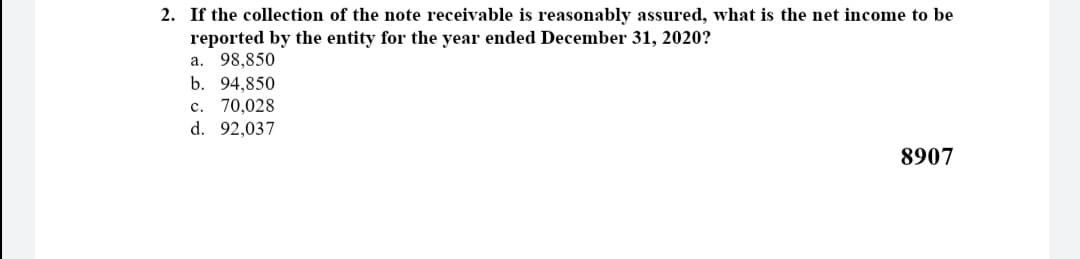

2. If the collection of the note receivable is reasonably assured, what is the net income to be reported by the entity for the year ended December 31, 2020? a. 98,850 b. 94,850 c. 70,028 d. 92,037 8907

2. If the collection of the note receivable is reasonably assured, what is the net income to be reported by the entity for the year ended December 31, 2020? a. 98,850 b. 94,850 c. 70,028 d. 92,037 8907

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 10MC: On January 1, 2019, Park Company accepted a 36,000, non-interest-bearing, 3-year note from a major...

Related questions

Question

Transcribed Image Text:2. If the collection of the note receivable is reasonably assured, what is the net income to be

reported by the entity for the year ended December 31, 2020?

a. 98,850

b. 94,850

c. 70,028

d. 92,037

8907

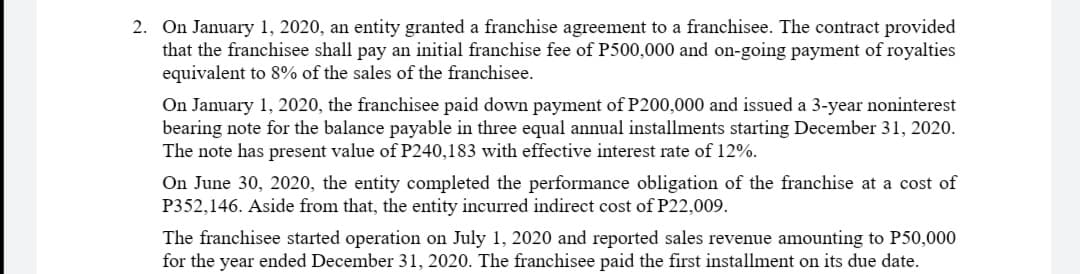

Transcribed Image Text:2. On January 1, 2020, an entity granted a franchise agreement to a franchisee. The contract provided

that the franchisee shall pay an initial franchise fee of P500,000 and on-going payment of royalties

equivalent to 8% of the sales of the franchisee.

On January 1, 2020, the franchisee paid down payment of P200,000 and issued a 3-year noninterest

bearing note for the balance payable in three equal annual installments starting December 31, 2020.

The note has present value of P240,183 with effective interest rate of 12%.

On June 30, 2020, the entity completed the performance obligation of the franchise at a cost of

P352,146. Aside from that, the entity incurred indirect cost of P22,009.

The franchisee started operation on July 1, 2020 and reported sales revenue amounting to P50,000

for the year ended December 31, 2020. The franchisee paid the first installment on its due date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning