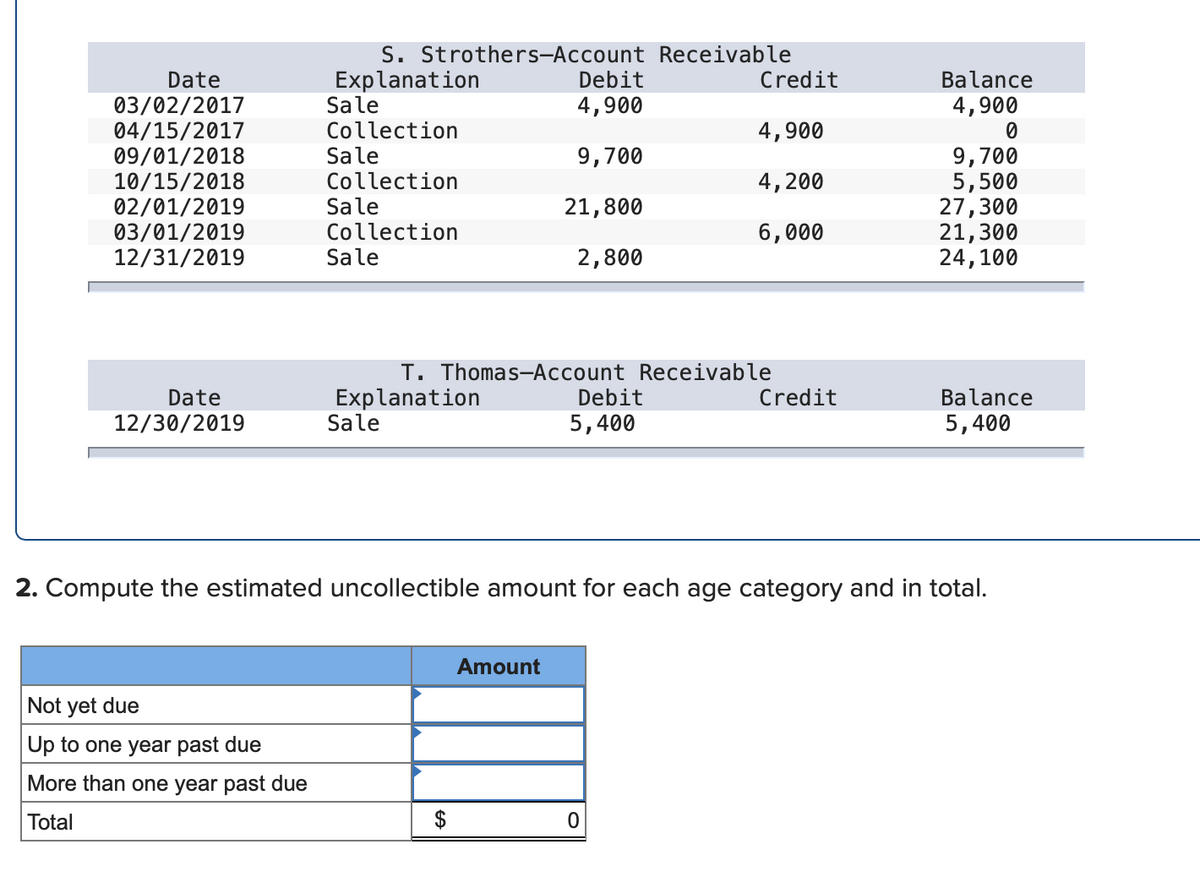

2. Compute the estimated uncollectible amount for each age category and in total. Amount Not yet due Up to one year past due More than one year past due Total $

2. Compute the estimated uncollectible amount for each age category and in total. Amount Not yet due Up to one year past due More than one year past due Total $

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 85APSA: Determining Bad Debt Expense Using the Aging Method At the beginning of the year, Tennyson Auto...

Related questions

Question

Please answer the question. I provided two picture's so I do not have to type out everything!

Transcribed Image Text:S. Strothers-Account Receivable

Debit

4,900

Explanation

Sale

Collection

Sale

Collection

Sale

Collection

Sale

Date

Credit

Balance

03/02/2017

04/15/2017

09/01/2018

10/15/2018

02/01/2019

03/01/2019

12/31/2019

4,900

4,900

9,700

5,500

27,300

21,300

24,100

9,700

4,200

21,800

6,000

2,800

T. Thomas-Account Receivable

Explanation

Date

Debit

Credit

Balance

12/30/2019

Sale

5,400

5,400

2. Compute the estimated uncollectible amount for each age category and in total.

Amount

Not yet due

Up to one year past due

More than one year past due

Total

2$

![Required information

[The following information applies to the questions displayed below.]

Blue Skies Equipment Company uses the aging approach to estimate bad debt expense at the end of each accounting

year. Credit sales occur frequently on terms n/60. The balance of each account receivable is aged on the basis of three

time periods as follows: (1) not yet due, (2) up to one year past due, and (3) more than one year past due. Experience has

shown that for each age group, the average loss rate on the amount of the receivable at year-end due to uncollectibility is

(a) 4 percent, (b) 13 percent, and (c) 31 percent, respectively.

At December 31, 2019 (end of the current accounting year), the Accounts Receivable balance was $51,300 and the

Allowance for Doubtful Accounts balance was $1,090 (credit). In determining which accounts have been paid, the

company applies collections to the oldest sales first. To simplify, only five customer accounts are used; the details of each

on December 31, 2019, follow:

B. Brown-Account Receivable

Debit

Explanation

Sale

Collection

Collection

Date

Credit

Balance

03/11/2018

06/30/2018

01/31/2019

14,300

11,100

6,500

14,300

3,200

4,600

D. Donalds-Account Receivable

Explanation

Sale

Collection

Collection

Date

Debit

Credit

Balance

02/28/2019

04/15/2019

11/30/2019

22,100

13,400

8,700

22,100

8,700

4,700

N. Napier-Account Receivable

Explanation

Sale

Collection

Date

Debit

Credit

Balance

11/30/2019

12/15/2019

8,800

8,800

6,600

2,200](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F7850c6f7-b79b-434d-9395-5e8ad7952f99%2Ff65abe58-5659-4200-8390-f4680f8cdf37%2Fom5sn9w_processed.png&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Blue Skies Equipment Company uses the aging approach to estimate bad debt expense at the end of each accounting

year. Credit sales occur frequently on terms n/60. The balance of each account receivable is aged on the basis of three

time periods as follows: (1) not yet due, (2) up to one year past due, and (3) more than one year past due. Experience has

shown that for each age group, the average loss rate on the amount of the receivable at year-end due to uncollectibility is

(a) 4 percent, (b) 13 percent, and (c) 31 percent, respectively.

At December 31, 2019 (end of the current accounting year), the Accounts Receivable balance was $51,300 and the

Allowance for Doubtful Accounts balance was $1,090 (credit). In determining which accounts have been paid, the

company applies collections to the oldest sales first. To simplify, only five customer accounts are used; the details of each

on December 31, 2019, follow:

B. Brown-Account Receivable

Debit

Explanation

Sale

Collection

Collection

Date

Credit

Balance

03/11/2018

06/30/2018

01/31/2019

14,300

11,100

6,500

14,300

3,200

4,600

D. Donalds-Account Receivable

Explanation

Sale

Collection

Collection

Date

Debit

Credit

Balance

02/28/2019

04/15/2019

11/30/2019

22,100

13,400

8,700

22,100

8,700

4,700

N. Napier-Account Receivable

Explanation

Sale

Collection

Date

Debit

Credit

Balance

11/30/2019

12/15/2019

8,800

8,800

6,600

2,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning