How much is the balance of the “Allowance for Uncollectible Accounts” to be reported in the Statement of Financial Position as at May 31, 2021? How much is the Amortized Cost/Net Realizable Value of the Accounts Receivable at May 31, 2021?

How much is the balance of the “Allowance for Uncollectible Accounts” to be reported in the Statement of Financial Position as at May 31, 2021? How much is the Amortized Cost/Net Realizable Value of the Accounts Receivable at May 31, 2021?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 6MC: Prior to adjustments, Barrett Companys account balances at December 31, 2019, for Accounts...

Related questions

Question

100%

Based on the given, these ar the requirements:

- How much should be reported as “Uncollectible Accounts Expense” in its fiscal year ending May 31, 2021 statement of comprehensive income?

- How much is the balance of the “Allowance for Uncollectible Accounts” to be reported in the

Statement of Financial Position as at May 31, 2021? - How much is the Amortized Cost/Net Realizable Value of the

Accounts Receivable at May 31, 2021?

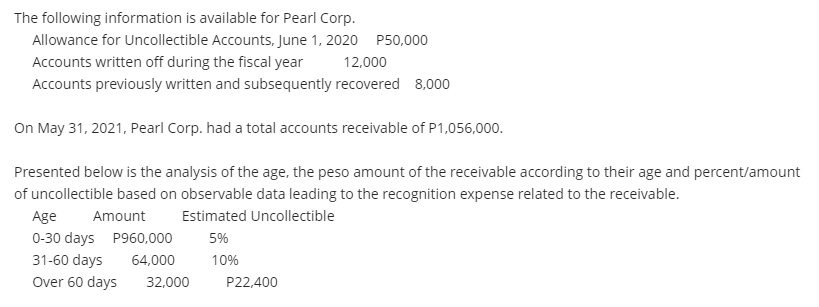

Transcribed Image Text:The following information is available for Pearl Corp.

Allowance for Uncollectible Accounts, June 1, 2020 P50,000

Accounts written off during the fiscal year

12,000

Accounts previously written and subsequently recovered 8,000

On May 31, 2021, Pearl Corp. had a total accounts receivable of P1,056,000.

Presented below is the analysis of the age, the peso amount of the receivable according to their age and percent/amount

of uncollectible based on observable data leading to the recognition expense related to the receivable.

Estimated Uncollectible

Age

0-30 days P960,000

31-60 days

Amount

5%

64,000

10%

Over 60 days

32,000

P22,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning