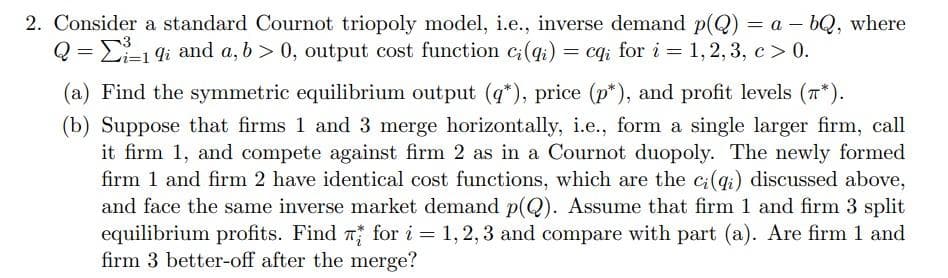

2. Consider a standard Cournot triopoly model, i.e., inverse demand p(Q) = a - bQ, where Q = -1 9₁ and a, b>0, output cost function ci(qi) = cqi for i = 1, 2, 3, c> 0. qi (a) Find the symmetric equilibrium output (q*), price (p*), and profit levels (*). (b) Suppose that firms 1 and 3 merge horizontally, i.e., form a single larger firm, call it firm 1, and compete against firm 2 as in a Cournot duopoly. The newly formed firm 1 and firm 2 have identical cost functions, which are the ci(qi) discussed above, and face the same inverse market demand p(Q). Assume that firm 1 and firm 3 split equilibrium profits. Find for i = 1, 2, 3 and compare with part (a). Are firm 1 and firm 3 better-off after the merge?

2. Consider a standard Cournot triopoly model, i.e., inverse demand p(Q) = a - bQ, where Q = -1 9₁ and a, b>0, output cost function ci(qi) = cqi for i = 1, 2, 3, c> 0. qi (a) Find the symmetric equilibrium output (q*), price (p*), and profit levels (*). (b) Suppose that firms 1 and 3 merge horizontally, i.e., form a single larger firm, call it firm 1, and compete against firm 2 as in a Cournot duopoly. The newly formed firm 1 and firm 2 have identical cost functions, which are the ci(qi) discussed above, and face the same inverse market demand p(Q). Assume that firm 1 and firm 3 split equilibrium profits. Find for i = 1, 2, 3 and compare with part (a). Are firm 1 and firm 3 better-off after the merge?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter13: best-practice Tactics: Game Theory

Section: Chapter Questions

Problem 6E

Related questions

Question

Transcribed Image Text:2. Consider a standard Cournot triopoly model, i.e., inverse demand p(Q) = a - bQ, where

Q = -19i and a, b>0, output cost function ci(qi) = cqi for i = 1, 2, 3, c> 0.

qi

(a) Find the symmetric equilibrium output (q*), price (p*), and profit levels (*).

(b) Suppose that firms 1 and 3 merge horizontally, i.e., form a single larger firm, call

it firm 1, and compete against firm 2 as in a Cournot duopoly. The newly formed

firm 1 and firm 2 have identical cost functions, which are the ci(qi) discussed above,

and face the same inverse market demand p(Q). Assume that firm 1 and firm 3 split

equilibrium profits. Find for i = 1, 2, 3 and compare with part (a). Are firm 1 and

firm 3 better-off after the merge?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 7 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning