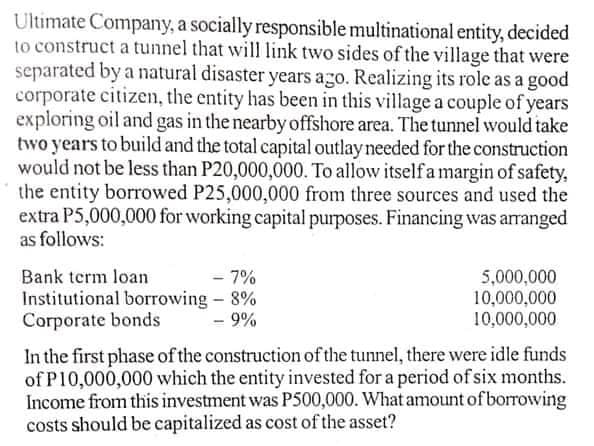

Ultimate Company, a socially responsible multinational entity, decided to construct a tunnel that will link two sides of the village that were separated by a natural disaster years ago. Realizing its role as a good corporate citizen, the entity has been in this village a couple of years exploring oil and gas in the nearby offshore area. The tunnel would take two years to build and the total capital outlay needed for the construction would not be less than P20,000,000. To allow itselfa margin of safety, the entity borrowed P25,000,000 from three sources and used the extra P5,000,000 for working capital purposes. Financing was arranged as follows: - 7% Bank term loan Institutional borrowing - 8% Corporate bonds 5,000,000 10,000,000 10,000,000 - 9% In the first phase of the construction of the tunnel, there were idle funds of P10,000,000 which the entity invested for a period of six months. Income from this investment was P500,000. What amount of borrowing costs should be capitalized as cost of the asset?

Ultimate Company, a socially responsible multinational entity, decided to construct a tunnel that will link two sides of the village that were separated by a natural disaster years ago. Realizing its role as a good corporate citizen, the entity has been in this village a couple of years exploring oil and gas in the nearby offshore area. The tunnel would take two years to build and the total capital outlay needed for the construction would not be less than P20,000,000. To allow itselfa margin of safety, the entity borrowed P25,000,000 from three sources and used the extra P5,000,000 for working capital purposes. Financing was arranged as follows: - 7% Bank term loan Institutional borrowing - 8% Corporate bonds 5,000,000 10,000,000 10,000,000 - 9% In the first phase of the construction of the tunnel, there were idle funds of P10,000,000 which the entity invested for a period of six months. Income from this investment was P500,000. What amount of borrowing costs should be capitalized as cost of the asset?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 12P: After discovering a new gold vein in the Colorado mountains, CTC Mining Corporation must decide...

Related questions

Question

PLEASE ANSWER IMMEDIATELY

Transcribed Image Text:Ultimate Company, a socially responsible multinational entity, decided

to construct a tunnel that will link two sides of the village that were

separated by a natural disaster years ago. Realizing its role as a good

corporate citizen, the entity has been in this village a couple of years

exploring oil and gas in the nearby offshore area. The tunnel would take

two years to build and the total capital outlay needed for the construction

would not be less than P20,000,000. To allow itselfa margin of safety,

the entity borrowed P25,000,000 from three sources and used the

extra P5,000,000 for working capital purposes. Financing was arranged

as follows:

- 7%

Bank term loan

Institutional borrowing 8%

Corporate bonds

5,000,000

10,000,000

10,000,000

- 9%

In the first phase of the construction of the tunnel, there were idle funds

of P10,000,000 which the entity invested for a period of six months.

Income from this investment was P500,000. What amount of borrowing

costs should be capitalized as cost of the asset?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning