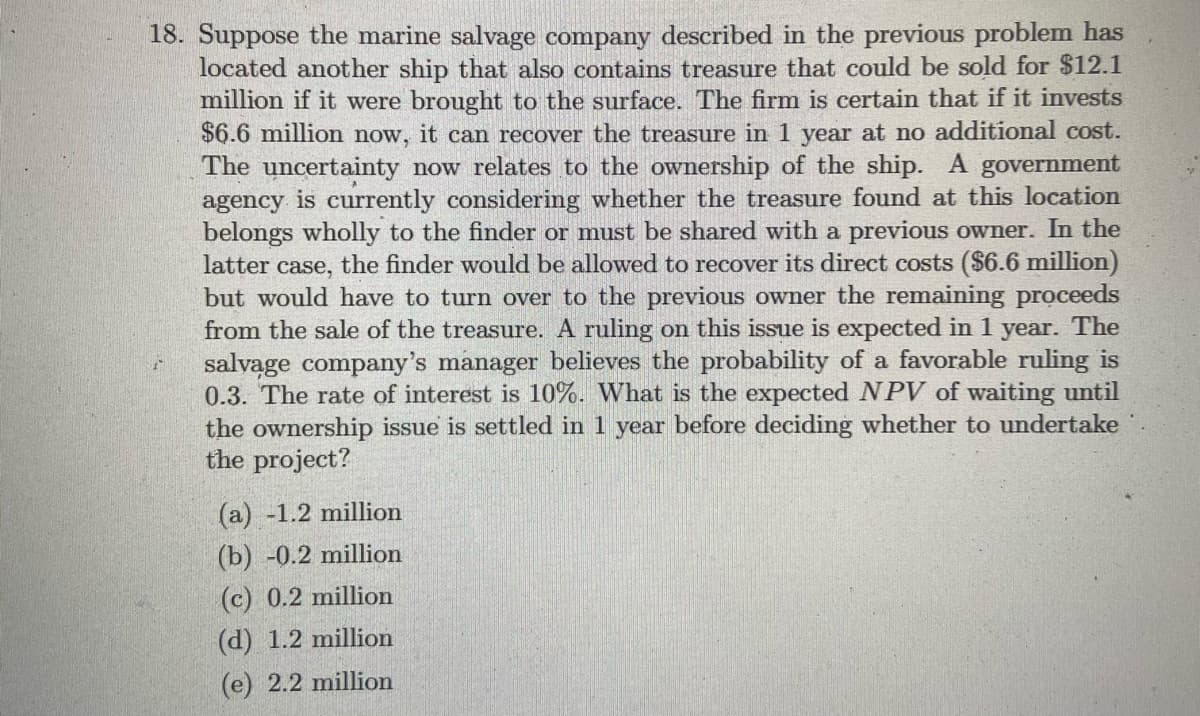

18. Suppose the marine salvage company described in the previous problem has located another ship that also contains treasure that could be sold for $12.1 million if it were brought to the surface. The firm is certain that if it invests $6.6 million now, it can recover the treasure in 1 year at no additional cost. The uncertainty now relates to the ownership of the ship. A government agency is currently considering whether the treasure found at this location belongs wholly to the finder or must be shared with a previous owner. In the latter case, the finder would be allowed to recover its direct costs ($6.6 million) but would have to turn over to the previous owner the remaining proceeds from the sale of the treasure. A ruling on this issue is expected in 1 year. The salvąge company's manager believes the probability of a favorable ruling is 0.3. The rate of interest is 10%. What is the expected NPV of waiting until the ownership issue is settled in 1 year before deciding whether to undertake the project? (a) -1.2 million (b) -0.2 million (c) 0.2 million (d) 1.2 million (e) 2.2 million

18. Suppose the marine salvage company described in the previous problem has located another ship that also contains treasure that could be sold for $12.1 million if it were brought to the surface. The firm is certain that if it invests $6.6 million now, it can recover the treasure in 1 year at no additional cost. The uncertainty now relates to the ownership of the ship. A government agency is currently considering whether the treasure found at this location belongs wholly to the finder or must be shared with a previous owner. In the latter case, the finder would be allowed to recover its direct costs ($6.6 million) but would have to turn over to the previous owner the remaining proceeds from the sale of the treasure. A ruling on this issue is expected in 1 year. The salvąge company's manager believes the probability of a favorable ruling is 0.3. The rate of interest is 10%. What is the expected NPV of waiting until the ownership issue is settled in 1 year before deciding whether to undertake the project? (a) -1.2 million (b) -0.2 million (c) 0.2 million (d) 1.2 million (e) 2.2 million

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 12P: After discovering a new gold vein in the Colorado mountains, CTC Mining Corporation must decide...

Related questions

Question

Transcribed Image Text:18. Suppose the marine salvage company described in the previous problem has

located another ship that also contains treasure that could be sold for $12.1

million if it were brought to the surface. The firm is certain that if it invests

$6.6 million now, it can recover the treasure in 1 year at no additional cost.

The uncertainty now relates to the ownership of the ship. A government

agency is currently considering whether the treasure found at this location

belongs wholly to the finder or must be shared with a previous owner. In the

latter case, the finder would be allowed to recover its direct costs ($6.6 million)

but would have to turn over to the previous owner the remaining proceeds

from the sale of the treasure. A ruling on this issue is expected in 1

salvąge company's manager believes the probability of a favorable ruling is

0.3. The rate of interest is 10%. What is the expected NPV of waiting until

the ownership issue is settled in 1 year before deciding whether to undertake

the project?

year.

The

(a) -1.2 million

(b) -0.2 million

(c) 0.2 million

(d) 1.2 million

(e) 2.2 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning