2. A new small truck is offered for sale for $16,00 month closed-end lease for $280 per month. If t kept for 6 years and it is expected to be sold leased there will be a $1,500 lease signing fee years and returned to the dealer with no cash truck will be leased with the same lease signin years, and at the end of that lease the truck will no cash payments. Draw the cash flows for the option. Find the effective interest rate per mor flows for each option over the 6-year period. A maintenance costs for these two options are ex

2. A new small truck is offered for sale for $16,00 month closed-end lease for $280 per month. If t kept for 6 years and it is expected to be sold leased there will be a $1,500 lease signing fee years and returned to the dealer with no cash truck will be leased with the same lease signin years, and at the end of that lease the truck will no cash payments. Draw the cash flows for the option. Find the effective interest rate per mor flows for each option over the 6-year period. A maintenance costs for these two options are ex

Algebra for College Students

10th Edition

ISBN:9781285195780

Author:Jerome E. Kaufmann, Karen L. Schwitters

Publisher:Jerome E. Kaufmann, Karen L. Schwitters

Chapter14: Sequences And Mathematical Induction

Section14.3: Another Look At Problem Solving

Problem 30PS

Related questions

Question

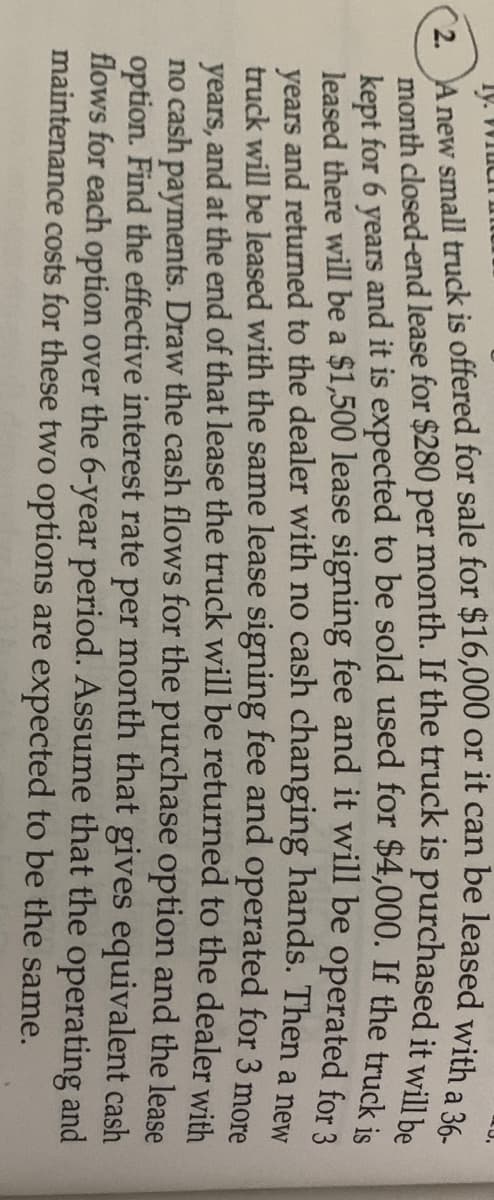

Transcribed Image Text:kept for 6 years and it is expected to be sold used for $4,000. If the truck

leased there will be a $1,500 lease signing fee and it will be operated for 3

vears and returned to the dealer with no cash changing hands. Then a new

truck will be leased with the same lease signing fee and operated for 3 more

years, and at the end of that lease the truck will be returned to the dealer with

no cash payments. Draw the cash flows for the purchase option and the lease

option. Find the effective interest rate per month that gives equivalent cash

flows for each option over the 6-year period. Assume that the operating and

maintenance costs for these two options are expected to be the same.

Expert Solution

Step 1

Given Truck price = $16,000

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning