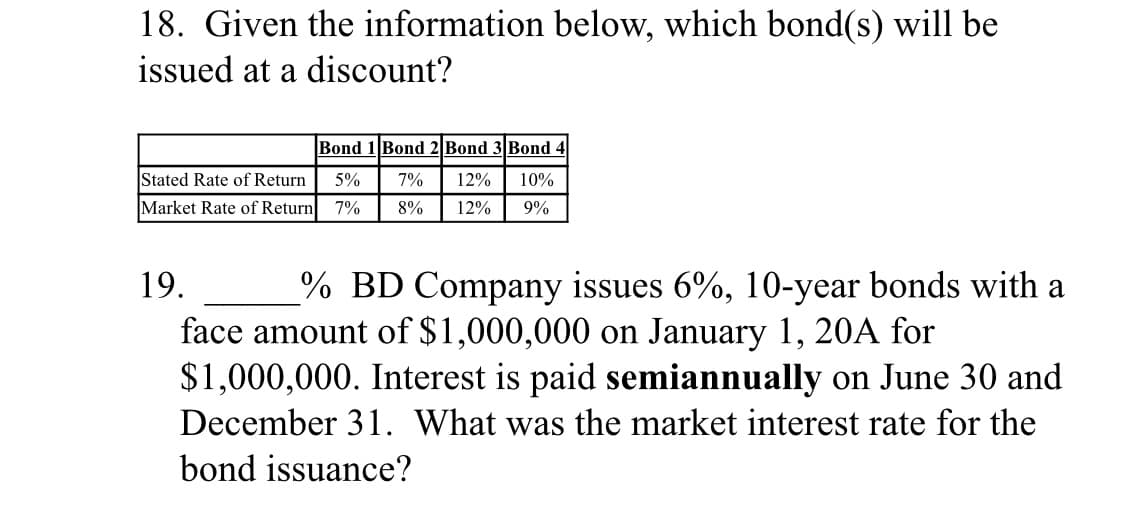

18. Given the information below, which bond(s) will be issued at a discount? Bond 1 Bond 2 Bond 3 Bond 4 Stated Rate of Return 5% 7% 12% 10% Market Rate of Return 7% 8% 12% 9% 19. % BD Company issues 6%, 10-year bonds with a face amount of $1,000,000 on January 1, 20A for $1,000,000. Interest is paid semiannually on June 30 and December 31. What was the market interest rate for the bond issuance?

18. Given the information below, which bond(s) will be issued at a discount? Bond 1 Bond 2 Bond 3 Bond 4 Stated Rate of Return 5% 7% 12% 10% Market Rate of Return 7% 8% 12% 9% 19. % BD Company issues 6%, 10-year bonds with a face amount of $1,000,000 on January 1, 20A for $1,000,000. Interest is paid semiannually on June 30 and December 31. What was the market interest rate for the bond issuance?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.3E: Issue Price The following terms relate to independent bond issues: 500 bonds; $1,000 face value; 8%...

Related questions

Question

What the answer for question 18 and 19?

Transcribed Image Text:18. Given the information below, which bond(s) will be

issued at a discount?

Bond 1 Bond 2 Bond 3 Bond 4

Stated Rate of Return

5%

7%

12%

10%

Market Rate of Return 7%

8%

12%

9%

19.

% BD Company issues 6%, 10-year bonds with a

face amount of $1,000,000 on January 1, 20A for

$1,000,000. Interest is paid semiannually on June 30 and

December 31. What was the market interest rate for the

bond issuance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,